BARCELONA, Spain–The hype around mobile payments is just the tip of the iceberg when it comes to the coming transformation for how people purchase goods and services.

That’s according to Ed McLaughlin, chief emerging payments officer for MasterCard, who spoke with CNET about his company’s vision.

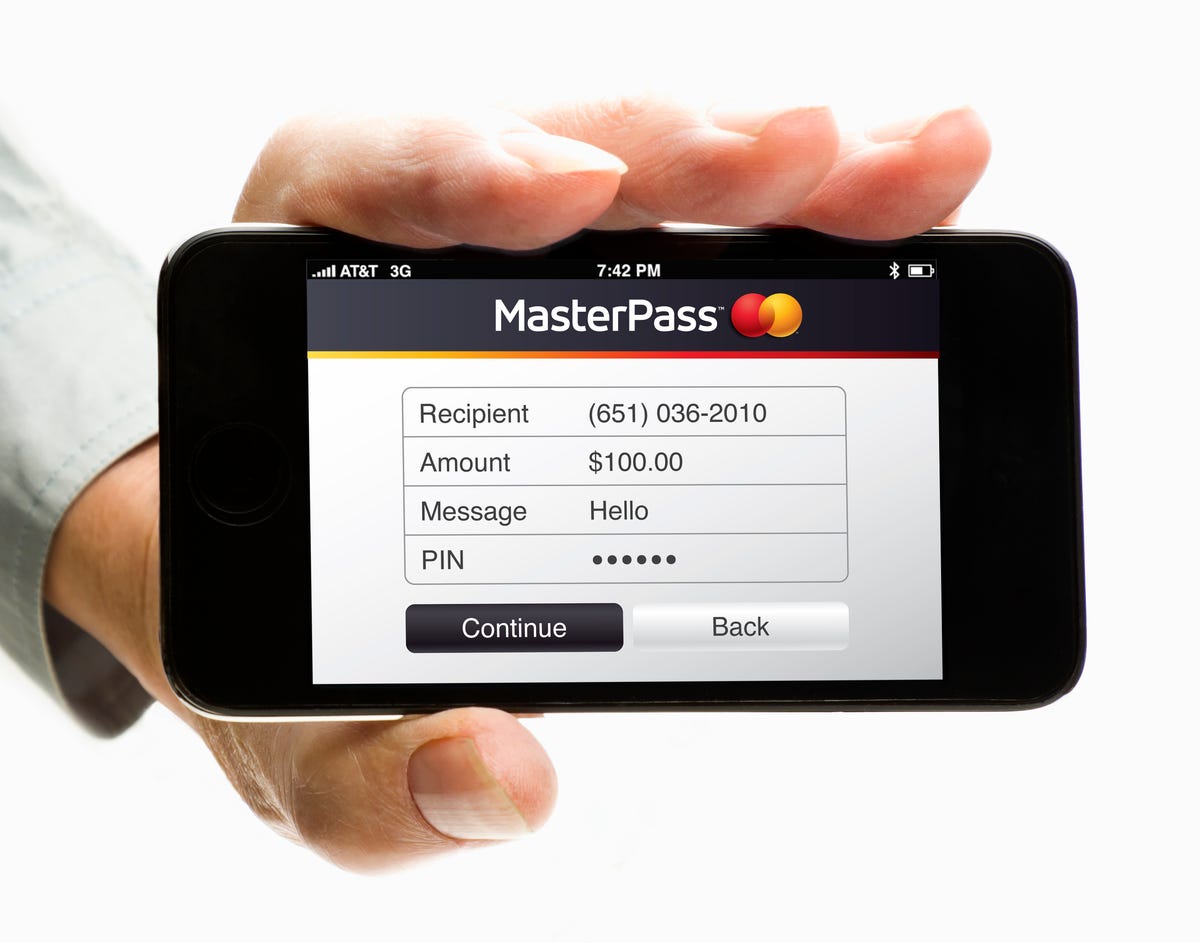

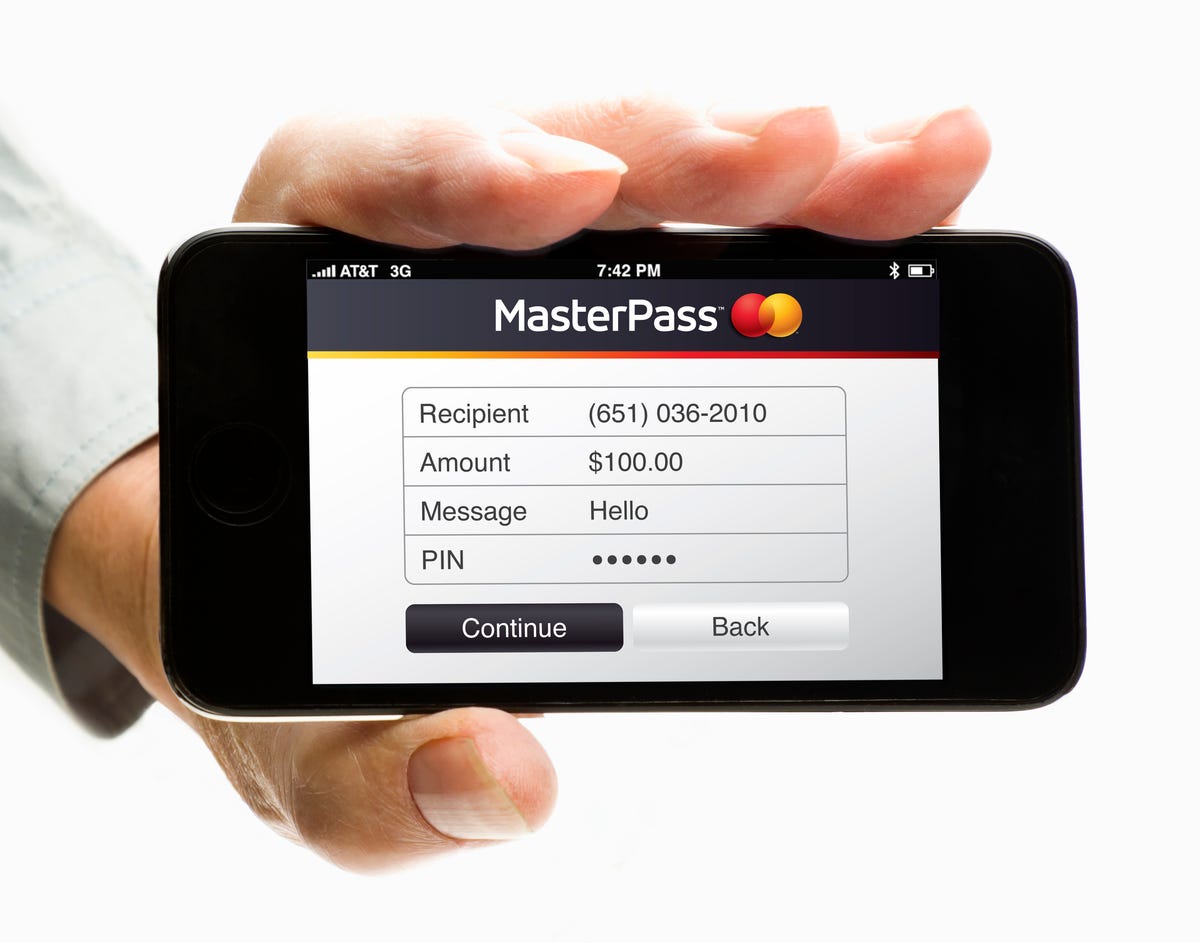

While at the Mobile World Congress conference, MasterCard unveiled its MasterPass system, which addresses not only mobile payments, but also all forms of digital transactions. MasterPass is designed for purchases made in stores, online, or on the phone.

“It’s a foundation for moving to a world beyond plastic,” McLaughlin said. “We’re in a generational shift from the physical to the connected digital.”

While other players are focusing on the traditional concept of mobile payment, or the idea of flashing your smartphone in front of a cash register to pay for clothes, food, and other items, MasterPass will attempt to unify all transactions under one system.

As a result, both the merchant and consumer have a consistent experience whether the purchase is made at the cash register with a phone or credit card, online, or through a browser on the smartphone.

“There’s no e-commerce or m-commerce, there’s just commerce,” McLaughlin said.

Related stories

- MWC 2022: How to Watch the Samsung Galaxy Book Reveal

- CES 2021: What to expect as the show goes all-digital

- Microsoft warns it might miss revenue guidance because of coronavirus

- Spending time with Huawei’s new Mate XS

- LG unveils new K series phones

That’s not to say that mobile payments isn’t a huge driver of what’s going on in the industry, including at MasterCard. There are a few initiatives out there, on which MasterCard is also playing a part. Google, for instance, has had its Google Wallet out in the market for roughly a year and a half, but has seen limited adoption. ISIS, a joint venture between Verizon Wireless, AT&T, and T-Mobile, has started testing the service in Salt Lake City and Austin, Texas.

MasterPass is intended to tie it all together. For the consumer, MasterPass is a place to securely store credit card data, address books, and other important information in the cloud. It acts as a digital wallet that can use other branded credit cards as well. Bank, merchants, and other companies can offer their own wallets to consumers that are tied into MasterPass too. For online purchases, consumers can opt for a simpler checkout process with retailers who are participating in the program.

For merchants, MasterPass also includes a consistent method of accepting electronic payments regardless of location or device. More retailers are opting to use near-field communication, or NFC, technology to enable tap-and-pay functions at the register, as well as experimenting with different methods like the use of QR codes, and MasterPass is designed to address all of the different options.

MasterCard

Consumers in Australia and Canada will be able to sign up for the service through financial institutions in March. The U.S. will get access to it in the spring, the U.K. will get it in the summer, and it will gradually expand to other parts of the world, including China, Brazil and Spain.

MasterCard has lined up scores of financial institutions, including Citi and Commonwealth Bank in the U.S., merchants, and technology partners to help roll out the service.

So what’s taking so long?

McLaughlin has an interesting way of describing the transition to a digital payments world: “It’s happening, and it will happen when it gets better.”

The seemingly contradictory statement underscores perfectly the complexity and snail’s pace of progress that has weighed on the progress of mobile payments. The services and features are here, as evidenced by the initiatives of Google and the carriers, but for many people, it hasn’t yet happened and things still need to get a lot better.

Just as it took a long time for consumers to warm up to the idea of paying bills through a Web site, there will be a slow progression toward getting people to take their wallet into the cloud.

It’s been a journey just to get to where things are today. Previously, the carriers, banks, payment networks, and merchants all disagreed over which parties would take what cut. Ultimately, does the bank serve the customer? A merchant? Or Google? These are issues the payments industry is still settling.

MasterCard

MasterCard, for its part, is staying out of the fray. The company intends to stay in the background, aside from the MasterPass logo, and preserve the relationship between the merchant or bank and the consumer.

There remains, however, reluctance over the safety of these services, as well as a general lack of awareness. But ultimately, the move to digital is a good thing for consumers, McLaughlin said. For the first time, the act of paying could potentially become both easier and more secure. With traditional plastic credit cards, any effort to make things convenient often resulted in higher risks for the consumer.

Services such as MasterPass, or the ones provided by companies such as Square and Starbucks, also enable new ways to purchase items. Even now, restaurants and stores are experimenting with allowing consumers to order food or goods through mobile point-of-sale devices, allowing them to avoid checkout lines.

“It’s an extension of what we’ve been talking about,” McLaughlin said. “It’s a huge leap forward.”