Sprint’s new CEO, Marcelo Claure, has made good on his promise to get aggressive on pricing in an effort to draw new customers to the troubled wireless operator.

On Monday the company announced its first-ever family share plan, called the Family Share Pack, which will double the amount of data subscribers get for the same price as its competitors. To attract new customers to the network, the company also introduced two new promotions that provide even more data for the same price as the competing options. And it stole a move from T-Mobile’s playbook with an offer to reimburse customers for early termination fees if they switch to Sprint.

The move, orchestrated by Claure, is meant to turn things around for Sprint, which has steadily been losing customers every quarter. Claure, who joined Sprint’s board in January, stepped into the chief executive suite only a week ago. He took over for Dan Hesse, who left the company after Sprint abandoned plans to acquire rival T-Mobile. Claure, who is said to have a close relationship with Masayoshi Son, Sprint’s chairman and CEO of Sprint’s parent company, Softbank, told employees last week that the company would waste no time in slashing prices to respond to competitive threats.

Staying true to his word, the company revealed details of this new plan on Monday evening. Rather than simply slashing prices, the company is leveraging its high-capacity data network to offer consumers more value. The company had been testing family share plans in certain markets, which CNET first reported in July.

“The focus (of the new plan) is on giving away more data for the same price, rather than lowering prices per se,” Jan Dawson, chief analyst at the independent research firm Jackdaw, said in a note Monday evening. “And with all the capacity available on the Sprint network, Sprint can afford to do so.”

The new pricing plan and promotions finally put Sprint, which lost 220,000 customers in the second quarter of 2014, in a position to compete more aggressively with its competitors and win over new subscribers.

“Sprint is offering the best value to data-hungry consumers. Period,” Claure said in the press release announcing the new service and promotions. “We want customers to think twice before choosing another wireless carrier.”

While Claure’s intentions to grow Sprint’s subscriber base with plans that offer more bang for the buck will likely result in some short-term subscriber growth, the execution of these plans and promotions may leave many consumers scratching their heads trying to figure out how all the amazing promises of lower prices and better values really adds up.

The pricing plan, in conjunction with the special promotions that apply only to new subscribers and will last only through the end of 2015, are complicated and hard to decipher. That said, a closer look at what’s being offered shows that Sprint could become the value leader in the industry, beating out the current wireless golden child, T-Mobile. Of course, consumers will only make the leap to Sprint if they can figure out how the plans and promotions work.

“The new pricing plans are somewhat complex,” admitted analyst Dawson. “And so the overall impact is a little more complicated than Sprint’s ‘double the data’ headline suggests. However, it’s undoubtedly a better deal for most customers than competitors’ equivalent data plans.”

What are the plans?

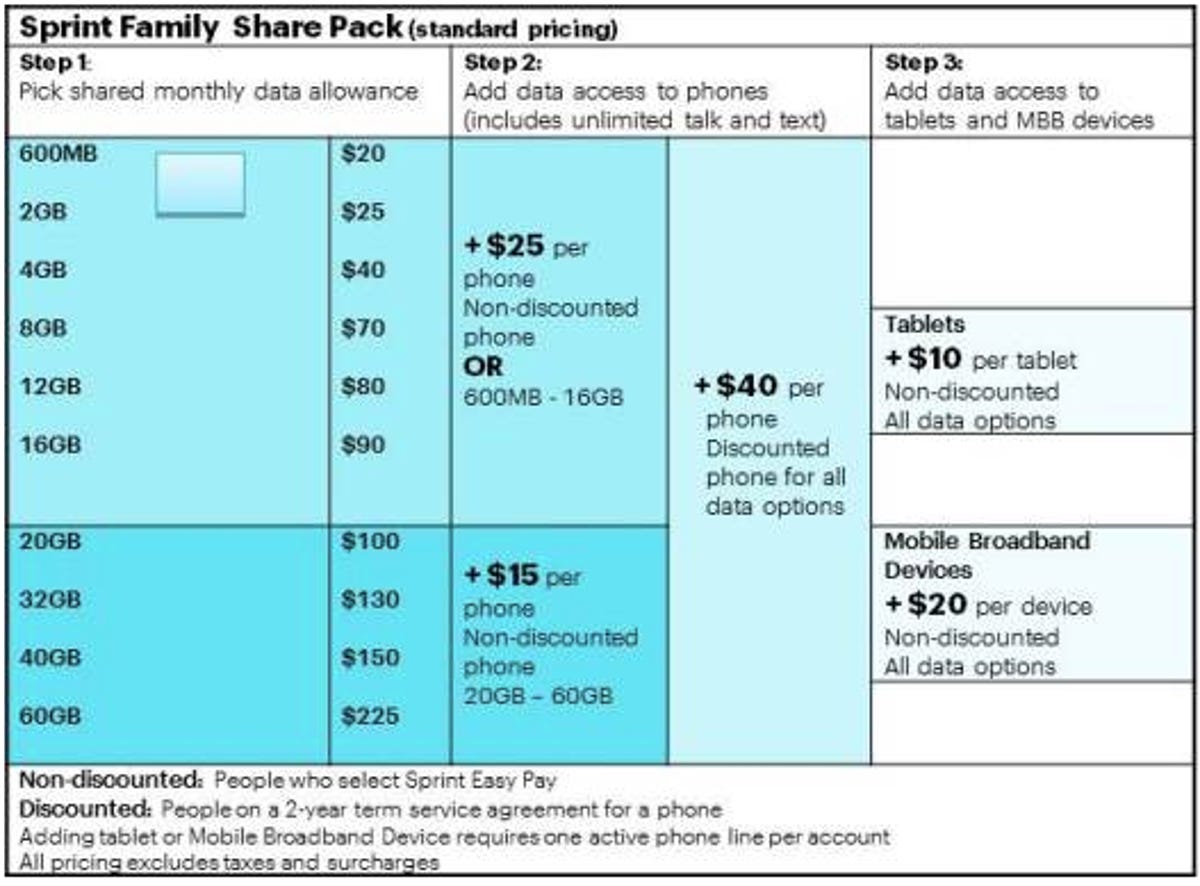

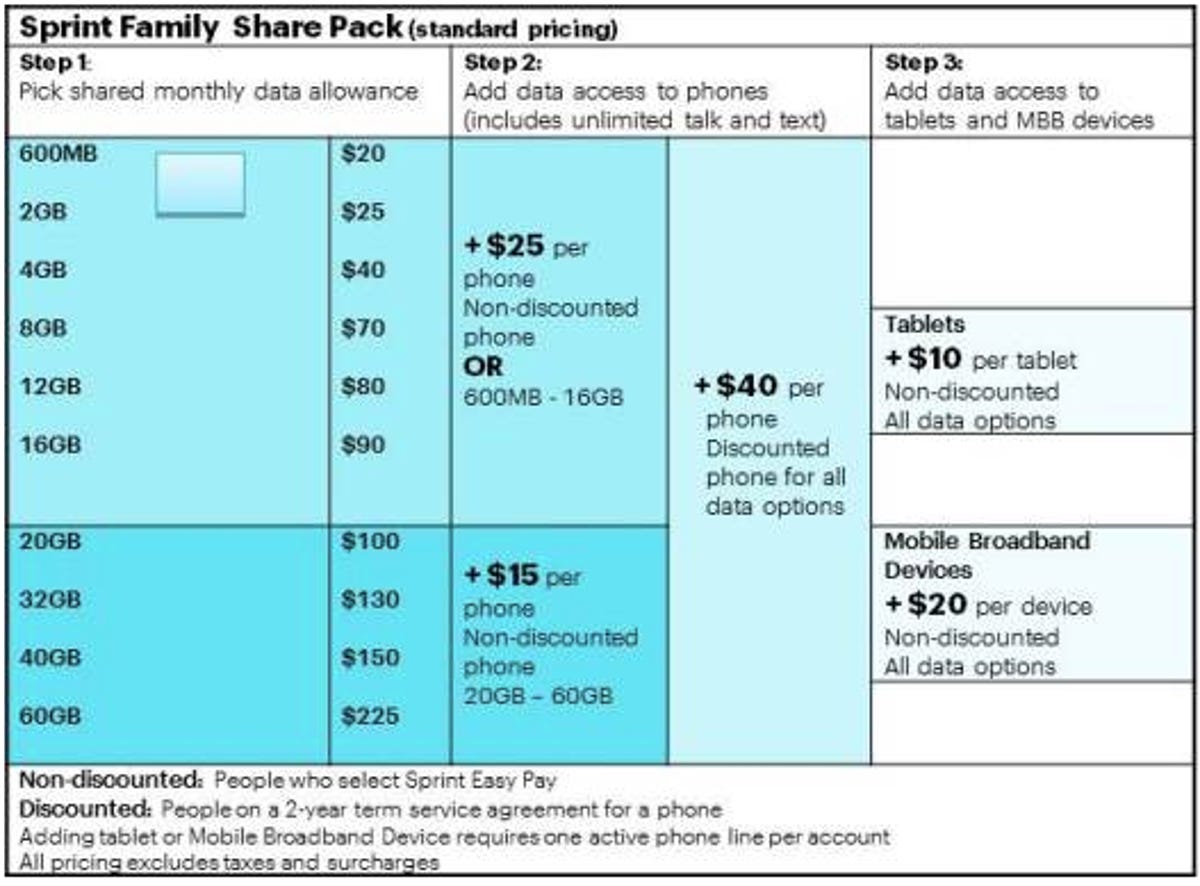

As part of the Family Pack, Sprint has finally embraced the share model that AT&T and Verizon introduced more than two years ago. This model allows consumers to buy a “bucket” of data, which also bundles unlimited texting and calling, and then customers pay to add additional lines or devices to the data plan.

Sprint

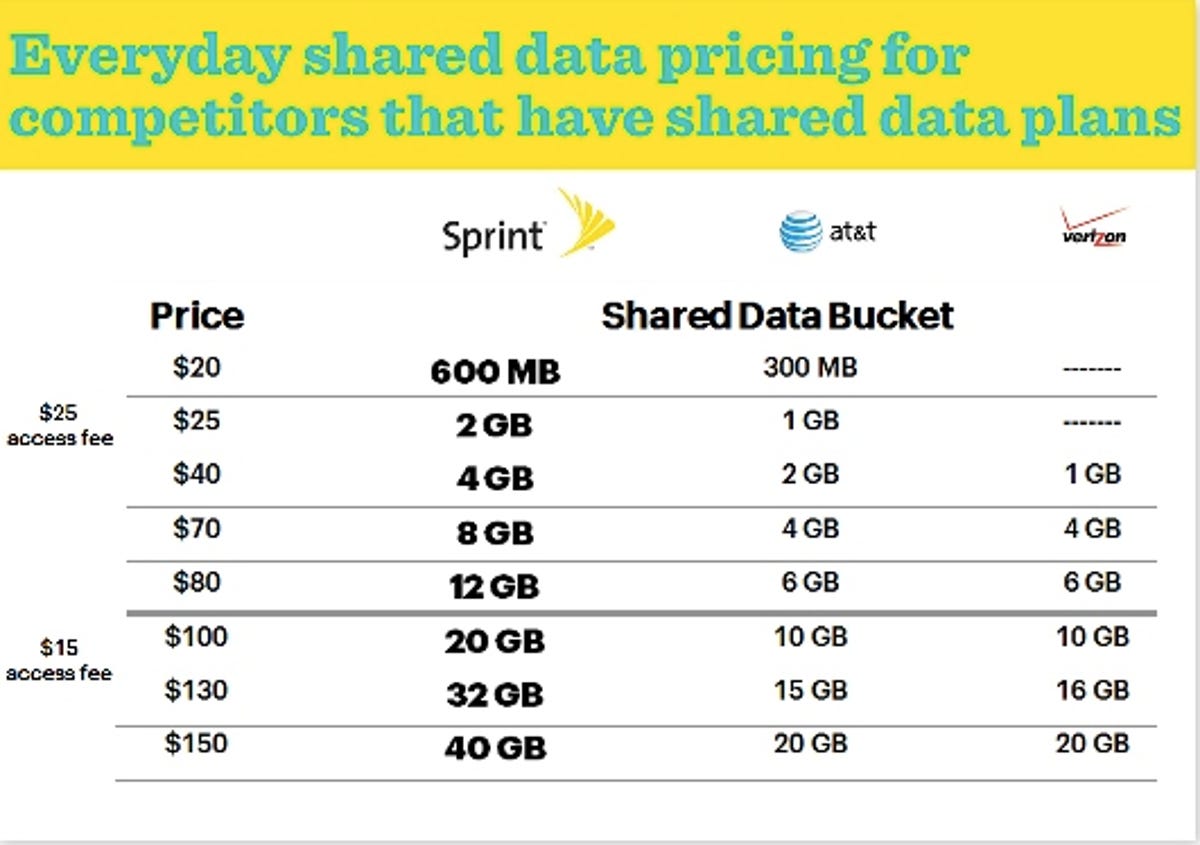

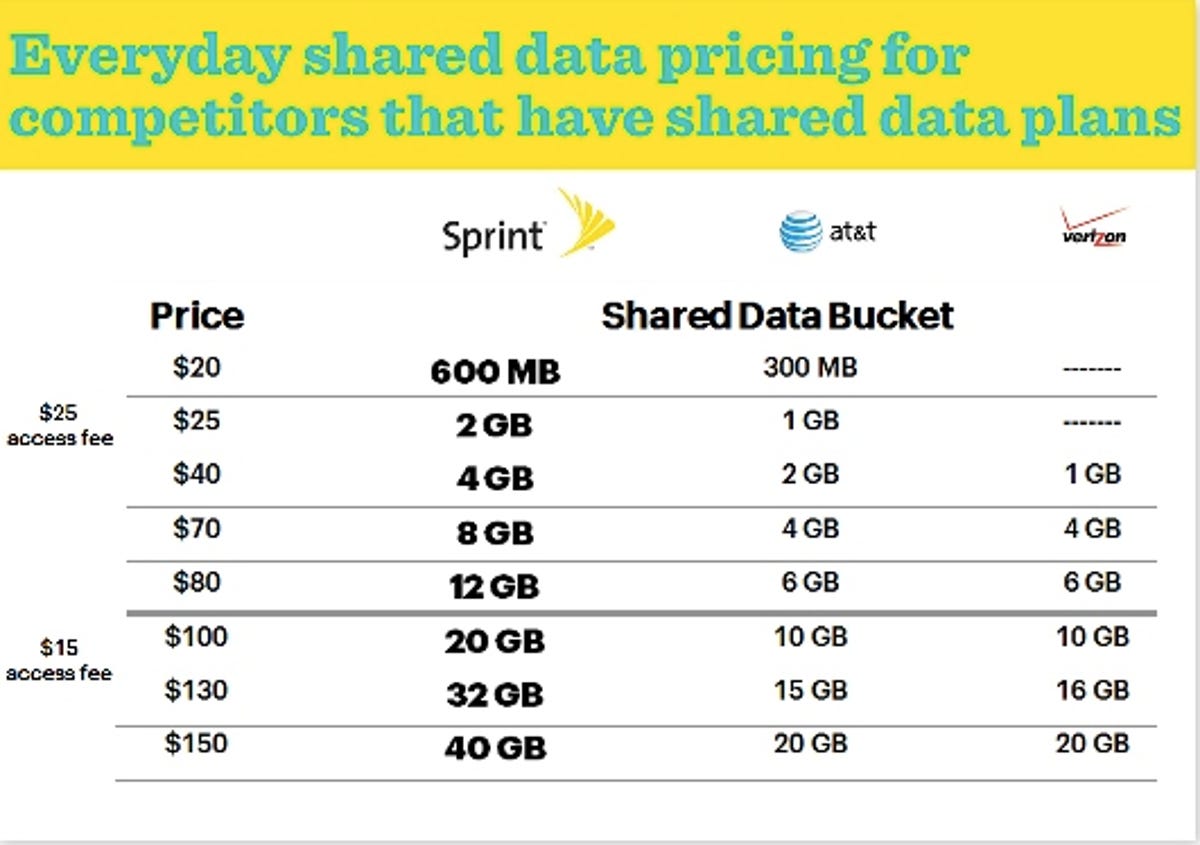

Sprint’s plan operates exactly like similar plans from AT&T and Verizon. What’s different is that Sprint offers more data for similar pricing than its competitors. Sprint’s data buckets start at 600MB and go up to 60GB. By contrast, AT&T’s data share plans start at 300MB and go up to 40GB of data.

As an example, a family of four who already owns their own phones or who are financing their phones through Sprint’s Easy Pay program can get double the data for the exact same price as they are paying AT&T or Verizon. So for $160 a month Sprint customers can get 20GB of data compared with 10GB of data for the same price on AT&T or Verizon. ( Check out this Ask Maggie column from earlier this month, which offers a comparison on the four-member family plans from the four major wireless carriers.)

The plan starts to get confusing when you add lines and consider promotions and discounts. Specifically, the cost of adding a device depends on whether the phone is being financed or whether it’s offered for a subsidized price on a two-year contract.

Sprint

If it’s financed, the cost is lower, but that price varies depending on how much data the customers has. For instance, customers signing up for a data package that has less than 16GB of data will either pay $25 a month to connect each device to the service if the phone is financed through Sprint’s Easy Pay service, or if the customer brings his own device. If the customer is signed up to a two-year contract and has bought a subsidized phone, the cost to add each additional line is $40 per device per month.

To be fair, this confusing price structure is similar to what’s offered by AT&T and Verizon Wireless, which also vary the cost of adding lines, depending on how much data a subscriber purchases or whether the devices are paid for.

New customers get even sweeter discounts

But for Sprint, things get even more complicated when promotions for new customers are added into the mix. Not only will Sprint pay to reimburse new subscribers’ cancellation fees up to $350 per line when they switch to Sprint, but it’s also adding even more value to the plans by waiving the device connection fees for anyone subscribing to 20GB or more of data each month. This means that families can pay a flat $100 for the 20GB data plan and add as many lines or devices to the plan as they like, and the plan will still cost $100 a month.

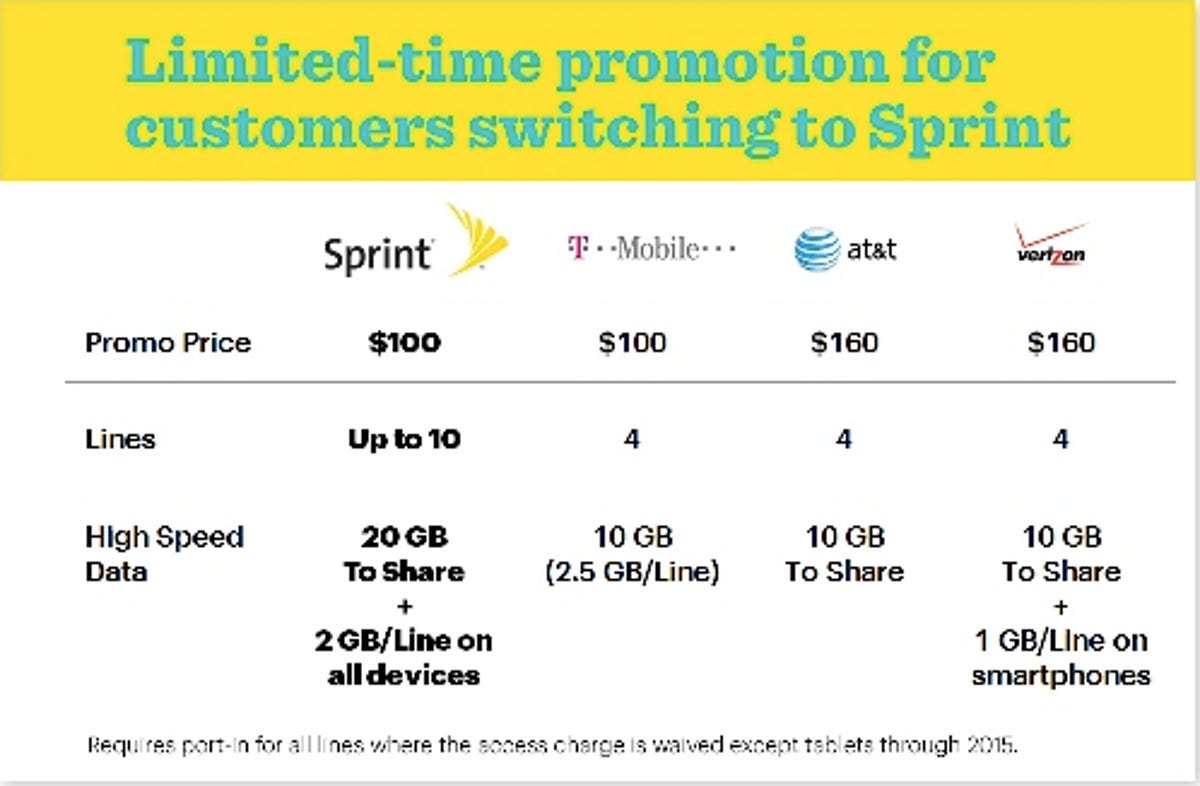

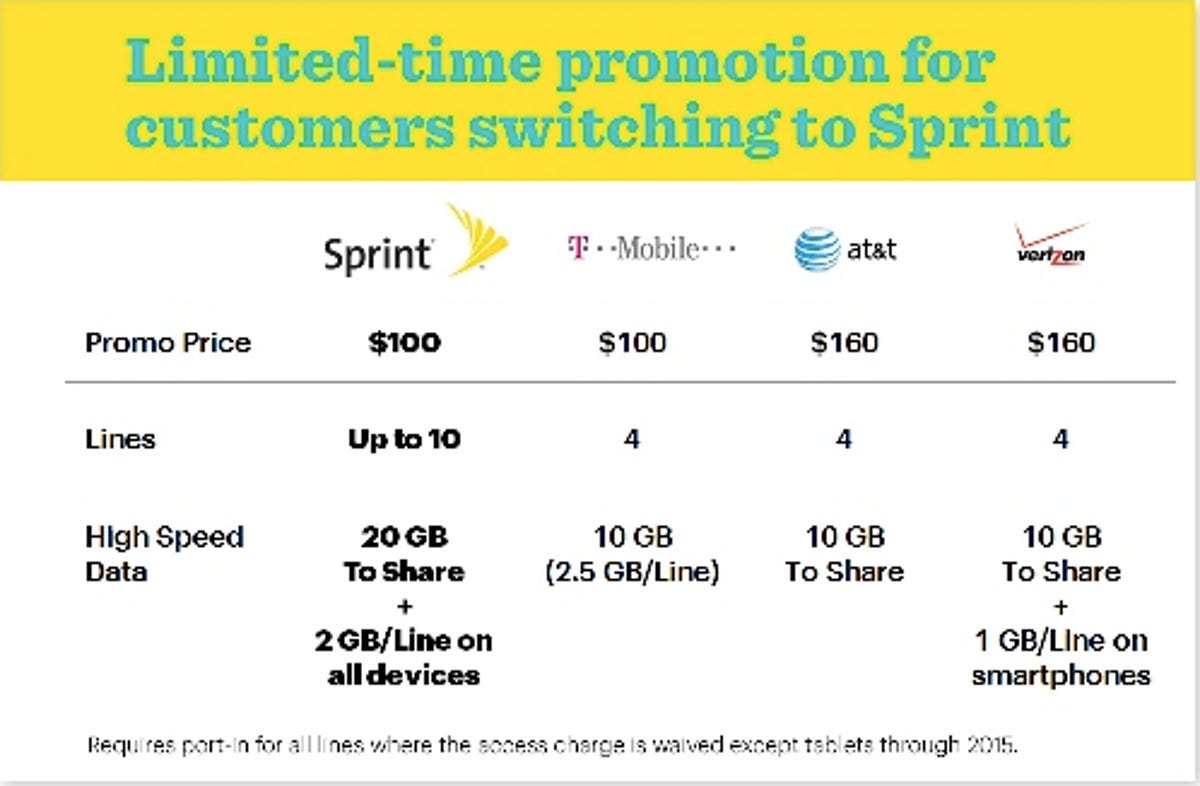

For a family of four, this is a discount of $60 a month, putting the offer on par with T-Mobile’s recently announced family plan promotion, which offers a total of 10GB of data to a family of four for $100 a month. Like Sprint’s offer, T-Mobile’s offer is only good through the end of 2015. The key difference compared with T-Mobile’s offer is that Sprint is offering twice the data capacity for the same $100 price tag.

But the specials don’t stop there for new customers. All new Sprint customers, regardless of how much data they subscribe to, will get 2GB more data added to their monthly plans for each new line on the plan. This means that if you are subscribed to the 20GB plan, and you add 10 new customers to the plan, you can get up to 40GB of data and only pay a service fee of $100 a month. This would give each customer signed up to this plan approximately 4GB of data each month for just $10.

To put this in perspective, under Sprint’s now discontinued Framily plan, for a group of 10, each individual could get 4GB of data for $35 a month or unlimited data for $45 a month. Of course, once this promotion ends, the price will go up. At that time a group of 10 individuals on the same Family Share Pack will pay $30 each for 4GB of data. (This is also the price that current Sprint customers would pay if they switch from Framily to the new Family Share Pack plans.)

Sprint

There is no question that the new plan and the promotions offer Sprint customers a lot of value. But these special offers make what is supposed to be a simpler and more streamlined pricing structure overly-complicated.

And there are catches. For one, the promotions are only available to new Sprint customers. Second, Sprint requires that customers buy new devices through Sprint’s Easy Pay financing plan to qualify for the promotions. This ultimately increases the monthly cost of the service, depending on the device that is being financed. In other words, customers are prohibited from bringing their own Sprint devices to the network and receiving the promotional price. And they cannot sign a two-year contract, buy a subsidized phone, and get the device fee waived or qualify for additional data on their plan.

Framily is out; Family Share Pack is in

Ironically, Sprint is trying to sell this new plan as simpler than its previous attempt to compete on pricing, the Framily plan, which offered subscribers deeper discounts on service the more people that joined the Framily plan. It also offered customers within the same Framily the option to get billed separately. The offer was introduced in January.

What’s happening to that plan now? Even though Sprint’s previous CEO said in April that the Framily plan was one of its most successful service plans, signing up 1 million customers in the first 40 days it was offered, company officials confirmed that Sprint’s heavily marketed “Framily” plan will be replaced by the Family Share Pack plans.

Claure alluded to the dismantling of the Framily plan last week when he spoke to employees in a town hall meeting. According to Light Reading, which was first to report on the meeting, he criticized the old plans as being difficult to sell because retail employees were unable to communicate their value.

Sprint is expected to stop selling the Framily plan on August 22 when the new Family Share Pack is offered, a spokeswoman said. Current Framily customers can keep their plans, and they can continue adding lines to their accounts for the discounts, she added. They also have the option of switching to a Share Pack offer with no penalty.

Unlimited data no more?

While it is true that the Family Pack service offers more data for the same price as similar plans from Sprint’s competitors, the fact that Sprint is even offering a share plan is a big deal. Since AT&T and Verizon first introduced their own share plans a little more than two years ago, Sprint has been critical of them in its marketing. To stand out from its competition, Sprint has been a champion of unlimited data services.

Meanwhile, AT&T and Verizon no longer sell unlimited data service to new customers. In fact, they’ve introduced network management practices and pricing programs to actively encourage customers, who are grandfathered into their old unlimited data plans, to abandon them. T-Mobile still offers unlimited data.

“It’s a sign that Sprint is bowing to the inevitable, both in embracing shared data plans, which are becoming the industry norm, and in competing on price when its network is not yet up to the challenge,” analyst Jan Dawson said in his note.

Sprint has not yet said what it will do about its unlimited data offering. There was no mention of an unlimited tier as part of the Family Share Pack announcement. Hesse, Sprint’s former CEO, had been adamant that Sprint’s unlimited data plan was a key differentiator for the operator. A year ago, the company offered its Unlimited Guarantee to new and existing customers that they would get unlimited talk, text and data for the life of the line of service.

“Sprint’s been losing subscribers for the last few quarters, and desperately needs to start turning around the negative trend,” Dawson continued. “Sprint’s former CEO had resisted the urge to compete aggressively on price, so this is the first sign that Claure will be more aggressive.”

In the company’s press release Claure said that Sprint would be making another major announcement later this week to discuss individual plans, which a company spokeswoman hinted would address the question of unlimited data.

Chances for success

It’s unlikely that Sprint’s woes can be solved entirely by aggressive pricing structures.

The real issue for Sprint is the fact that it’s been going through a painful network upgrade as it rips out old infrastructure and replaces it with more flexible gear that will allow the company to use spectrum it’s acquired from Nextel and Clearwire along with spectrum it already owned to build its 2G and 3G Sprint network. The process, which is supposed to eventually make the network operate more smoothly, has resulted in poor service quality, frustrating and outraging subscribers. Additionally, the company has been slow to introduce faster speeds to its network when compared to rivals who are lighting up cities much more quickly with 4G LTE technology.

“They had to do something,” Ross Rubin, principal analyst at Reticle Research, said in an interview. “They simply can’t compete today in terms of network speeds without changing something.”

Even though its network is not yet up to snuff as compared to its competitors, the company is making improvements. And there are indications that performance is improving where the network has already been upgraded. But the big advantage that Sprint has over its competitors is the amount of sheer capacity it has in its network.

Because it owns so much spectrum and there are so few customers actually on its network, it’s able to offer more data for the same price as its rivals.

“Most customers will not come anywhere near using 20GB in a month even across four lines,” Jackdaw analyst Jan Dawson said. “So there’s little risk involved for Sprint.”

What could be more risky for Sprint are the promotions that it’s offering. Specifically, the offer to pay early termination fees for consumers moving to Sprint’s service. It will likely have a negative short-term effect on the financials, just as it did for T-Mobile when it began paying customers’ early termination fees. But it’s all part of a plan to increase subscribership as quickly as possible.

The bigger challenge for Sprint is making sure that the rest of its network upgrade goes smoothly and quickly so that these new subscribers actually have a high-speed network they can use.

“As T-Mobile has demonstrated, price discounting and giveaways can provide a useful boost to short-term growth,” Dawson said. “But longer-term growth will require better underlying network performance too.”