Marichrist Benitez/CNET

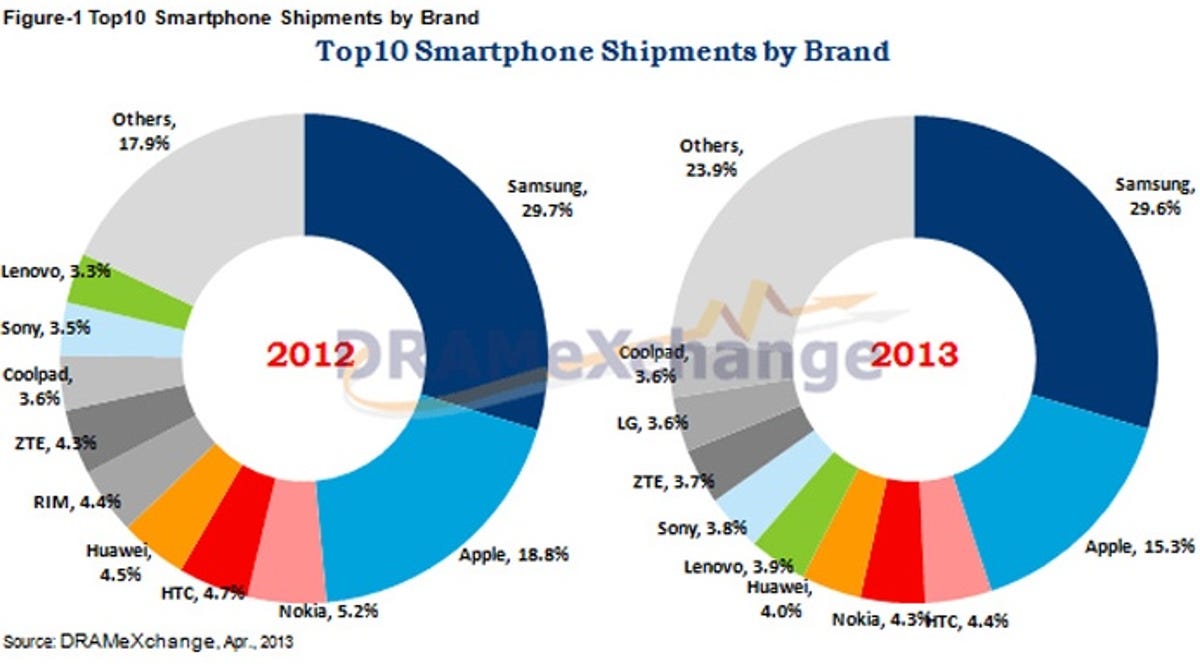

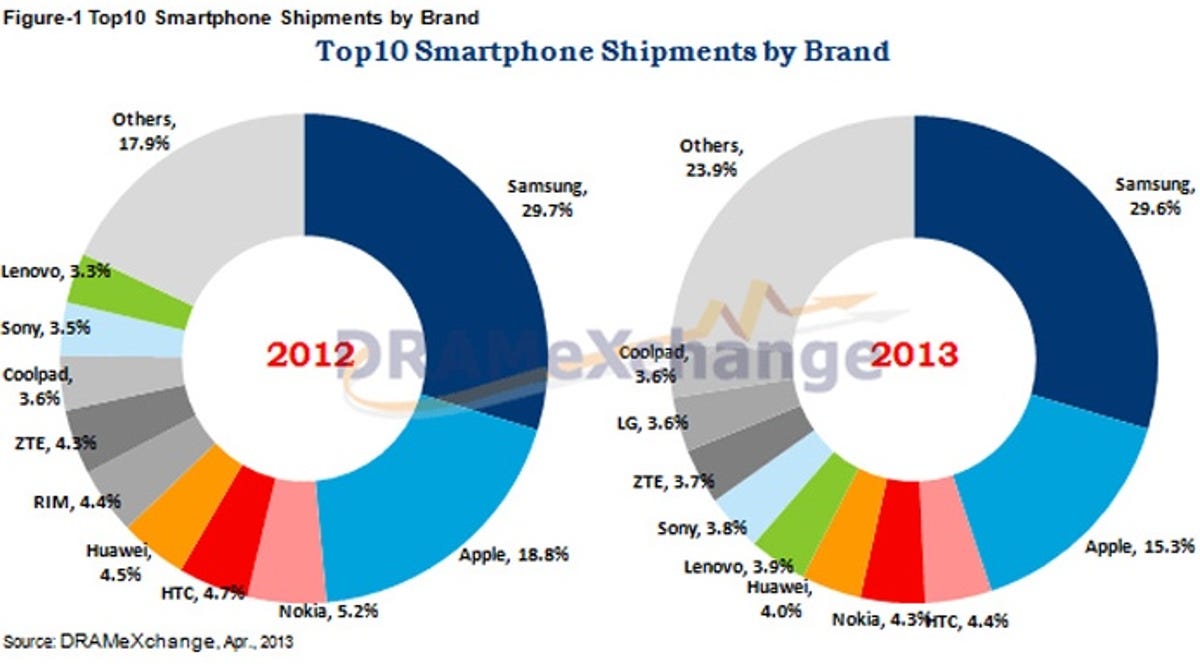

You don’t have to look far to see evidence that the world of successful, high-end smartphone makers is shrinking to two major contenders — Apple and Samsung — while other important brands, like BlackBerry, HTC, and Nokia, have faded in prominence or struggle to compete.

Read more Smartphones Unlocked

- How to sell your phone for cash

- Why the US is poised for off-contract shift

- Mind-numbing mobile plans do buyers no favors

- When is a smartphone just too big?

- Smartphone innovation: What’s next

- 6 things I want from NFC

- Your smartphone’s secret afterlife

- Smartphone batteries: Problems and fixes

- The ABCs of smartphone screens

Still, like ground cover beneath a canopy of trees, smaller or less well-known brands have a chance to grow, even thrive, in emerging markets.

Lenovo is picking up steam in China, the most important growth market there is; and even on the brink of extinction, BlackBerry phones are still selling throughout Africa, South America, and the Middle East.

In fact, emerging markets spread across Asia, South America, Africa, Europe, and the Middle East are where important smartphone battles of 2014 and beyond will be fought and won, and the reason why lesser-known players like Archos, Geeksphone, and Meizu keep on keeping on despite extreme pressure from the 800-pound gorillas.

Why the developing world is so important Smartphone adoption is on the rise in places where, up until last year, feature phones outsold them. ABI Research says that smartphone penetration is at 20 percent out of a global population of 7.2 billion people.

Looking at it another way, smartphones accounted for a little over half (55 percent) of all mobile handset sales in 2013, a figure that will probably jump to about 64 percent in 2014. That means there are a lot of people who will be shopping for their first-ever smartphones, people who perhaps aren’t as focused on brand loyalty as they are on value.

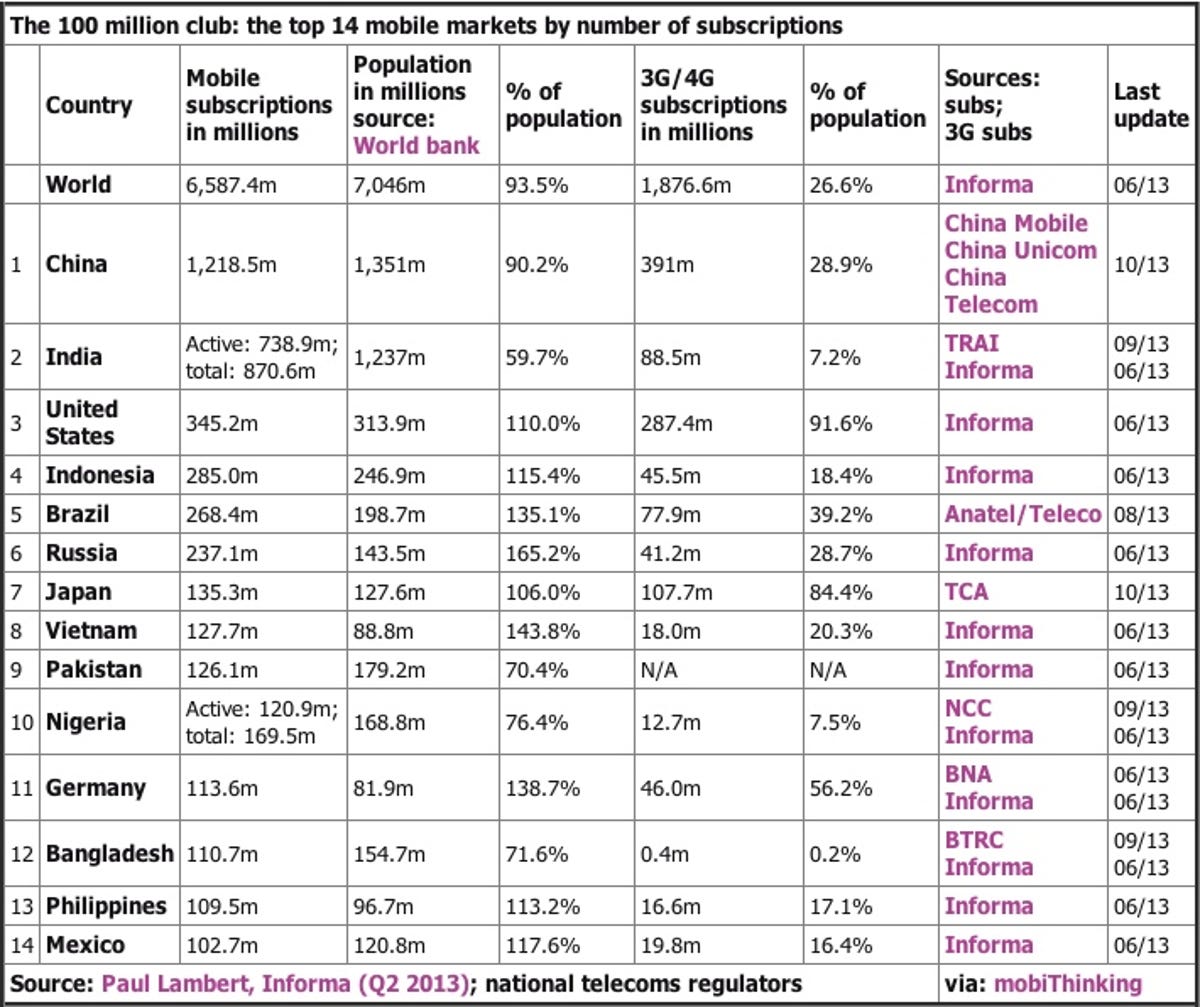

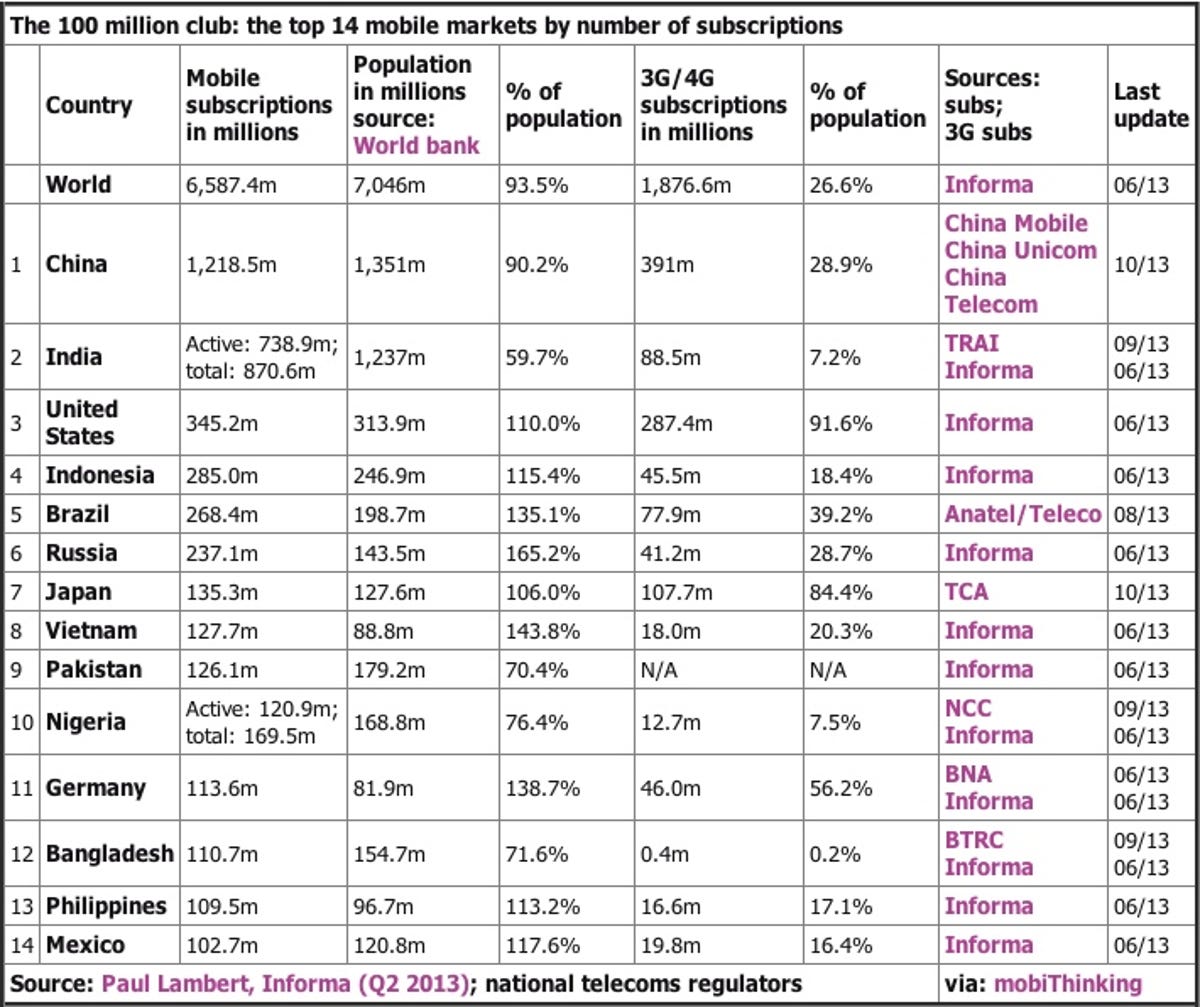

Informa

China and India aren’t just the most populous countries in the world, with over a billion people each, they’re also among the fastest-growing. That adds up to a smartphone boom over the next several years.

The analysts I spoke with for this article agree that growth will mostly come to low-cost smartphones, which are much lower-margin than premium smartphones like the iPhone, Samsung Galaxy Note, and HTC One. Yet, China and India are also getting more affluent over time, China especially. Phone makers that can dig in now on the lower end will have an advantage if they can provide a range of phones for customers who get more spending cash and start looking for the next step up.

While China and India certainly lead the way, other regions are also important. Even a year ago, Brazil saw an 89 percent boom in smartphone sales in the opening months of 2013, according to a report. In Africa, South Africa, Tanzania, and Nigeria have also been on the rise.

There’s no question that rich countries with saturated smartphone markets are the palaces of profit, a segment that in the US at least, Apple and Samsung have a tight grip on. But businesses can still grow on the low-margin entry-level smartphone.

Chinese manufacturers are the ones to watch. Nick Spencer, the Senior Practice Director for ABI Research’s mobile devices division, points to low-cost tier-one vendors — like Huawei, ZTE, Lenovo, and Xiaomi — and tier-two OEMs — like Coolpad, Gionee, and Oppo — as the main contenders.

DRAMeXchange

Often using chipmaker MediaTek’s reference design chipsets, he says, these companies can make budget phones very inexpensively, which drives down the cost. Their partnerships with Chinese carriers line up these home-grown manufacturers for almost guaranteed success in the fastest-growing, most populous smartphone market on Earth.

Fringe players to watch Smaller smartphone makers are mushrooming all over the world, some homegrown and serving targeted markets, others with more worldly ambitions. Here are four to keep an eye on in 2014.

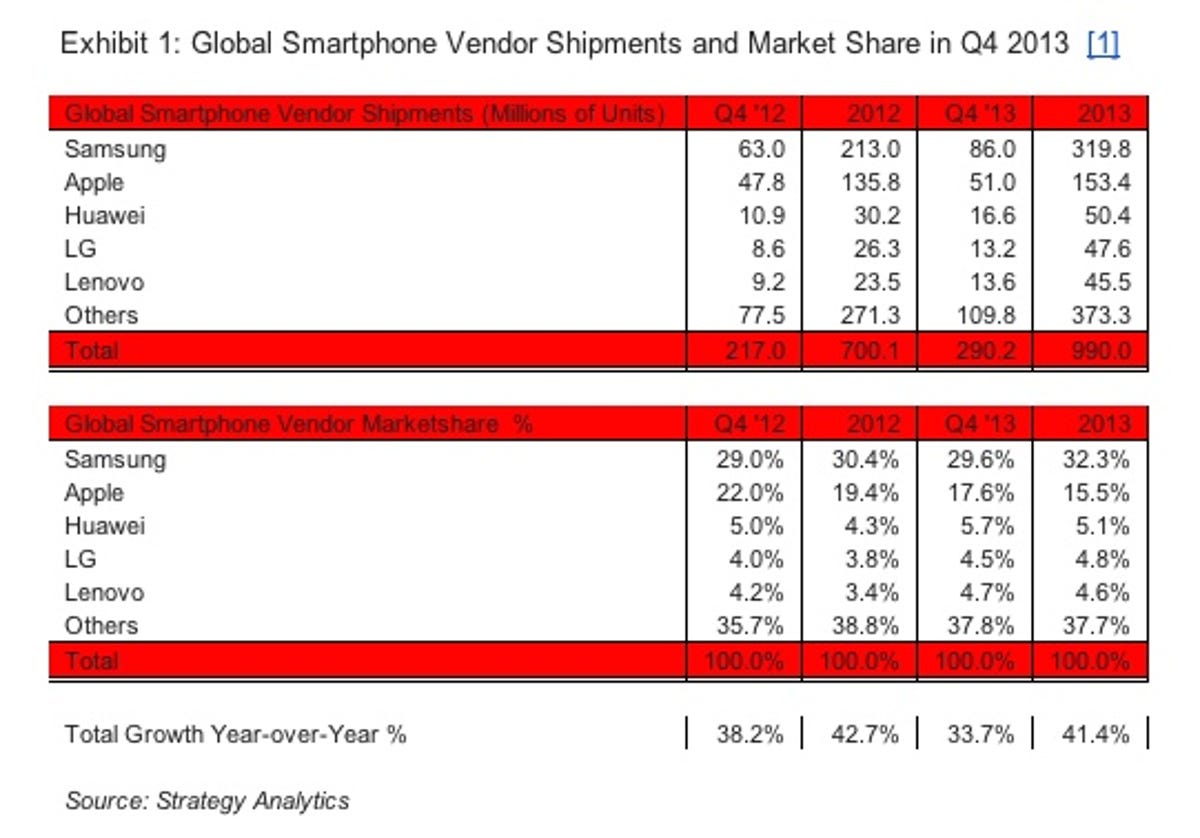

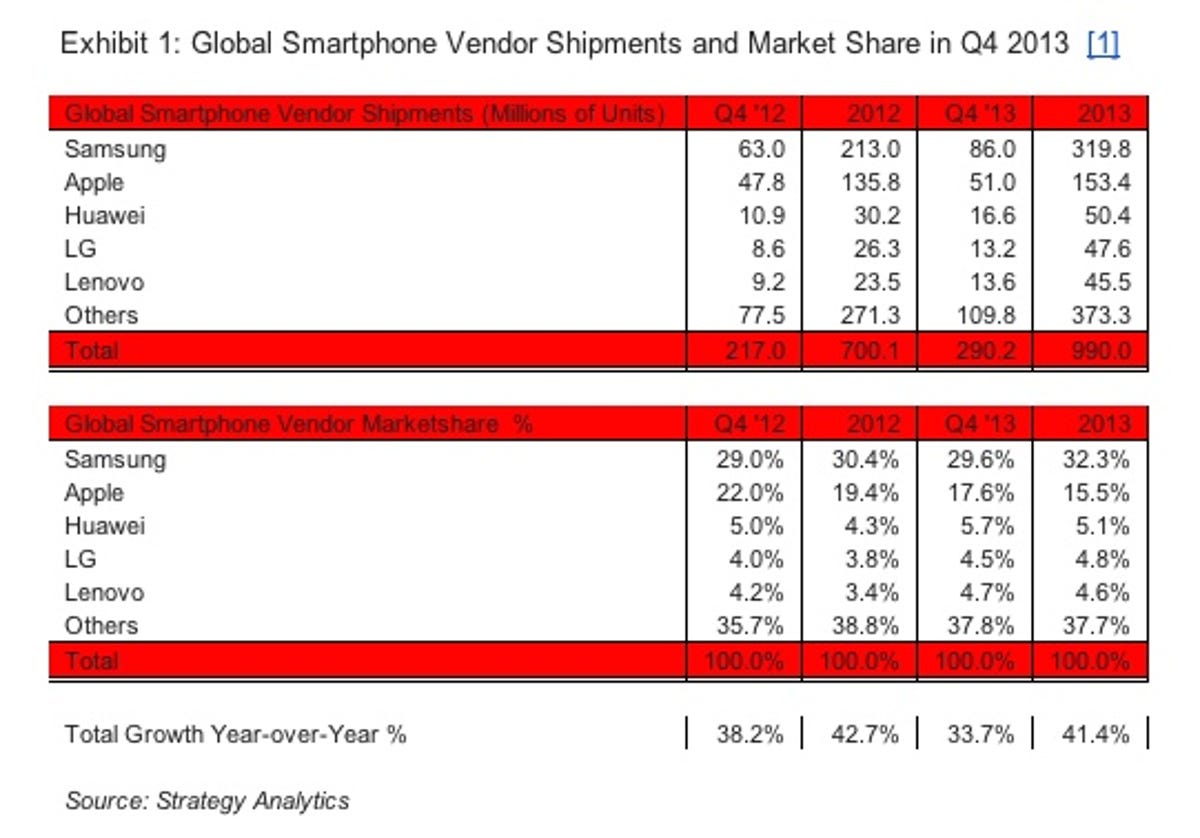

Traditional PC player Lenovo, whose relationships in China make it a significant Android brand there, was the fifth-largest global smartphone brand in all of 2013, according to Strategy Analytics, following Huawei in the third position and LG in fourth place.

Strategy Analytics

Budget smartphone vendors that make commodity smartphones have the advantage of undercutting pricier phones if they can act quickly enough, a profitable lesson that Indian smartphone maker Micromax learned when it started aggressively marketing copycats of high-end Samsung smartphones for a quarter of their price. Now Micromax is a top-three Indian brand, followed closely by Karbonn, another native son.

Alcatel, which can barely find a US carrier foothold, is the world’s sixth-largest smartphone brand, says Strategy Analytics, (ABI Research pegs it at seventh) with 13 percent market share in Central and Latin America, especially Brazil, Mexico, and Ecuador. Alcatel produces low-end Android phones, but is inching up the quality of its device portfolio overall.

Nokia isn’t exactly fringe yet, but it has declined, and its position could slip further under Microsoft’s future management of its devices arm. A strong role in emerging markets is one that Nokia has played for years, a foundation reflected in the Asha and Windows Phones at every price point. It’s also likely we’ll see Nokia’s first Android phone before the Microsoft smart devices deal is done. It wasn’t long ago that Nokia dominated the global mobile landscape, but the uptick or downturn of its post-Microsoft legacy is completely up in the air.

Chinese manufacturers Meizu, Oppo, Coolpad, and Xiaomi — the latter of which snapped up Google Android VP Hugo Barra — are other up-and-coming brands all vying for mobile dollars in a huge growth market.

They may all seem like small fries for now, but if the dramatic peaks and valleys of Nokia, Samsung, and Apple over the last few years have shown us anything, it’s that in the quickly shifting world of smartphones, today’s tadpoles could become tomorrow’s titans.

CNET

Smartphones Unlocked is a monthly column that dives deep into the inner workings of your trusty smartphone.