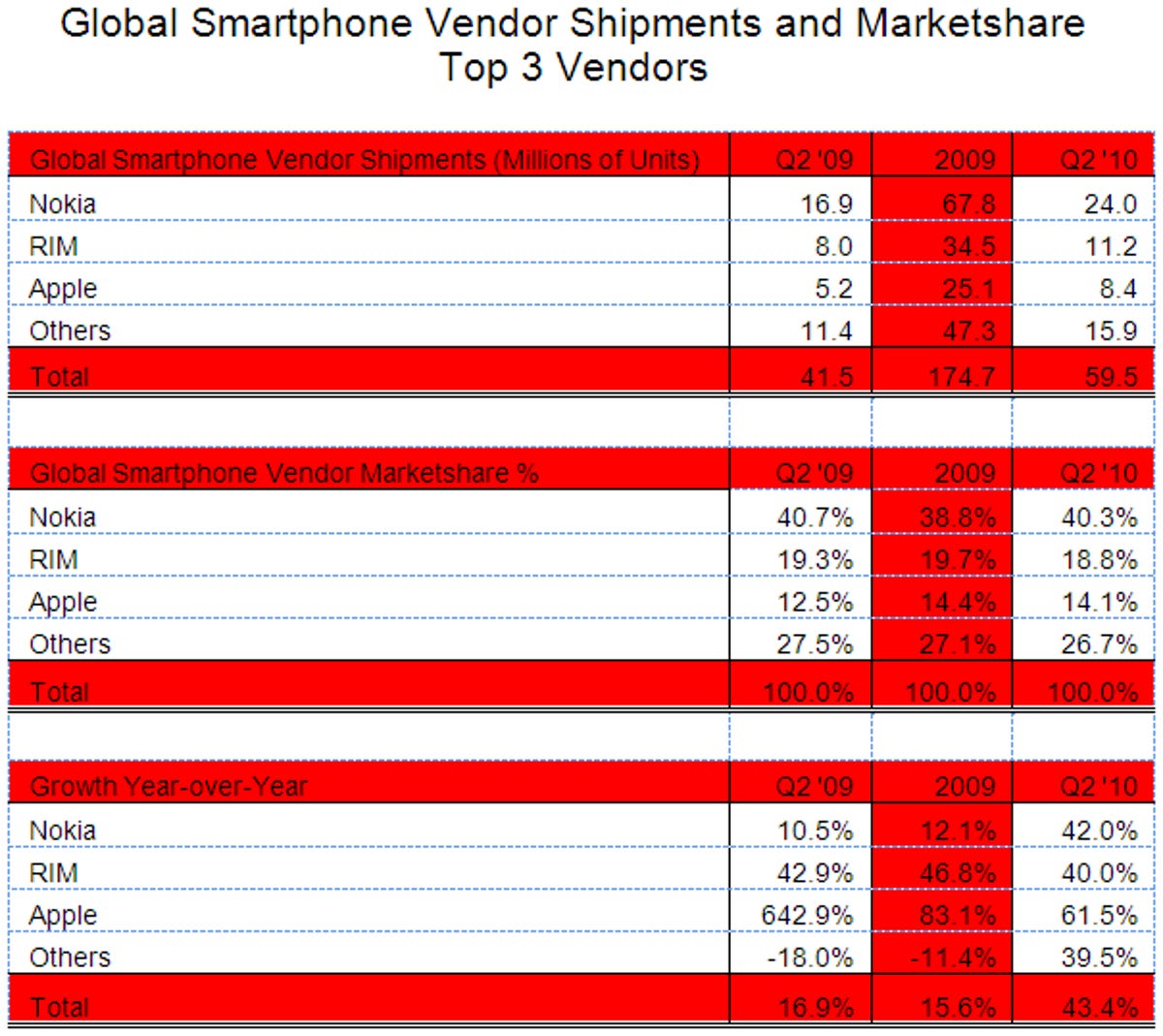

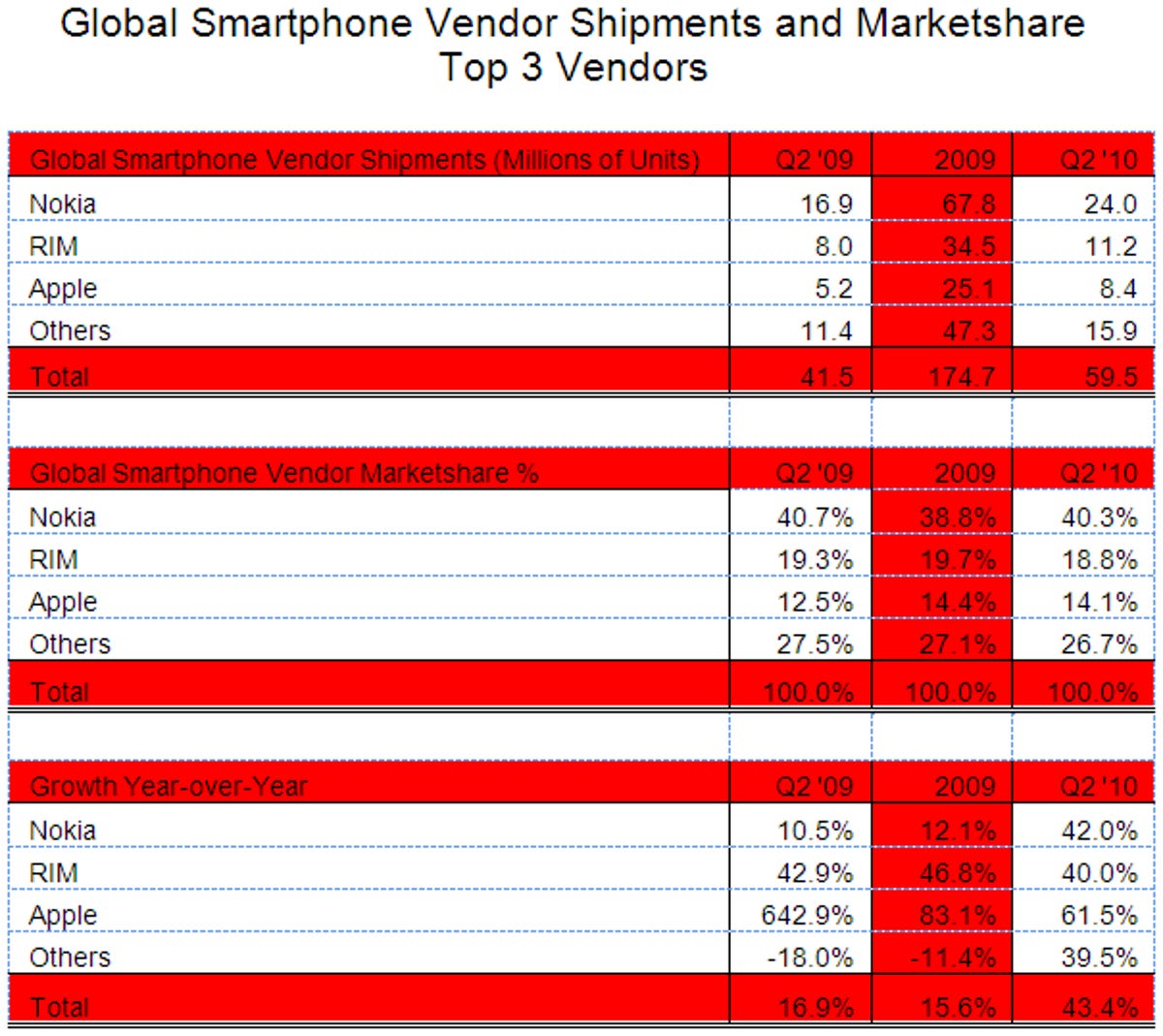

The second quarter saw 60 million smartphones shipped around the world, a 43 percent jump from a year ago, according to a study released Thursday by research firm Strategy Analytics.

Growth was driven by robust subsidies from carriers, strong competition between high-end vendors, and a rising selection of lower-cost phones running systems like Android and Symbian, according to the study. Overall, smartphones accounted for 19 percent of all handsets shipped during the period.

But the dizzying array of smartphones and the increasingly competitive market could pose a challenge to manufacturers trying to ramp up profits.

“The global smartphone industry is growing volume, but the industry’s value is beginning to feel the effects of intensifying competition,” Neil Mawston, director at Strategy Analytics and the author of the study, said in a statement. “Dozens of vendors from the telecoms, PC and consumer electronics industries are piling into the market and driving down prices. Even established brands such as Nokia, RIM, and Apple are finding it increasingly hard to raise prices and profits in the face of such fierce competition.”

Among the three major smartphone players, Nokia’s market share dipped slightly to 40.3 percent compared with 40.7 percent in 2009’s second quarter. Second-place Research in Motion saw its slice of the market fall to 18.8 percent from 19.3 percent a year-ago. And third-place Apple watched its share grow to 14.1 percent from 12.5 percent in last year’s quarter.

Strategy Analytics

Though RIM is the top smartphone maker in North and South America, Nokia still holds a commanding lead around the world. Over the period, Nokia shipped 24 million phones, compared with RIM’s 11.2 million and Apple’s 8.4 million.

Apple continues to see a surge in iPhone shipments, sales, and profits. But the growing tide of recent criticism facing the company could take a toll on market share, according to Strategy Analytics. Concerns over Apple’s production methods in China surfaced following a rash of suicides at the Foxconn manufacturing plant. Then the iPhone 4 antenna issue hit.

As a result, Strategy Analytics believes Apple’s honeymoon period may be coming to an end and that it will need to work hard during the second half of the year to prevent lost heart share from turning into lost market share.

“The Apple ‘antenna-gate’ saga highlights two key issues facing the global smartphone industry,” Mawston said. “First, the risk of device failure for all vendors will continue to rise as smartphones become more complex to design. And second, smartphone vendors and operators can differentiate their brands by offering good after-sales service when things go wrong.”

Apple’s second-quarter market share did drop slightly from the first quarter. But Mawston told CNET that the quarterly decline for Apple was more of a slowdown than a downturn, especially when looking at the overall surge in its share from 12.5 percent last year and 2 percent in 2008’s second quarter.

Mawston attributed the slowdown in Apple’s quarterly market share to a couple of factors. First, customers likely held off buying a new iPhone as they anxiously awaited the release of the iPhone 4 in late June. The numbers for the new iPhone 4 won’t show up in Apple’s market share results until the third quarter, explained the analyst.

But second, Apple may be reaching the upper limits of the number of customers it can grab through its current carriers, especially in major iPhone markets such as the U.S., China, and Japan. To expand market share much further, Apple will need to reach out beyond its current lineup of carriers.

“For them to go up toward the 20, 25, 30 percent level [in market share], then Apple’s going to have to sign up more multiple carriers in their major markets,” Mawston told CNET. “They’ve done that in France, the U.K., and a few other countries. But in the U.S., China, Japan, and other big countries, they’re still with single carriers. To see a significant upside on their numbers, they’re going to have to go multi-carrier with Verizon Wireless, China Mobile, and NTT DoCoMo to expand beyond where they currently are.”