Enlarge Image

Enlarge ImageGfK

The global smartphone market had a strong second quarter, due in large part to demand for higher-end smartphones like Apple’s iPhone 6 and Samsung’s Galaxy S6 line, according to new sales data.

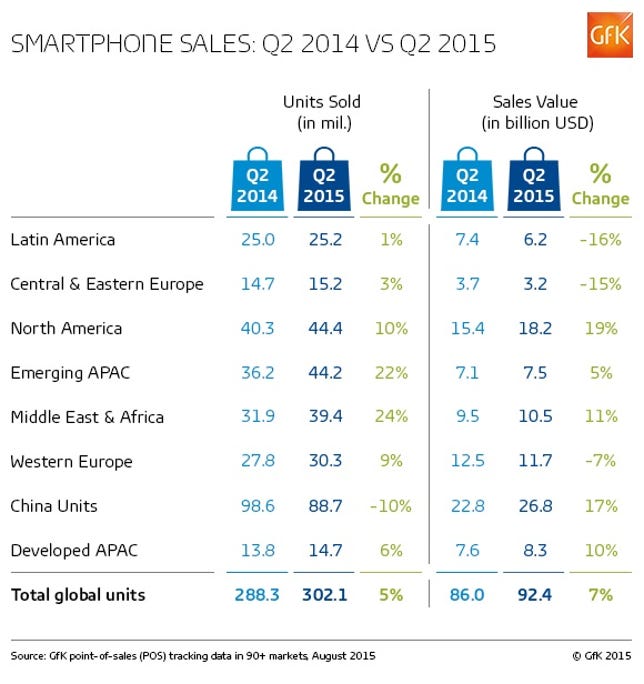

Total smartphone unit sales worldwide rose 5 percent to 302.1 million units in the second quarter, German research firm GfK reported on Monday. Meanwhile, smartphone vendors raked in the cash, generating $92.4 billion during the second quarter, up from $86 billion during the same period in 2014.

The GfK data, which tracks sales to users as opposed to supplier shipments, shows it may have been a troubling quarter for companies offering devices in the midrange of the market at prices between $250 and $500. In the two biggest smartphone markets — North America and China (which also account for the lion’s share of worldwide revenue) — consumers were most interested in higher-end smartphones that cost $500 or more. In the US, low-end handsets that cost up to $250 also proved popular among consumers.

“We see a price polarization as sales of high- and low-end devices grew at the expense of midranged devices,” GfK wrote in a statement detailing the North America market in the second quarter. “Smartphones in the high end captured 43 percent of smartphone unit share in Q2 2015, up from 38 percent in 2Q 2014.”

GfK added that high-end smartphones now account for 17 percent of the $26.8 billion China market, up from 10 percent last year.

The findings show little is changing in the smartphone space, as consumers continue to favor products that either sit at the top of the market or come in at a low price point. For the last few years, Apple and Samsung, the two market leaders, have continued to stake claim to the smartphone space largely on the backs of their high-end smartphones. However, other companies, including Huawei, Xiaomi, and others, have been able to succeed by offering compelling devices at lower cost.

“The overall growth of the smartphone market was not only driven by the success of premium flagship devices from Samsung, Apple, and others, but more importantly by the abundance of affordable handsets that continue to drive shipments in many key markets,” IDC research manager Anthony Scarsella said in a statement last month accompanying his company’s own report on the second-quarter smartphone market.

In July, research firm IDC reported that Samsung secured 21.7 percent of the global smartphone market in the second quarter on 73.2 million unit shipments. Apple’s 14.1 percent market share on 47.5 million shipments put the iPhone maker in second place.

China-based Huawei, which sells a range of smartphones to the country, was in third place with 8.9 percent market share. Its fellow China-based companies, Xiaomi and Lenovo, took fourth and fifth place, respectively.

China, however, proved to be a bit softer than other markets when it came to actual unit sales, according to GfK. While every other market around the world saw smartphone unit sales grow in the second quarter — most notably the Middle East and Africa, where smartphone sales jumped 24 percent — China saw a 10 percent year-over-year decline, according to GfK. The research firm didn’t say why China’s unit sales were down, but noted that its revenue jumped 17 percent, reflecting the market’s increasing desire to buy fewer, but pricier, smartphones.

Looking ahead, GfK said it expects 2015 to be a banner year for the smartphone market, notching its highest unit-sales figures ever of 1.3 billion units. The research firm says that worldwide smartphone sales volume will hit $400 billion, up 5 percent compared to the same period last year. North America will see the strong growth in sales revenue, jumping 16 percent year over year.