TrendForce

Samsung had a somewhat rough 2014, as its global smartphone market share slipped almost 5 percent, new data from research firm TrendForce shows.

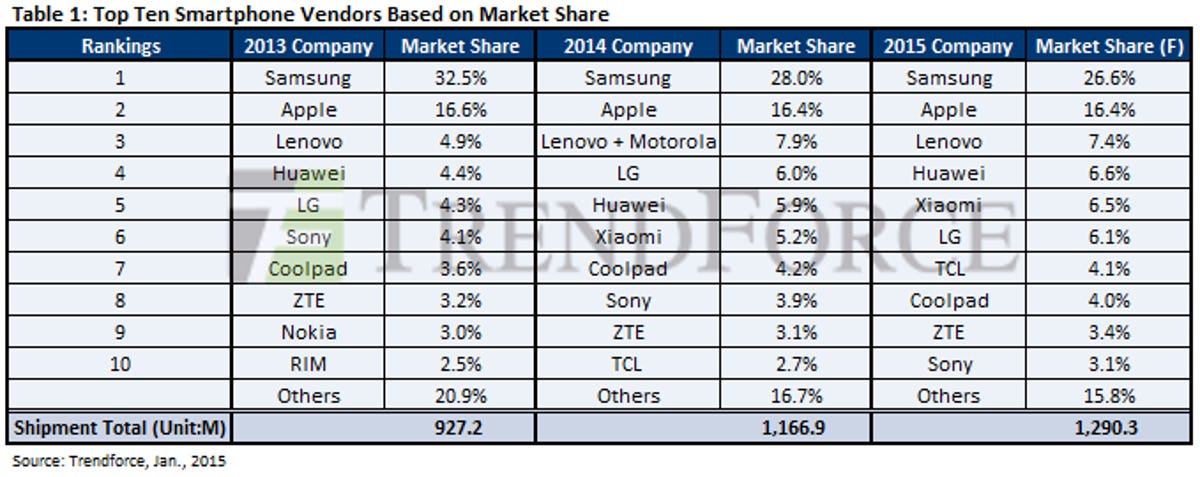

According to TrendForce, Samsung continued to lead the pack in 2014, owning 28 percent of the smartphone market, but that number was down from 32.5 percent in 2013. Apple, meanwhile, maintained steady year-over-year numbers in second place, accounting for 16.4 percent of all smartphone shipments in 2014. The iPhone maker held 16.4 percent of global market share in 2013.

Samsung did not immediately respond to a request for comment.

Lenovo and its newly purchased Motorola took the third spot in 2014 with 7.9 percent smartphone share, followed by LG at 6 percent and China-based Huawei at 5.9 percent, TrendForce says.

TrendForce’s data provides key insight into a smartphone business that is growing rapidly. The company’s data indicates that the smartphone market grew from 927.2 million global shipments in 2013 to 1.2 billion in 2014. It’s getting harder for a company like Samsung, which has been facing trouble, to maintain its lead as competition expands.

TrendForce’s findings are the latest in a string of bad news for Samsung’s smartphone operation. Over the past several quarters, Samsung has faced increasing competition in key markets, such as China, where competitors like Lenovo, Huawei and Xiaomi continue to gain market share.

Samsung has acknowledged with each passing quarter that it’s having trouble in the smartphone space. During an earnings call late last year, Samsung said that its marketing costs are skyrocketing in mobile in an effort to keep its smartphone shipments afloat. The company also said that it may have made a mistake in 2014 by offering too many smartphone models and not focusing enough on key products.

Samsung announced in November that it would cut the number of smartphone models it produces in 2015 to 30 percent. The news came after the company reported that its third-quarter income on mobile had tumbled 74 percent and its operating profits were the lowest they had been since the middle of 2011.

Although TrendForce didn’t get into the financial side of the smartphone market, the research firm indicated that Samsung likely will see its market share fall again in 2015 — albeit at a slower rate — to 26.6 percent. The company said it believes Apple’s smartphone market share will remain unchanged.

If these predictions came to fruition, they wouldn’t be a major issue for either company. TrendForce says that it expects smartphone shipments to jump to 1.3 billion in 2015, which means both Samsung and Apple will be selling more smartphones. For Samsung, therefore, cost control becomes a driving force as it seeks to improve its relations with investors and show that it can generate stronger margins on the products it sells.

One other important note from the TrendForce report: The research firm says LG “was the dark horse of 2014,” as its shipments grew 75.4 percent to 70 million units. TrendForce expects LG to hold on to about 6.1 percent of the market in 2015.