With a cash investment of $20.1 billion, Softbank plans to take control over struggling U.S. carrier Sprint Nextel next year under an agreement announced today.

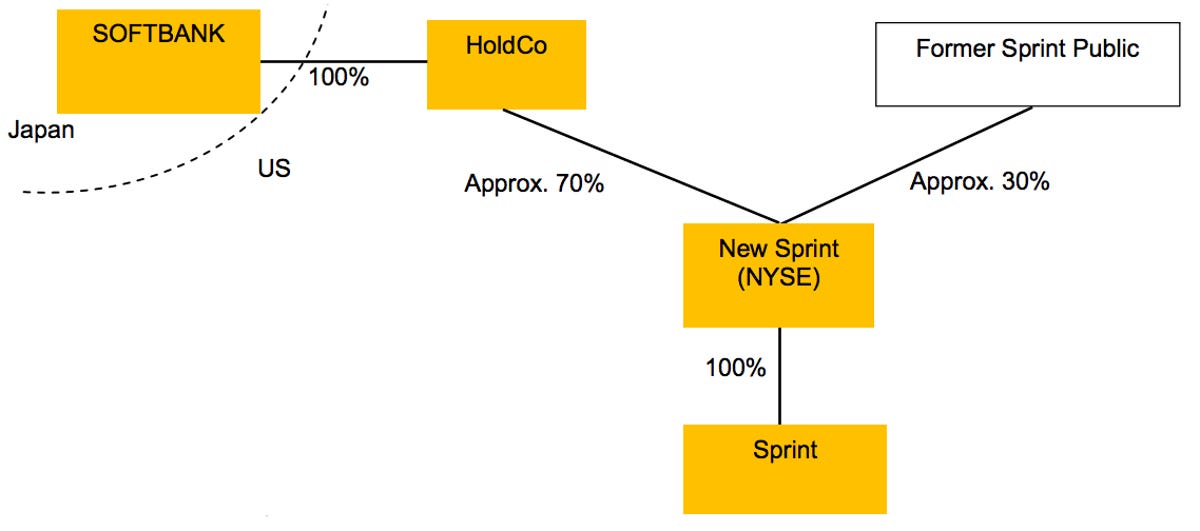

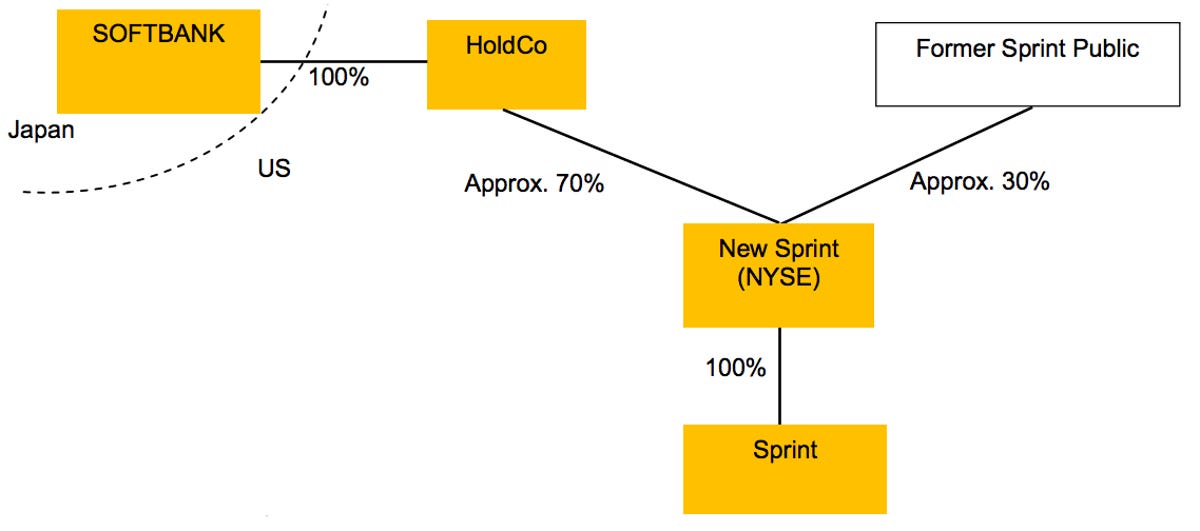

Under the all-cash deal, expected to close in mid-2013, the Japanese technology and investment firm will purchase 70 percent of Sprint’s stock for $12.1 billion and will invest $8 billion into the company, Softbank announced (PDF) today.

Softbank is offering to buy Sprint shareholders’ stock at $7.30, a 27 percent premium over the company’s closing stock price Friday. Both companies’ boards have approved the transaction.

Sprint had confirmed discussions with Softbank last week, and an announcement of the deal was expected today after CNBC reported some details last night.

Softbank CEO Masayoshi Son said the company expects the Sprint deal will continue the Japanese company’s successful record:

This transaction provides an excellent opportunity for Softbank to leverage its expertise in smartphones and next-generation high-speed networks, including LTE, to drive the mobile Internet revolution in the world’s largest market. As we have proven in Japan, we have achieved a V-shaped earnings recovery in the acquired mobile business and grown dramatically by introducing differentiated products and innovative services to an incumbent-led market. Our track record of innovation, combined with Sprint’s strong brand and local leadership provides a constructive beginning toward creating a more competitive American mobile market.

Part of that track record involves Japan, where Son has been pleased with Softbank’s $20 billion investment in Vodafone Japan, he said in a 2011 speech at Mobile World Congress. At the time, Softbank’s share price dropped and the company lost $1 billion a year on the deal for four years, but then finances turned around.

“People started saying mobile is no longer profitable and so on,” Son said. “It was a risky bet…[but] sometimes craziness gives a good return.”

Softbank

The deal comes at a time when it’s tough to be a carrier other than Verizon or AT&T, the top two mobile operators in the United States. T-Mobile plans to acquire MetroPCS, a regional carrier, after AT&T’s deal to acquire T-Mobile collapsed.

Related stories

- T-Mobile Laying Off More Workers Post-Sprint Merger

- Mint Mobile, Xfinity Mobile, Google Fi, Visible: Which Wireless Networks Do Smaller Providers Use?

- I’m Racing My Own Son for $1,000 Because I Am an Idiot

The investment should be a big boost for Sprint, a company mired in red ink. In the second quarter, the company posted a net loss of $1.37 billion, and the financial troubles are expected in the third quarter, too.

Sprint CEO Dan Hesse said the deal will benefit shareholders and lead to a “stronger, better-capitalized Sprint.” And Sprint will learn from Softbank’s “successful deployment of LTE in Japan as we build out our advanced LTE network, improve the customer experience, and continue the turnaround of our operations.”

LTE, which stands for long-term evolution, is the technology behind the higher-speed 4G wireless networks, and upgrading a network to use it requires expensive investments and scarce electromagnetic spectrum. Verizon has a major lead here, with 417 areas covered by LTE and a plan to move voice communications to LTE by late 2013 or early 2014.

Softbank plans to pay cash for the deal. The money will come from a combination of Softbank’s own reserves and financing from Mizuho Corporate Bank, Sumitomo Mitsui Banking, the Bank of Tokyo-Mitsubishi UFJ, and Deutsche Bank.

CNET/Marguerite Reardon