In case the market needs more evidence of the strength of mobile versus PCs, all it has to do is look at Qualcomm.

The wireless-chip maker, which helped popularize the CDMA technology used in cell phones, today reported quarterly financial results that were better than it had anticipated, and it provided bullish projections for the current period and year.

Related stories:

- Qualcomm CEO says legacy apps have to go touch

- Qualcomm nabs Microsoft’s CES keynote slot

- Intel’s cautious outlook suggests the PC market still stinks

Its strong results — which sent shares up about 8 percent in after-hours trading — contrast pretty sharply with the dismal forecasts from many other semiconductor companies, most notably PC chip giant Intel. Intel last month gave a fairly grim outlook for the last three months of the year, saying PC buyers remain cautious about new purchases thanks to the lousy economy and the popularity of tablets.

For example, Qualcomm said its revenue this quarter would soar 20 percent to 30 percent year-over-year. Intel, meanwhile, said its fourth-quarter sales would slide about 2 percent from the year-earlier quarter.

So why is Qualcomm doing so well?

Its strength all comes down to the market it addresses: mobile.

Here’s what Chief Executive Paul Jacobs said during a conference call:

I’m really happy that the year turned out so well. It was a little harder year than I had anticipated. The very beginning of the year we had our engineering teams working feverishly to get chipsets done. They did that so well and then we ran into supply constraints and had to talk to customers about not being able to give them everything that they wanted. You add that to a somewhat uncertain macroeconomic environment.

At the end of the day, global demand for data and for mobile data and smartphones and tablets and all these devices just really pulled it through. That’s a testament to the employee base, the focus they had, and the worldwide excitement around mobile technology.

Qualcomm isn’t exactly a household name, but the odds are fairly high that many homes have at least one device that uses its chips. The company dominates the market for providing wireless processors, like 3G CDMA and 4G LTE, and it also makes application processors for smartphones and tablets. Its chips are used in Apple’s newest devices, and it also powers all Windows Phone 8 products.

Nobody can deny that the PC market pretty much stinks right now, while demand for smartphones and tablets continues to grow. The companies with more exposure to mobile, and particularly to customers like Apple and Samsung, are seeing their sales and earnings jump while PC chip rivals see their numbers shrink. That includes Qualcomm.

Some concerns linger

Of course, not all has been rosy for Qualcomm on the mobile front. For one, competition is getting stronger. The company is doing very well in smartphones, but some rivals — like Nvidia — are ratcheting up a lot of design wins in tablets. The Google Nexus 7 and Microsoft Surface both use Nvidia’s Tegra processor.

Also, Qualcomm has its eyes on the PC market with the launch of Microsoft’s newest operating system, but development on such devices has seen some hiccups. HP, which previously was working with Qualcomm on a Windows RT device, scrapped its plans several months ago. And Samsung, which has created a Qualcomm-powered Windows RT product, has said it’s holding off on shipping the device. Dell, another Qualcomm partner, also isn’t currently shipping its product.

Qualcomm President Steve Mollenkopf told CNET in an interview that there aren’t any technology issues holding up the products. Rather, the timing is based on the device makers’ strategies.

“You’re not going to be disappointed in terms of when they’re going to ship,” Mollenkopf said. “But we’re being careful not to give our customers’ schedules, particularly when there’s so much marketing associated with launch, and people sometimes move launches around in terms of when they want to get the most bang.”

Meanwhile, Qualcomm has been struggling to build enough chips to meet its customers’ demand, and that continues to be a problem. However, the company expects that situation to be behind it by the end of December.

“We still have demand higher than our ability to supply, but we’re adding enough supply,” Mollenkopf said. He noted that Qualcomm’s foundry partner, Taiwan Semiconductor Manufacturing Co., or TSMC, gave Qualcomm additional capacity, and other manufacturing partners also have provided more chips.

All shortages were related to Qualcomm’s LTE chips and the semiconductors that integrate LTE with an application processor.

The shortfall “was really caused because what you’re seeing is this massive market of smartphones moving toward newer tech,” Mollenkopf said. “If you look at how much of the semiconductor market today is associated with mobile, it’s pretty significant. That stressed us for the first time.”

Qualcomm

Qualcomm blows away estimates

For the fiscal fourth quarter ended September 30, Qualcomm reported net income of $1.27 billion, or 73 cents a share, up from $1.06 billion, or 62 cents a share, a year ago.

Excluding certain costs, per-share earnings rose to 89 cents from 80 cents. That’s much better than Qualcomm’s projections in July for per-share earnings of 78 cents to 84 cents.

Revenue climbed 18 percent to $4.87 billion, topping Qualcomm’s estimate of $4.45 billion to $4.85 billion.

Licensing revenue (earned mainly from companies using CDMA technology), gained 15 percent to $1.66 billion.

For the current fiscal year, Qualcomm expects adjusted per-share earnings of $4.12 to $4.32 a share, better than the $4.13 a share anticipated by analysts, according to Thomson Reuters. It also projected revenue of $23 billion to $24 billion, above analysts’ view for $21.69 billion.

For the first quarter, the company expects adjusted earnings of $1.08 to $1.16 a share, versus the $1 a share projected by the Street. And for revenue, Qualcomm is looking for $5.6 billion to $6.1 billion, much better than analysts’ forecast of $5.3 billion.

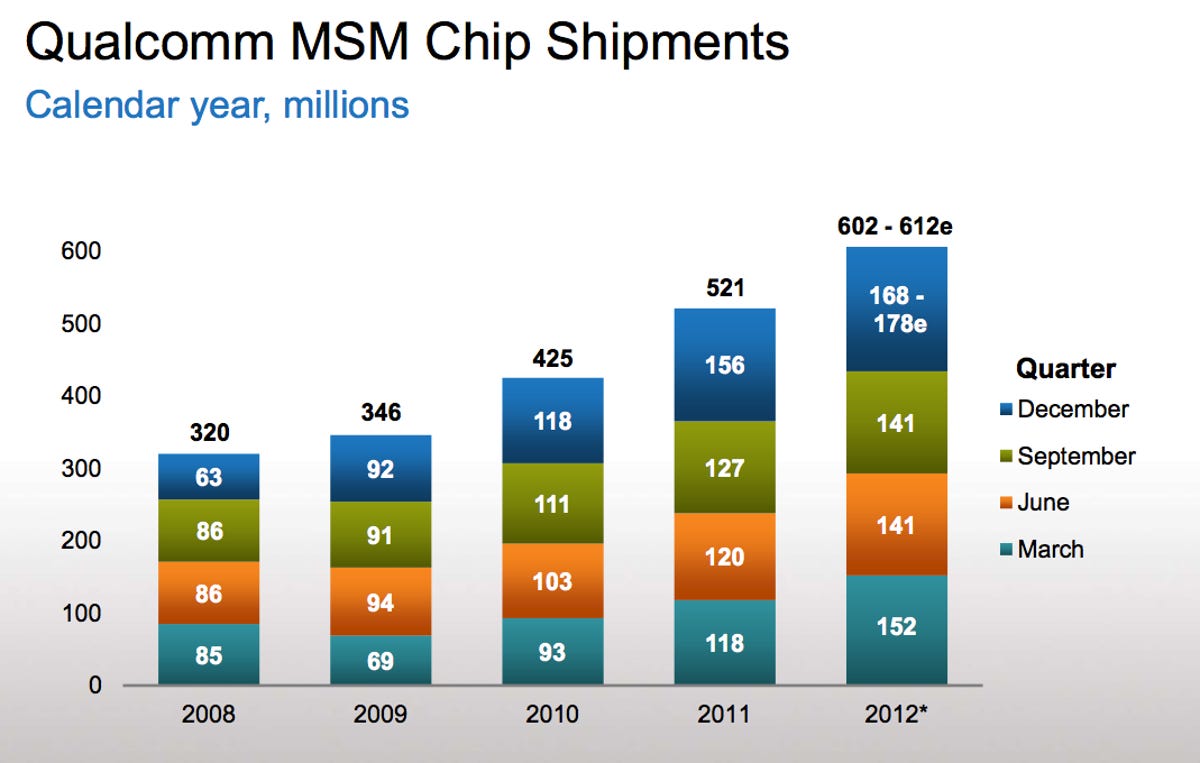

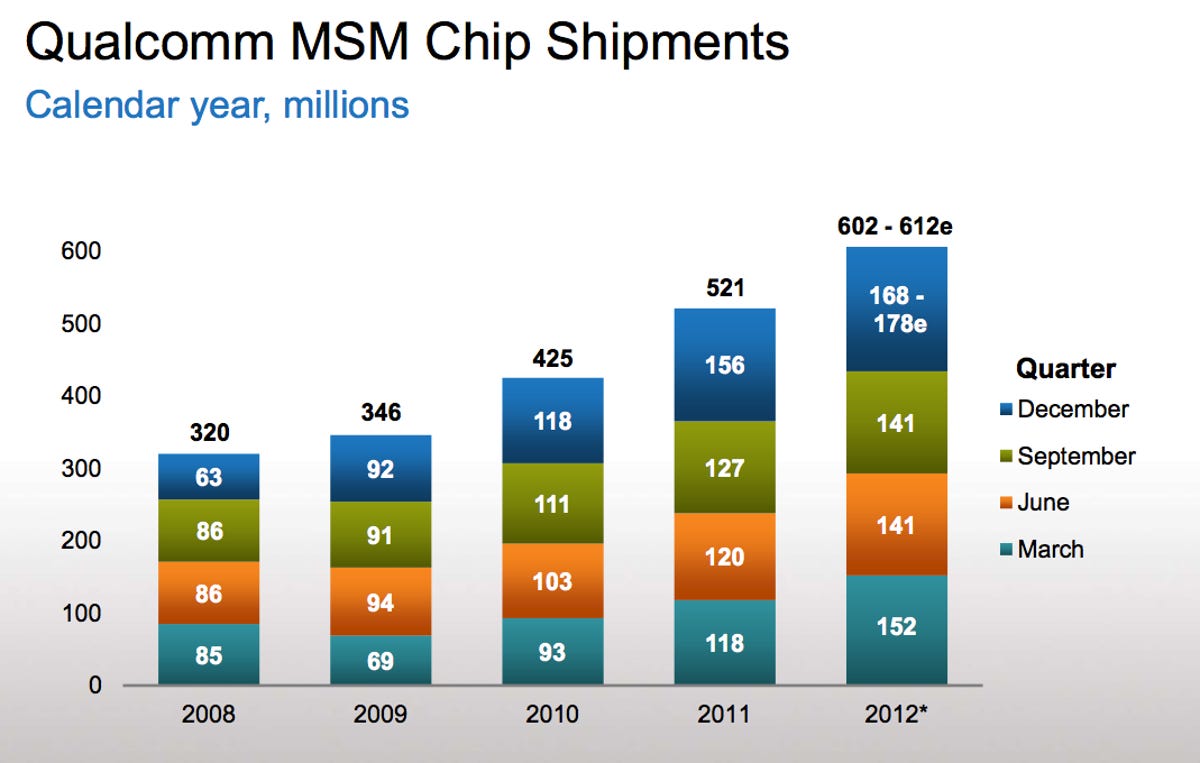

Meanwhile, Qualcomm said it shipped 141 million chipsets during the fiscal fourth quarter, up 11 percent from the year-ago period and above the midpoint of the company’s earlier projections. For this current period, it’s looking to ship about 168 million to 178 million units, up 8 percent to 14 percent from the previous year.

HTC’s Windows Phone 8X flagship strikes a pose (pictures)