Sarah Tew/CNET

Wearable devices scored their eighth straight quarter of solid growth, according to a new report released by market researcher IDC.

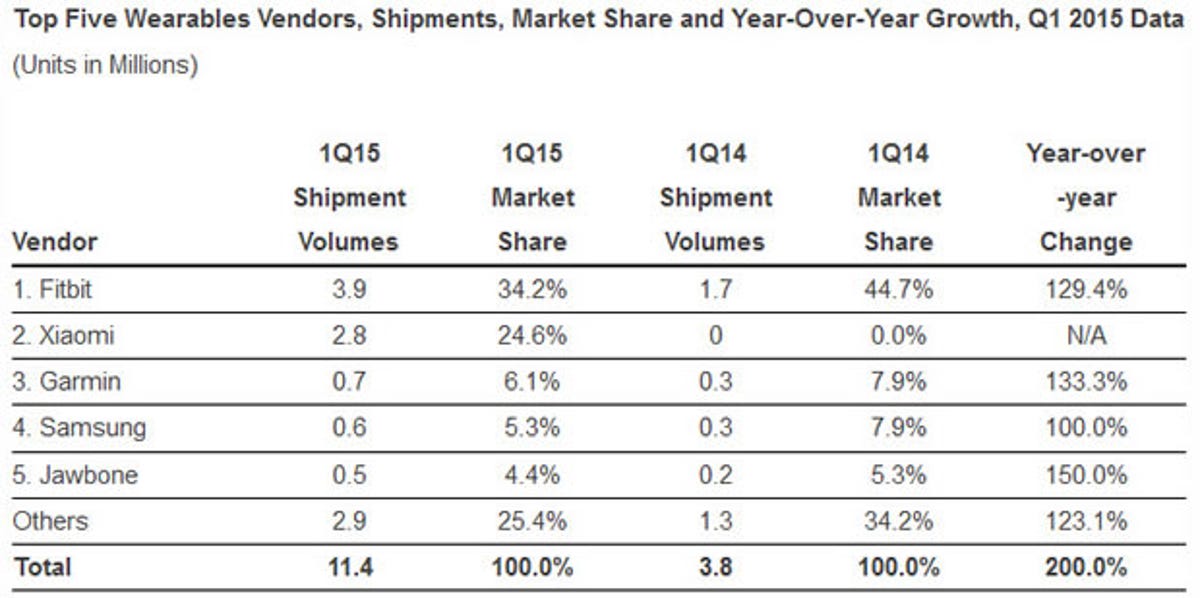

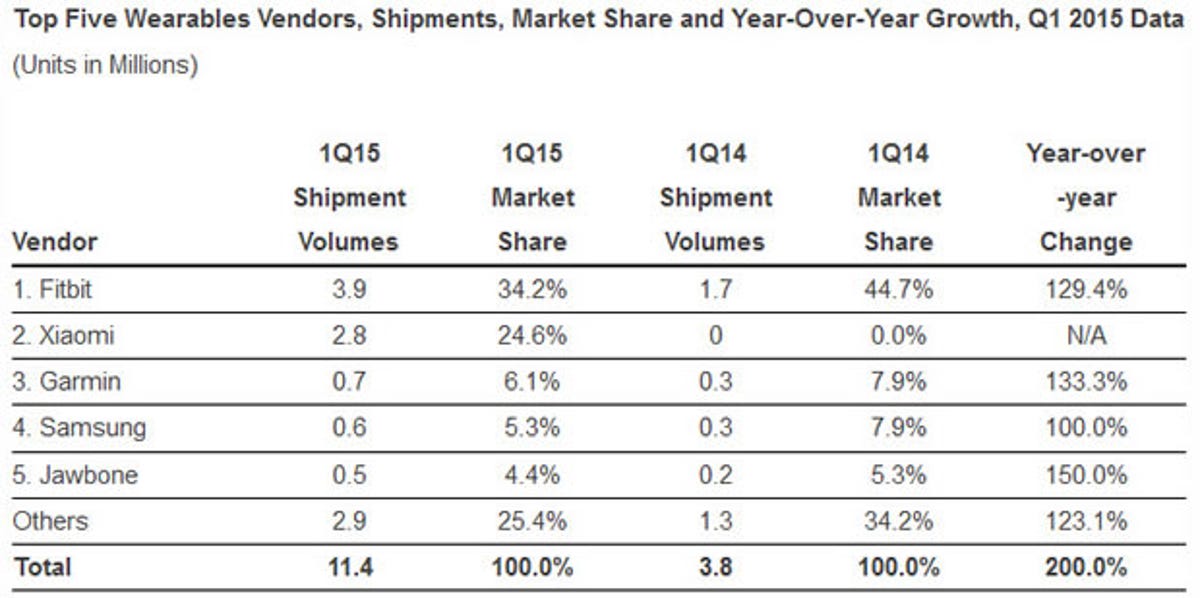

During the first quarter of the year, a total of 11.4 million wearable devices shipped around the world, triple the 3.8 million shipped during the same quarter in 2014, IDC said Wednesday. The gain was especially significant as the first quarter usually sees a dip in sales and shipments for tech products following the strong holiday season.

The market for wearables, which includes smartwatches and activity trackers, has taken time to catch on among consumers. As more products have hit the market, customers are now seeing a greater diversity, triggering more interest. Demand for wearables is also on the rise in emerging markets. But IDC attributed the latest surge in growth in part to lower prices.

“As with any young market, price erosion has been quite drastic,” Jitesh Ubrani, senior research analyst for IDC Worldwide Mobile Device Trackers, said in a press release. “We now see over 40 percent of the devices priced under $100, and that’s one reason why the top five vendors have been able to grow their dominance from two-thirds of the market in the first quarter of last year to three-quarters this quarter.”

The next big test lies in consumers’ response to the new Apple Watch and its premium pricing — Apple’s smartwatch starts at $349 and soars upward from there. Other vendors will likely still rely on lower prices to lure in consumers. But buyers may now expect other smartwatches and even fitness trackers to stand out more to compete with the Apple Watch.

“What remains to be seen is how Apple’s arrival will change the landscape,” Ramon Llamas, research manager for IDC Wearables, said. “The Apple Watch will likely become the device that other wearables will be measured against, fairly or not. This will force the competition to up their game in order to stay on the leading edge of the market.”

Sales of the Apple Watch officially kicked off on April 24, so the device was not a factor in IDC’s first-quarter report. Apple itself, meanwhile, does not break down sales figures for its new smartwatch. Reporting on the company’s fiscal second-quarter earnings in late April, CEO Tim Cook was mum about actual sales data, instead saying that customer response for the Apple Watch has been “overwhelmingly positive” and acknowledging that demand has been outstripped supply.

A report released Tuesday by investment firm Global Equities Research said that Apple has so far received 7 million orders for its watch but has only been able to ship 2.5 million orders, presumably due to supply constraints. Apple is expected to ship around 5 million Apple Watches by the end of the current quarter ending June 30, twice the number anticipated by analysts, Trip Chowdhry, managing director of Global Equities Research, told CNNMoney. If those numbers prove true, Apple would be on track to top the charts as the new leader in the wearables markets.

IDC

For the first quarter, however, Fitbit let the pack with 3.9 million shipments of its fitness and activity trackers, IDC said. The company led the quarter by releasing three new products — the Charge, Charge HR, and the Surge — while demand continued for its older Flex band and other devices.

In second place was Chinese vendor Xiaomi, which shipped 2.8 million units of its $13 Mi Band fitness monitor . The number was impressive according to IDC since the product just started shipping in the second half of 2014 and had been largely limited to Xiaomi’s home base of China.

Garmin took the No. 3 spot by shipping 700,000 units of its health and fitness trackers. Largely geared toward hikers, runners and other sports enthusiasts, most of Garmin’s devices are equipped with GPS to zero in on your location and distance.

Samsung shipped a total of 600,000 wearable for the quarter, up from 300,000 for the same quarter in 2014. IDC pegged the growth on global demand for Samsung’s Gear smartwatches, including the Gear, Gear 2, Gear Fit, Gear 2 Neo, Gear S and Gear Live. But one limiting factors is the ability of Gear to pair with only certain high-end Samsung smartphones.

Finally, Jawbone shoved aside both Pebble and Sony to take fifth place with total wearable shipments of 500,000. Growth was triggered by the company’s new Up Move activity tracker as well as ongoing demand for its UP24 device.