This story is part of WWDC 2022, CNET’s complete coverage from and about Apple’s annual developers conference.

Apple

Twelve years ago, with the launch of the iTunes music store, Apple changed how we purchase and listen to music. Now it hopes to shake things up again — despite playing catchup this time around.

Apple is expected to debut a subscription streaming-music service, making it one of the central announcements at the company’s annual developers conference next week in San Francisco. Consider it a reboot of the Beats Music streaming service it purchased last year.

Apple shelled out $3 billion to buy headphones maker Beats — by far its biggest acquisition ever — and Beats Music, a fledgling subscription music service that gives members all-you-can-eat access to songs for $10 a month, was part of the package. Since the deal closed in August, Beats Music has been in a holding pattern while rivals like Spotify grow rapidly and newcomers, such as Jay Z’s Tidal, enter the market. But as Apple has shown before, the game isn’t over until the Cupertino, Calif., consumer electronics giant tries to change it.

See also

- CNET’s complete WWDC coverage

- Join CNET’s WWDC 2015 live blog

- Apple’s 2015 developers conference: What we expect

- Apple finally confirms it’s buying Beats

Apple’s music service could once again change up how consumers purchase music by placing a spotlight on the burgeoning trend of music subscriptions. Instead of paying 99 cents a track, consumers pay a monthly fee — reportedly $10 a month — for access to virtually any song they want. The company’s embrace of subscriptions comes amid shifting patterns in how consumers listen to and purchase music. The question is, can Apple take advantage of the shift?

“It certainly helps to be Apple, but its [service] needs to be better, too,” said Russ Crupnick, managing partner at consulting firm MusicWatch. “Which is what they’re very good at.”

Unlike the moment of its original iTunes revolution, Apple isn’t alone in this business. Sweden-based startup Spotify is the global leader in music subscriptions, with 15 million paying members out of its 60 million listeners. Tidal relaunched its service in March under rapper mogul Jay Z with a $19.99-a-month subscription fee. Even the original Beats Music operated under the same model.

In the past few years, revenue from streamed music has overtaken physical sales of tunes and is closing in on digital downloads, all while Apple’s arena of single-purchased tracks has begun to decline. But streaming’s popularity has been fueled by free, ad-supported options — not the more lucrative monthly subscriptions that the record industry idealizes as a profits savior.

Apple’s advantage: hundreds of millions of consumers are already familiar and comfortable with iTunes. And Apple has their credit card and purchase information already stored.

Apple declined to comment for this story.

Resisting the stream

In January 2001, Apple introduced its iTunes digital jukebox software that let users import songs from CDs and manage their personal music libraries. It wasn’t until two years later that it started allowing people to purchase digital songs from the iTunes Music Store for 99 cents apiece. The reasoning behind the offering was to not only make more money but also to get users hooked on iTunes and Apple’s iPod music players.

“Consumers don’t want to be treated like criminals, and artists don’t want their valuable work stolen,” Steve Jobs, Apple’s then-CEO, said in an April 2003 press release announcing the service. “The iTunes Music Store offers a groundbreaking solution for both.”

iTunes ended up making the iPod the best-selling music player in the market and kickstarted Apple’s ascent in the electronics industry. A year ago, Apple revealed it had sold 35 billion songs since launching iTunes.

Jobs, known for his love of music, was defiant about a subscription service for years. He called the subscription model “bankrupt” in Rolling Stone in 2003 and told Reuters “people want to own their music” in 2007. But as streaming options grew in popularity, Apple realized it needed to go with the flow. The company in 2013 launched iTunes Radio, a Pandora-like streaming radio service that generates revenue from advertising — and from sales promoted by a big red and green “buy song” link included on the screen while a tune plays.

The falling demand for song downloads — and the lukewarm response to iTunes Radio — is part of the reason Apple decided to purchase Beats. Legendary record producer Jimmy Iovine, rapper Dr. Dre and Nine Inch Nails frontman Trent Reznor all joined Apple through the acquisition, and Beats Music Chief Executive Ian C. Rogers became the head of iTunes Radio.

Now playing:

Watch this:

Inside Scoop: What’s expected from Apple’s 2015 WWDC

2:53

Until this point, Beats and iTunes have remained separate services, though they’ve pooled expertise and resources. And so far, Apple has done little publicly with Beats besides pushing its music service with current iTunes customers and promoting its headphones in Apple Stores.

That will change when Apple shows off its revamped service on Monday.

While Apple had pressed the record labels for a lower price, its service will likely cost the industry standard of $10 a month. The Beats Music identity is going away, and Apple also likely will embed the offering into its current Music app, which means it automatically shows up on iPhones and iPads.

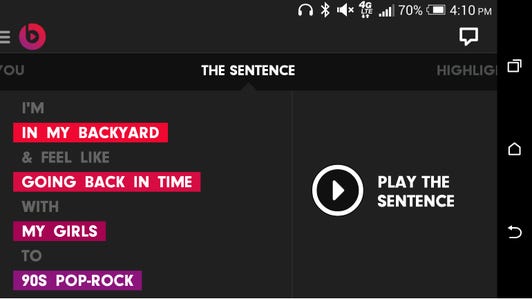

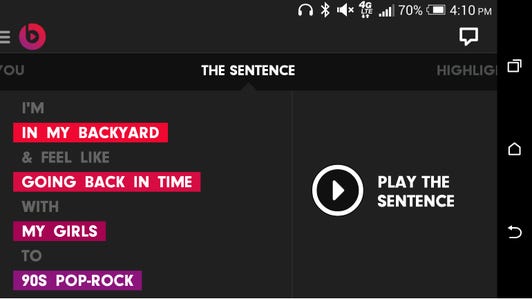

The revamped service likely will include many of Beat’s features — such as curated playlists — but will incorporate a more Apple-like look and feel. The company also has reportedly been pursuing exclusive deals with artists to offer their albums on the new service first, and its offering could give musicians more control over their material, providing them with pages where they can post track samples, videos and concert details.

Apple also is reportedly revitalizing iTunes Radio with channels programmed and hosted by live DJs, including high profile artists like Drake.

Watching other players score

In the year since Apple unveiled its plans to buy Beats, the streaming music service has watched competitors’ usage grow while its own held stagnant. Except for Pandora, which is run by a publicly traded company, online music services don’t provide regular updates about their listeners. But third-party peeks indicate Beats Music’s status dawdled while it sat on the sidelines.

Fewer people in the US visited Beats Music in April than a year earlier, right before Apple unveiled its takeover, making it the only service among the six main competitors in online streaming music to see that traffic fall, according to traffic scorekeeper ComScore. Internet radio service Pandora, on-demand streamer Spotify, user-uploaded audio site SoundCloud, and subscription services Rhapsody and Rdio all had increasing visits to their sites and apps across desktop and mobile between May 2014 and April 2015 — while Beats’ unique visitors slipped to 1.1 million from 1.4 million. By comparison, April saw Pandora rack up 86 million visitors and Spotify reach 38 million.

In fact, Beats was the only service to see its visitors drop below the 1 million mark during the last year. In July, ComScore counted only 941,000 unique visitors.

Beats Music’s brand perception struggled as well. Immediately after Apple said it would buy Beats, the subscription service’s appeal was modestly positive, based on a “Buzz score” by YouGov BrandIndex. Beats Music scored 3.3, meaning 3.3 percent more people viewed it positively than negatively. One year later, that score slipped to 0.6, and it dipped into negative territory once. While Pandora’s favorability also saw ups and downs, its appeal always far outstripped Beats, most recently at about 15.

Playing by Apple’s rules

Apple may be coming to the subscription game late, but it benefits from unique advantages.

The world’s most valuable company, Apple sits on a huge stockpile of cash ($193.5 billion as of the end of March), especially compared with companies like Spotify and Pandora that are still trying to figure out how to be profitable. Even though Apple typically doesn’t enter businesses where it loses money, it could operate a subscription service at a loss as long as it fuels its more profitable hardware sales.

Importantly, Apple already has payment relationships with more than 800 million people worldwide through iTunes. That’s a big advantage, said Wei Shi, analyst for Strategy Analytics. “If consumers feel that [Apple’s] proposition is more compelling, it’s easier for them to pay,” he said.

Apple’s possession of payment details could be meaningful for the music industry as well, said Tom Silverman, the founder of hip-hop label Tommy Boy Records and organizer of the New Music Seminar yearly conference to discuss shifts in the recording industry.

Rock out with Beats Music (pictures)

If the company can convert a fraction of those iTunes users into people paying a monthly rate, it would tip the number of worldwide music subscribers over the 100 million threshold that Silverman marks as a turning point for streaming music becoming a sustainable business model. “That can change the music business in one year,” he said.

But the lesson of iTunes Radio shows how Apple can misfire despite its advantages.

Before launching its Internet radio product in 2013, anticipation was high that Apple could be creating a “Pandora killer.” But Pandora’s listening stats continued to grow unabated, and iTunes Radio has failed to gain significant traction.

“They came up against Pandora with a water pistol,” said Crupnick of MusicWatch. Crupnick’s annual music study found iTunes Radio accounts for just 5 percent of the listening hours among the major streaming services, which includes Pandora, Spotify, iHeartRadio and YouTube. He found that only about 10 percent of the US population on the Internet use iTunes Radio, compared with 16 percent for Spotify — a much smaller company — and 35 percent for Pandora.

The challenge in streaming music is less about the company and more about who will change consumer beliefs about paying for music subscriptions, Crupnick said. “What is it that Apple can say to the market that is different than what Spotify has said, or Rdio or Tidal or Rhapsody?”

Being late to the game has never hurt the company in the past. It wasn’t the first to make a digital music player, smartphone or tablet, but the iPod, iPhone and iPad dominated their competitors. Analysts believe Apple Watch can make inroads in the wearable market where other pioneers flopped.

And Apple, Crupnick noted, has been superb at teaching consumers the benefits of a new technology, be it the iPod paired with iTunes, the iPhone or the iPad. Streaming music subscriptions haven’t yet experienced that “iPhone moment, where consumers go ‘That’s really cool and worth paying for,'” he said.

But for Apple, that’s a familiar tune.

Check out CNET’s live blog from WWDC on Monday, as well as full coverage from the event.