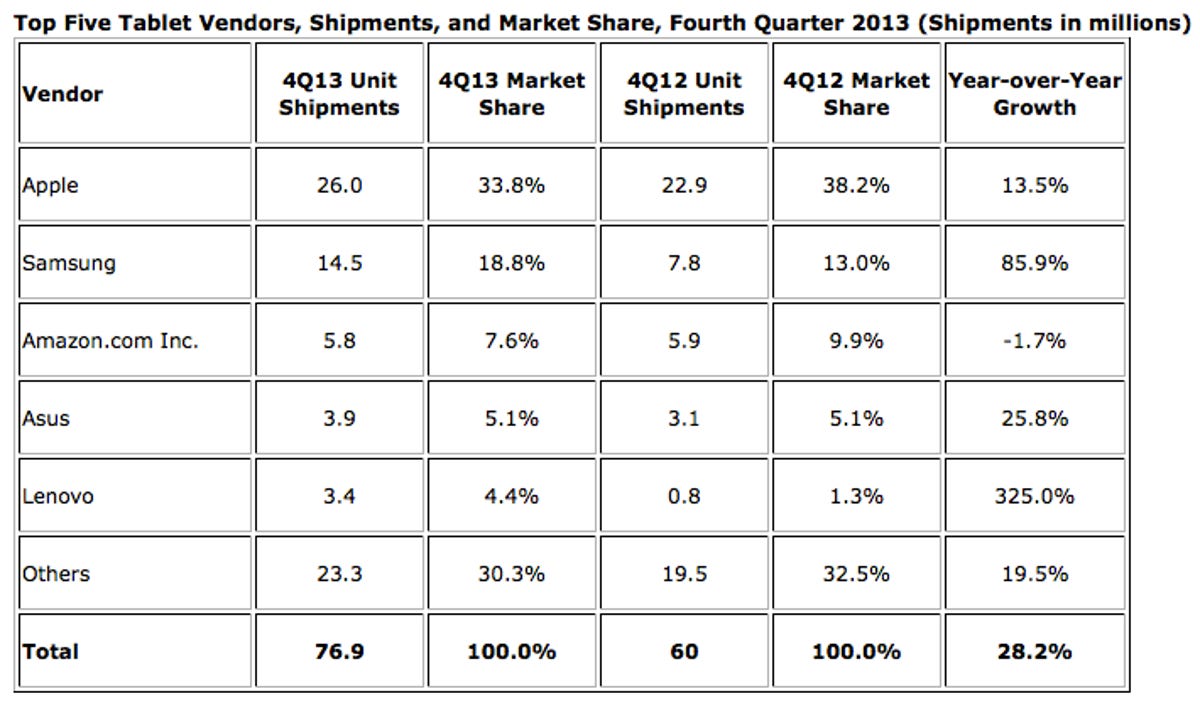

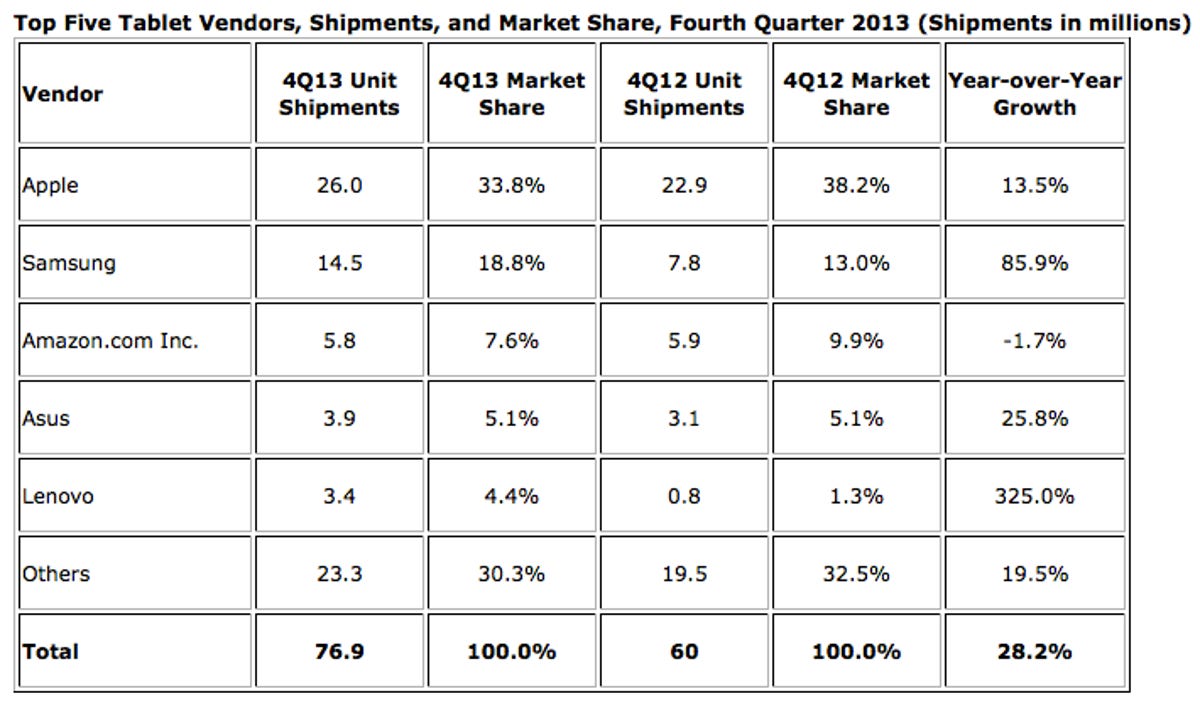

The holidays proved to be a boon for the tablet market. Worldwide shipments of the iPad, Kindle, Galaxy Note, and other tablets grew to 76.9 million in the fourth quarter of 2013. That’s 62.4 percent growth over the previous quarter. For the full year of 2013, tablet shipments totaled 217.1 million, up from 144.2 million in 2012 — which equals a growth rate of 50.6 percent.

These latest figures come from a new survey by research firm IDC, which shows that even though the tablet market is clearly displaying strong growth, it appears to be slowing.

The fourth quarter of 2013 was up 28.2 percent over the same quarter of 2012, but 2012 showed a growth rate of 87.1 percent over 2011.

“It’s becoming increasingly clear that markets such as the US are reaching high levels of consumer saturation and while emerging markets continue to show strong growth this has not been enough to sustain the dramatic worldwide growth rates of years past,” IDC research director Tom Mainelli said in a statement. “We expect commercial purchases of tablets to continue to accelerate in mature markets, but softness in the consumer segment — brought about by high penetration rates and increased competition for the consumer dollar — point to a more challenging environment for tablets in 2014 and beyond.”

So, which companies appear to be winning the tablet game? Not surprisingly, Apple, Samsung, and Amazon are at the top. Apple led the charge in 2013’s fourth quarter with 26 million shipments, which is up from 22.9 million in the fourth quarter of 2012. This means Apple had 33.8 percent of the tablet market share last quarter, while Samsung had 18.8 percent and Amazon had 7.6 percent.

According to IDC, 2013’s fourth quarter was Apple’s most successful on record. However, the company’s year-over-year growth of 13.5 percent is below the rate of other companies. Samsung showed 85.9 percent year-over-year growth, and Lenovo displayed an astounding 325 percent year-over-year growth. These numbers are consistent with other data released throughout the year, which showed Apple losing its edge on the tablet market.

“Lenovo’s access to the Chinese white-box manufacturing infrastructure has helped it drive more low-priced tablet products into the market, growing its share from just 1.3 percent in the same quarter last year,” IDC Worldwide Quarterly Tablet Tracker research analyst Jitesh Ubrani said. “The company’s strength in emerging markets, and its increased market share in adjoining markets such as PCs and smartphones, makes it well positioned to see additional tablet gains in 2014.”

IDC Worldwide Tablet Tracker