Earlier this month, Sprint Nextel’s leadership team sat dumbfounded on stage as an increasingly contentious audience of investors questioned the company’s strategy of pursuing its own 4G network alone.

The investor presentation, which came mere days after the unveiling of the iPhone 4S, was among the most raucous in recent memory. The agitation only grew when the executives refused to talk about the financial impact of the carrying the iPhone, which came at a hefty price. The meeting ended with the team, led by Sprint CEO Dan Hesse, making a beeline for the exit.

“What we regret is not doing a better job of setting better expectations,” Hesse said in an interview with CNET today. “We didn’t really understand that expectations were different.”

It took a few weeks, but Sprint finally made good on its promises of answering the big questions–something investors had expected during the event in early October–during a conference call to discuss its third-quarter results.

Sprint provided a slew of details regarding the iPhone, including the length of its agreement and when exactly it expects to see a financial benefit from the deal. It also announced a new technical deal with Clearwire, easing concerns sparked during the analyst presentation that Sprint was essentially dumping its longtime 4G partner. The company even addressed the financing concern with a new debt agreement and plans to obtain financing over the next few years.

In doing so, Sprint provided a measure of comfort to investors over its long-term prospects. To be sure, the company continues to have its share of issues–as illustrated by an 10 percent drop in its stock this morning–but today’s conference call laid out a confident road map for the next few years.

“There’s a lot of road between now and then, and we are not prepared to make a directional bet either way,” said Craig Moffett, an analyst at Sanford C. Bernstein & Co. LLC. “But for the first time in a year, expectations are appropriately low, and there are now at least a few glimmers of hope.”

Sprint walked away from its investor day event a bit humbled, and to its credit, the company acknowledged and attempted to rectify the issue.

“I apologize for not disclosing more during the analyst presentation,” Chief Financial Officer Joe Euteneuer said during the conference call today. “There were things we could have done to address your concerns.”

iPhone answers

When Euteneuer was asked several times during the investor day event about the iPhone, which had just been unveiled, he offered little response, much to the frustration of analysts in the audience.

Today, Sprint provided a lot more answers.

Hesse said he expects the company to sell more than the 1 million iPhones many on Wall Street had estimated it would sell in the fourth quarter. The higher volume translates to a higher near-term financial hit.

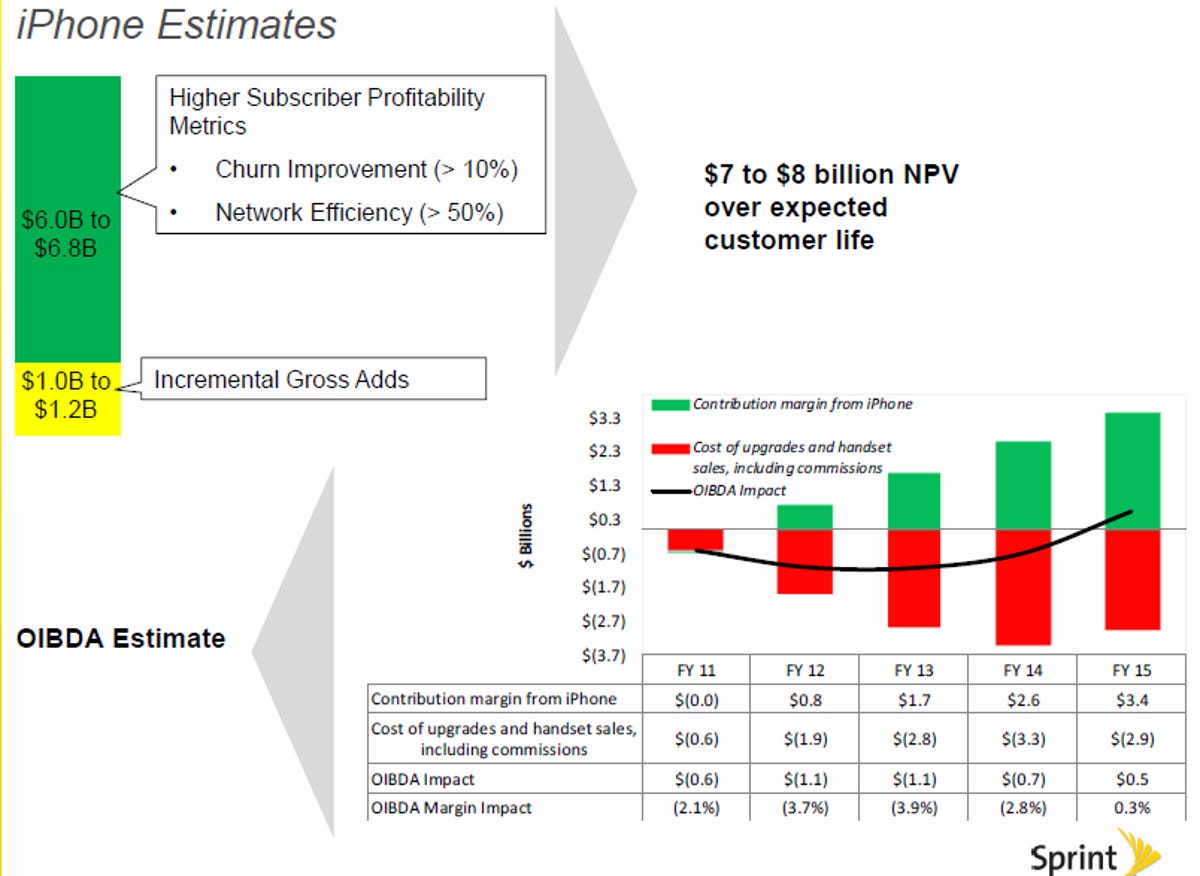

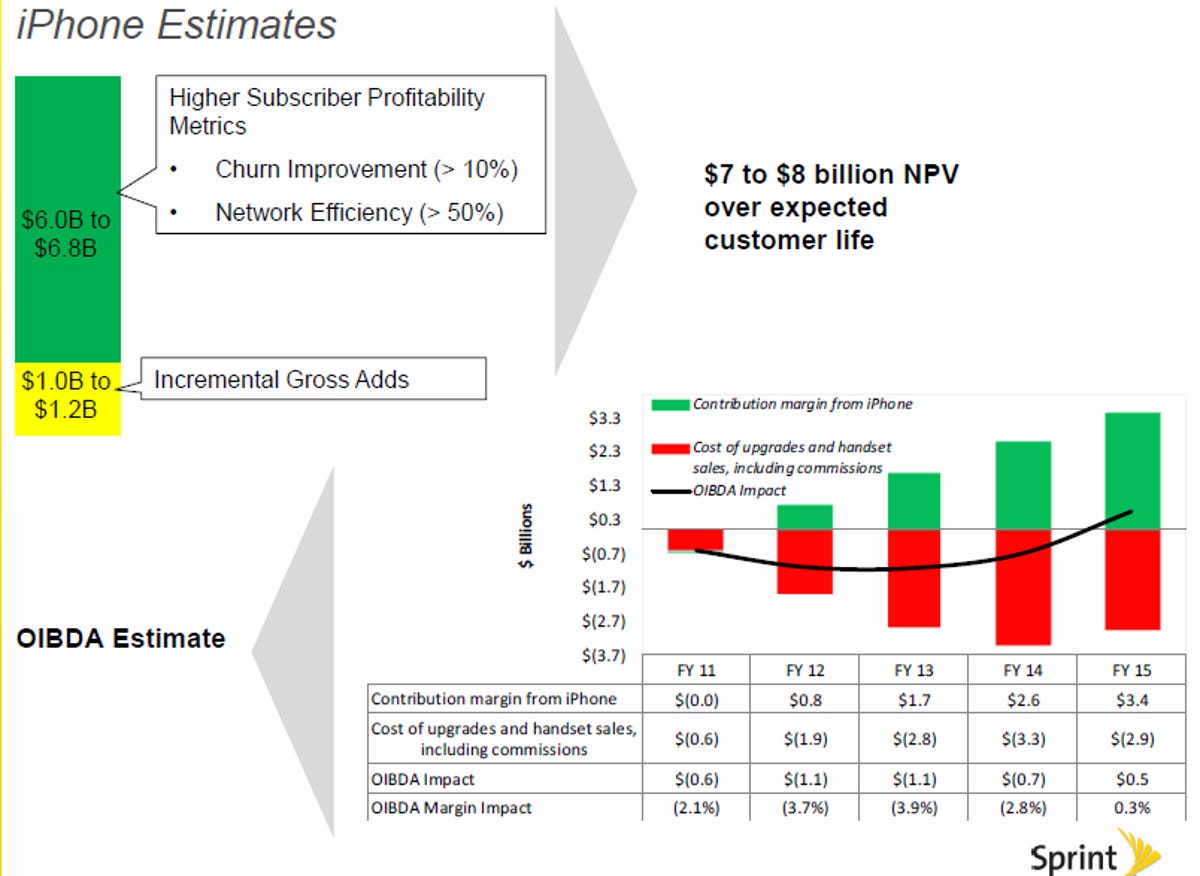

Euteneuer said the company plans to take a hit of $500 million to $700 million in the fourth quarter operating income, $900 million next year and $1.2 billion before the deal starts to be beneficial. He also confirmed the deal would last four years, and generate $7 billion to $8 billion in additional value through customer growth and lower turnover and support costs.

Sprint Nextel

He said the cost of adding a new iPhone customer would be 40 percent higher than through a normal smartphone, all driven by subsidies that are paid to Apple. But he added that the customers are more profitable and less likely to leave.

More importantly, the iPhone has already been able to attract new customers. Sales from the first two weeks indicate that it will break the record for percentage of buyers who are new customers vs. existing upgrades, which was previously held by the HTC Evo.

“The early indications are extremely encouraging,” Hesse said.

Hesse said the stock is down because of the higher-than-expected financial impact of the iPhone.

“I think the success of the iPhone has taken the street by surprise,” Hesse said. “We believe it’s very good for the long term. But in these times, people are extremely focused on the short term.”

Over the past few months, Sprint has increased its smartphone data plan by $10 a month, raised its early termination fees, and lengthened the upgrade time, all in preparation for the iPhone.

A “foundation” for Clearwire deal

When Sprint originally presented its 4G plans, it made little mention of its longtime partner Clearwire. For the past few years, Clearwire has supplied Sprint with its 4G WiMax service, which powers popular products such as the Evo and updated Evo 3D.

Sprint, however, made little mention of Clearwire through the first half of the investor day presentation, instead focusing on LightSquared as a potential partner for wireless capacity. That, coupled with Clearwire’s financing issues, led many in the audience to conclude that Sprint was dumping the company.

Some questioned why Sprint put its money into Clearwire and its spectrum, rather than to pursue its own LTE plans.

At the time, Hesse said Sprint didn’t have anything new to announce for Clearwire, and noted that the companies had a wholesale agreement through next year.

Hesse said the two companies have a non-binding cooperation agreement to work together on the technical specifications of Clearwire’s planned LTE network.

“The cooperation extends to the design and operations of the network, and ensure seamless hand-off and service layer control that meets Sprint’s customer experience requirements,” Hesse said.

The comments did a lot to reassure Clearwire investors–the stock is up nearly 25 percent this morning.

Hesse said the agreement provides a “foundation” for the two companies to strike a commercial agreement in which Sprint could use Clearwire’s LTE capacity. While no deal was in place, Hesse said he would expect to be able to use that spectrum by 2013. He added talks were ongoing.

Sprint’s position on Clearwire hasn’t changed since this the earlier investor presentation, Hesse said, although acknowledged there was a perception of change.

“Perhaps there is a change in what people understood what we meant to say,” he said.

Hesse added that Clearwire and LightSquared’s combined spectrum would give Sprint years of additional capacity. By itself, the company has enough spectrum resources to take its 4G network through 2014, he added.

He declined to comment on whether Sprint would provide financing to Clearwire.

Sprint’s financing addressed

The other issue left unanswered at the investor meeting was the state of its balance sheet and whether it would secure enough funding to continue to operate.

Sprint separately said today it had amended the terms of its credit agreement to allow it to borrow and to allow for the company to suffer a near-term drop in earnings due to the iPhone impact, which previously would have triggered a default.

In addition, Euteneuer laid out its plans to obtain additional financing over the next few years. The company plans to refinance $4 billion in debt and seek $1 billion to $3 billion in vendor financing from its supplier partners Ericsson, Alcatel-Lucent and Samsung Electronics.

“Sprint is finally taking steps to right the ship financially,” Moffett said.

The additional financing is required to pay for the large amount of subsidies required to offer the iPhone, as well as for its Network Vision plan, which consists of a major overhaul of its entire infrastructure to support a number of different wireless technologies.

“Once we accomplish those things, I believe many of the market concerns will go away,” Hesse said.