The dollars should continue to follow the eyeballs.

With consumers spending more and more time online, ad spending on the Web should overtake TV advertising by 2016 in the US, according to a report published Tuesday from market researcher Forrester. It said online marketing is expected to reach $103 billion in 2019 thanks to a 13 percent average annual growth, compared with $86 billion for TV. In all, digital ads by 2019 will account for 36 percent of all ad spending, above 30 percent for TV.

TV today remains the biggest advertising platform, but broadcast and cable companies face increasing pressure to adapt to changing consumer habits. Audiences now want more on-demand options for watching videos and listening to music, helping newer services like YouTube and Spotify grow. Looking to keep with the trends of viewing shows on a smartphone or binge-watching a whole season during a weekend, a handful of broadcasters are offering customers more options. CBS, the parent company of CNET, last month said it is launching a digital subscription video service. The announcement came just after HBO, owned by Time Warner, unveiled plans for a standalone service next year.

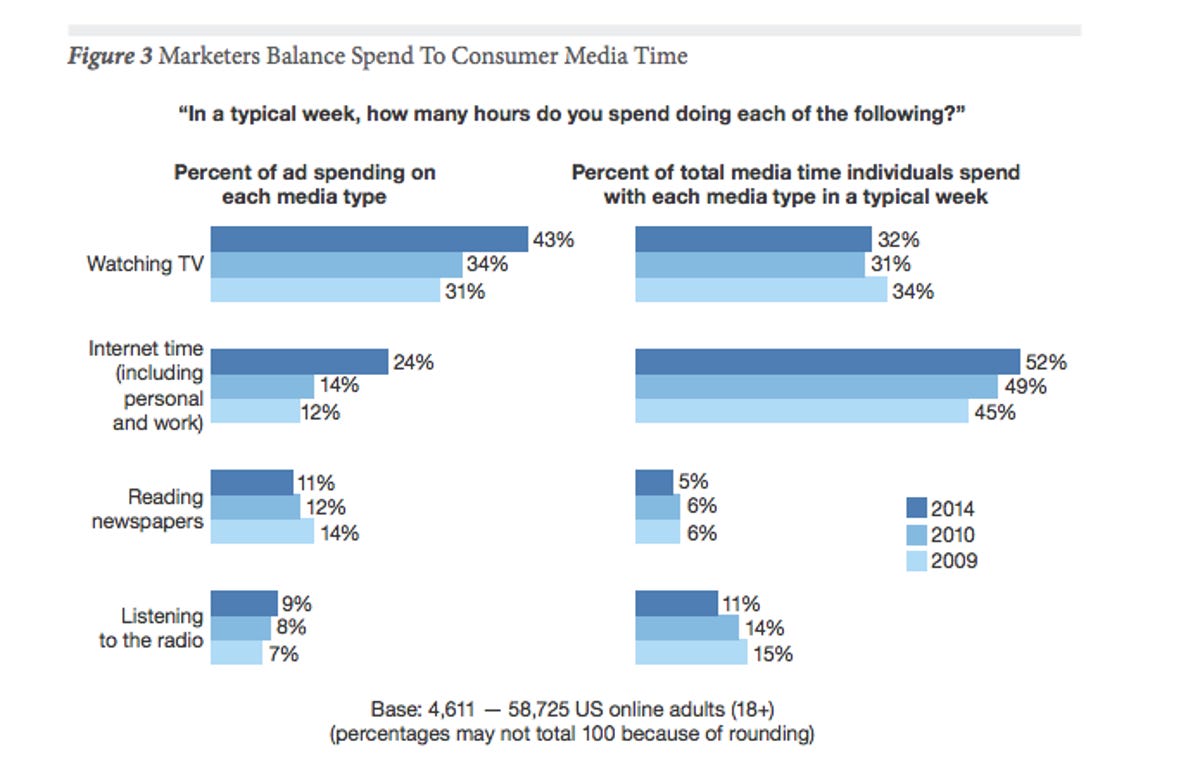

Forrester found that adults in the US already spend 52 percent of their total media time on the Internet during a typical week (including personal and work), up from 45 percent in 2009. Comparatively, TV time is down to 32 percent this year from 34 percent five years ago.

Forrester Research Inc.

That growth in Internet time is pushing more advertisers to spend more on email marketing, social media, display ads and search marketing, and away from shrinking audiences reading newspapers or listening to the radio. Also, marketers are expected to increase their online ad budgets since they can purchase more ad placements online, such as on Twitter, which was previously ad free, or using services like Slidejoy, which offers ads on smartphone lock-screens.

The Forrester forecast, reported earlier Tuesday by Advertising Age, said search advertising is expected to remain the biggest piece of online ad spending, but social advertising should grow the fastest of any online niche, a benefit to Facebook, the largest social network in the world.