Barclays’ new money service Pingit lets smart phone users send cash to each other via an app. The bank is touting it as a simple way to split a bill or sort an IOU — there’s a daily limit of £300 that can be pinged via the service, with no fee for you to send or receive cash.

Currently you need a UK Barclays current account to send money via Pingit, but the bank says non-Barclays account holders will be able to send money “soon”.

So how easy is it?

To send money you need to download the Barclays Pingit app — which is only available for Android, BlackBerry and iOS at the moment. I had no trouble downloading the app to an iPhone.

To receive money you don’t need to download the app, but you do need to register for Pingit, which means giving Barclays your mobile number. If you don’t have a smart phone you can still register online, or Barclays customers can register at a cashpoint — but we dread to think how unpopular that will make you with the people in the queue behind you.

The basic requirement to receive money via Pingit is having a mobile phone that’s capable of receiving text messages. If the person you’re trying to send cash to hasn’t registered for Pingit they’ll get a text telling them to register within 24 hours or the payment will be cancelled and the money stays in your account.

Payments are sent via the Pingit app — by keying in the recipient’s phone number and specifying the amount you want to send. And you’d better be sure you key in the correct digits. Get the number wrong and chances are that’s the last you’ll see of your cash — having gifted it to a random stranger.

What about the small print?

Barclays makes clear it won’t cover the cost of any unintended gifts — noting in its T&Cs, “We are not responsible if you send it to the wrong person.” It does say you should tell it asap if you realise you’ve sent cash to the wrong digits, and adds that it will “attempt” to recover it. So basically don’t expect to see the cash again.

Before sending money, Barclays also notes you should check your intended recipient is “happy for their number to be shared in this way” — which is far too blasé for my tastes. Let’s face it, no one is going to do that. But if you read a bit more of the Pingit T&Cs you’ll see Barclays gives itself the right to send marketing missives to registered mobile numbers. In other words: hello SMS spam.

To opt out of receiving spam texts you have to write to Barclays (and when they say “write” they really do mean by taking pen to paper, and adding envelope and stamp) — or “by visiting your local branch and providing your full name, address and account details and the types of communication that you no longer wish to receive (eg mail, telephone or email)”. Hardly a convenient way to say ‘don’t spam me’.

Registering via the Pingit app

If you have one of the supported smart phones and can download the app, it will walk you through the registration process.

We soon ran into problems registering. First up you’re asked to create a five-digit code for security, and then to enter your mobile number and bank account details — and then the app will send a mobile verification code via SMS. This has to be entered back into the app to unlock the next stage of the registration process: verification.

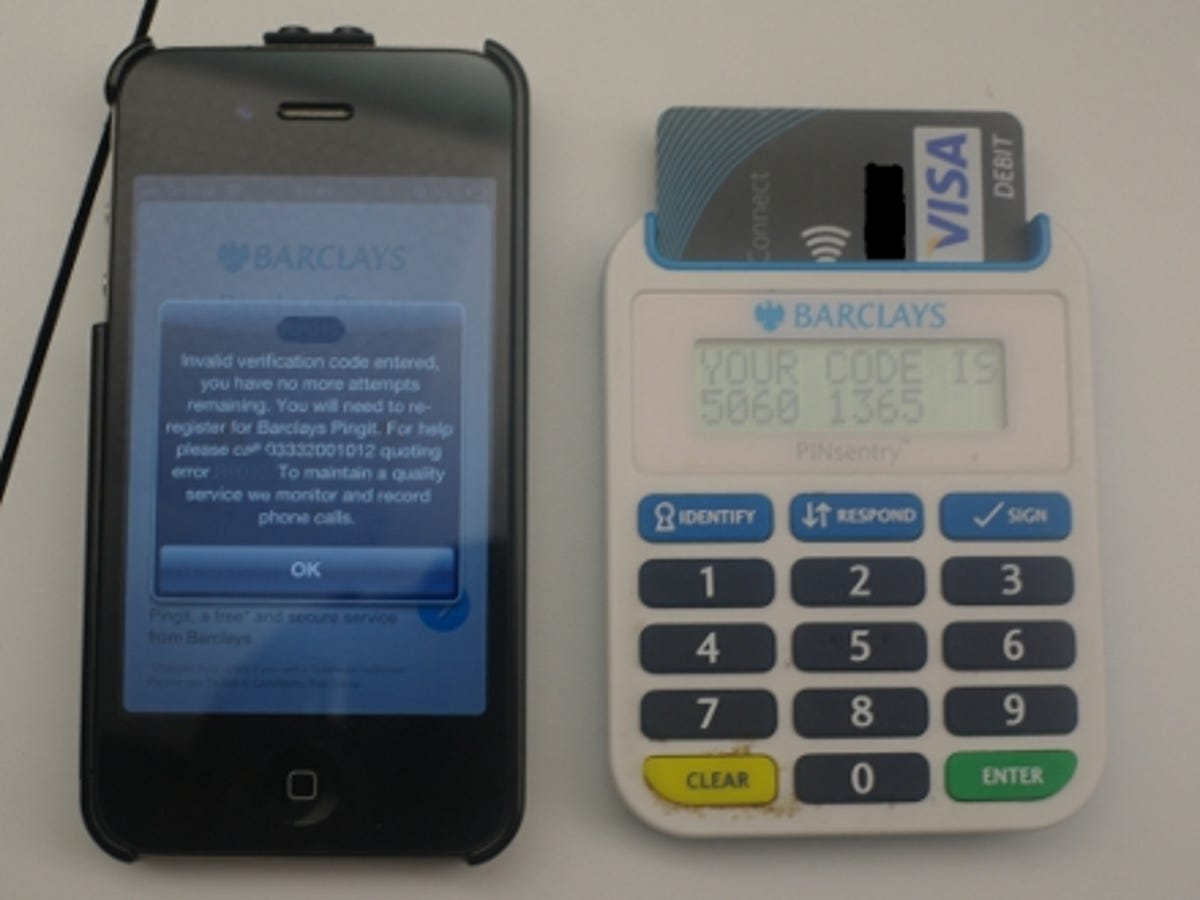

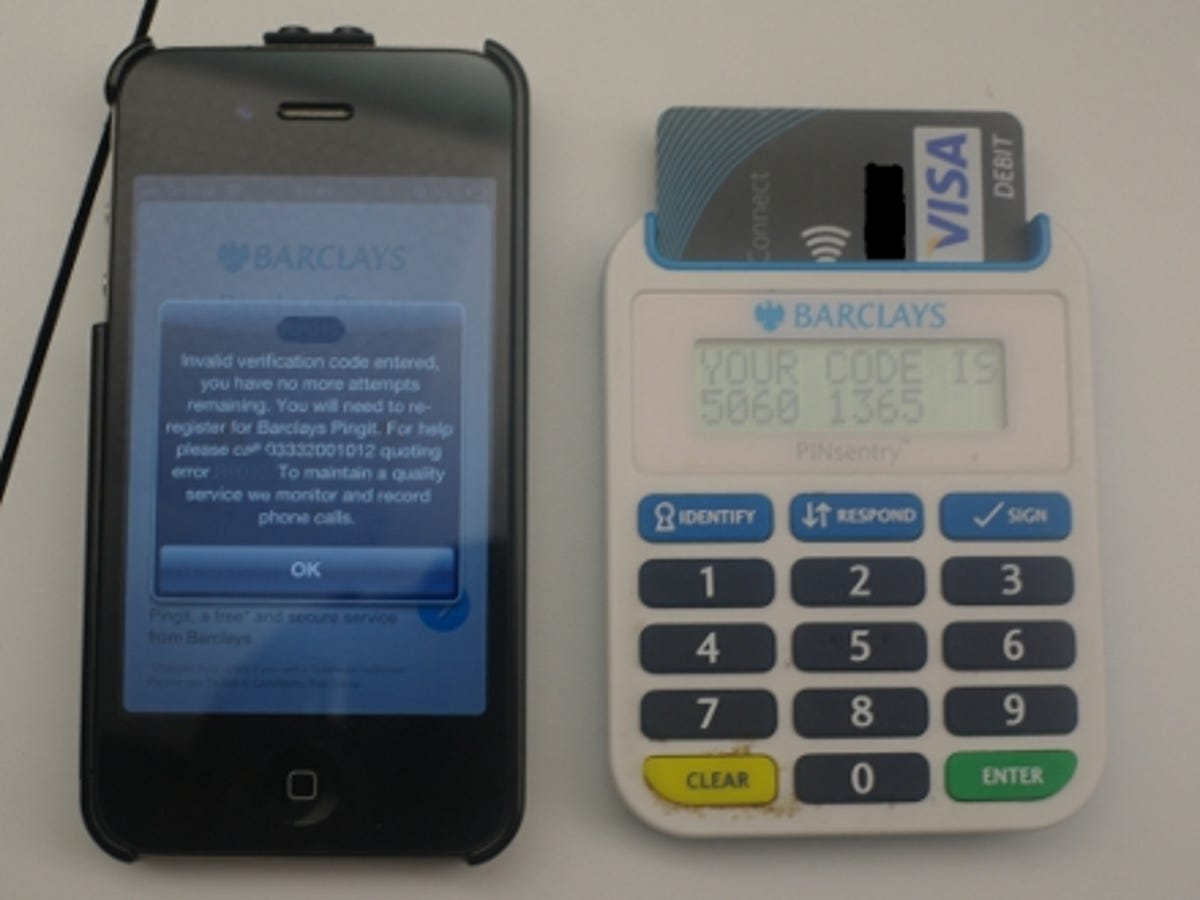

To verify your Pingit account you’ll either need your Pinsentry — a desktop gadget that Barclays uses to boost the security of its online banking service by generating one-time codes — or find a Barclays ATM or bank branch.

My fellow Craver Rich’s attempt to register using a Pinsentry hit the buffers — after first selecting the wrong key on the Pinsentry he was rightly blocked. But two more attempts, this time mashing all the correct buttons and inputting the supplied digits, were also rebuffed. After the third attempt he found himself locked out owing to “invalid verification code entered” — and was told he had “no more attempts remaining”.

The Pinsentry and the Pingit app didn’t get on, so registration stalled.

To continue, the app suggested he ring a phone number and quote another supplied code — or “re-register for Barclays Pingit”. Since the first attempt to register had failed, it was unclear how to go about re-registering, since he was locked out of the app. Presumably another trip to the bank branch beckoned.

How secure is it?

Getting registered and verified involves plenty of hoops to jump through — indeed, it put us off using the service — so that feels reasonably secure. Even if someone nabs your phone and knows your account details they’re not going to know your PIN, so they won’t be able to register you without your say so.

Once registered, the app itself is protected by a five-digit passcode. Barclays won’t let you choose 12345 or 11111 on the grounds that it’s “too obvious”. So provided you don’t choose other silly stuff like your birthday the passcode should keep light-fingered phone thieves from sending themselves your cash. There is also the £300 daily limit putting a ceiling on the amount of cash that can leak out of your account this way.

A far less secure aspect of Pingit is the amount of mobile phone numbers Barclays is going to harvest as people try to pay their mates that £20 they owe them, and forget to ask whether they want their phone number shared with the bank. There’s no way to receive the cash without registering either — and that means accepting Barclays’ right to spam you.

Aren’t there other ways to pay with a mobile phone?

Pingit is designed for settling small cash loans between friends and the like. If you want to make payments in shops with your mobile it’s not going to be much use. For that you’ll need a phone with an NFC chip in it — the same short-range contactless communications technology found in the Oyster travelcards that let people swipe in and out of the London Underground.

Last year Google demoed a mobile wallet with NFC in it that can be used to swipe to pay, but it hasn’t launched outside the US. In the UK, the number of contactless credit and debit cards has been steadily increasing, but NFC phones remain a rarity for now — despite having been talked about for years.

Orange and Barclaycard have been making noise recently about launching an NFC phone this summer.

The London Olympics could also give NFC phones a bit of a leg up — with plans to hand NFC handsets to athletes. Google is also reportedly trying to bring its mobile wallet here in time for the Olympics.

Have you paid for stuff with your phone? Would you use Pingit? Does the potential for text spam bother you? Let me know in the comments, or over on the CNET UK Facebook page.