James Martin/CNET

If history is any guide, the market for wearables — Web-connected devices such as smartwatches and high-tech glasses — will get even more attention in the coming months.

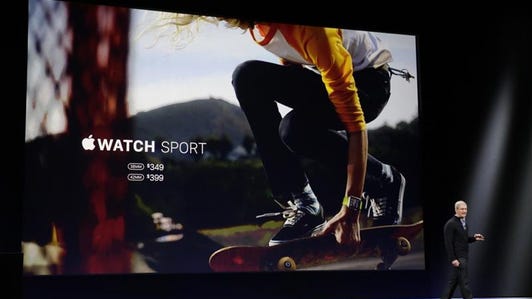

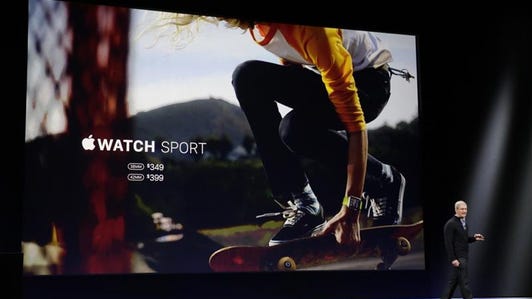

On Tuesday, Apple marched into the category, introducing the Apple Watch. The smartwatch will connect with Apple’s popular iPhone to let wearers send messages, track their fitness levels and listen to music, among other things. Apple will sell three versions of the gadget, priced starting at $349, in early 2015.

Apple isn’t the first company to make devices and services for the wearables market, with its new product coming well after Google, Samsung, Motorola and Sony produced their own offerings. But Apple has made a name for itself redefining every new product category it enters, livening stagnant markets for digital music players, mobile phones and tablets after it released its iPod, iPhone and iPad.

Related stories

- Apple reveals iPhone 6 Plus with 5.5-inch screen, starting at $299

- Apple jumps into wearable fray with Apple Watch smartwatch

- Apple Watch pairs up with Apple Pay mobile payment service

- What we didn’t get from Apple’s iPhone 6 event

- Apple’s September 9 event: CNET’s complete coverage

The watch comes in two sizes with six interchangeable bands, from a waterproof sports band to a leather strap to a high-end stainless steel band. The Apple Watch also comes in three collections, with the most luxurious version dipped in 18-karat gold.

The device will also work with a new mobile technology called Apple Pay that will allow you to buy things with a tap at the checkout.

Whether the company has added enough features to make the Apple Watch a hit with consumers is undetermined. But its very existence is already a good thing for the wearables market, according to Weston Henderek, director for connected devices at the NPD Group.

“It lifts the wearables space for everyone,” said Henderek. “The general public might now actually care about this stuff.”

Other tech giants have already begun working on efforts for the nascent device category. Google in March unveiled Android Wear, a modified version of its mobile operating system for phones and tablets that’s tailor-made for wearables. The platform already runs on a handful of smartwatches, including LG’s G Watch and Motorola’s Moto 360. And the search giant is promising a wave of new updates to the software. Google told CNET earlier this month it plans to add support for Bluetooth headsets and GPS functionality in coming months.

Samsung, the world’s largest maker of smartphones, has made the biggest push in the market so far, with a line of smartwatches already introduced — and upgraded — in recent months. Its products include the curved-screen Gear S, the first smartwatch with a built-in modem that allows it work without a smartphone for cellular connectivity.

All these companies are vying for a stake in the still raw, but promising, wearable device market. In 2013, 9.7 million wearables were shipped, according to CCS Insight. By the end of 2014, that figure is projected to jump to 22 million. And by 2018, 250 million wearables will be in use, the research firm estimates.

Apple, said CEO Tim Cook, aims to lead the pack with the Apple Watch. “”It will redefine what people expect from a watch.”

Wrangling for wrist real estate

For Google, Apple’s smartwatch means the mobile war between the companies has entered a new arena.

The two tech giants are already archrivals in smartphones and tablets, where Google’s Android mobile operating system is pitted against Apple’s iOS, the software that powers the iPhone and iPad. Google controls a dominant share of the market, with Android used on 80 percent of the world’s smartphones. But Apple’s closed ecosystem is sometimes a selling point for developers and consumers who argue that Android, with its many iterations that have been modified by manufacturers including Samsung, is fragmented.

Apple and Google didn’t respond to requests for comment.

With Android Wear, Google has tried to make sure the software is more uniform across devices from different manufacturers. Updates to the software will come directly from Google, instead of first having to go through wireless carriers to test the software on phones and tablets.

“It’s a lot simpler on watches,” Hiroshi Lockheimer, vice president of engineering for Android, told CNET last week. With phones, many companies’ schedules have to align to make updates available. “There are different things on that pipeline that just don’t exist [with smartwatches]. And it makes it possible for us as an industry to push these updates out a lot quicker.”

Apple Watch keeps up with the times (pictures)

+40 more

That ability to innovate quickly is a good thing for customers. And it may only get better with Google and Apple both looking over their shoulders at each other’s platform. “Android Wear is going to get a boost from this,” said Henderek. “It will cause everyone to up their game.”

Fast iteration on new consumer technologies is not new to either company. “This happened also, by the way, on phones,” said Lockheimer last week. “In the early days of Android, there were many more releases of Android, more often. I think you’re going to see the same trend here.”

What’s telling is that Apple’s Cook never called the Apple watch a “smartwatch” or “wearable” during Tuesday’s two-hour event. Instead, Cook trumpeted the advances that the company had made for watches, sans “smart” — more of a variation on a theme than an entirely new device. “What we didn’t do is take the iPhone and shrink the user interface and strap it on your wrist,” he said.

NPD’s Henderek said Apple intentionally tried to distance itself from the current market, which hasn’t yet found its stride. “They’re trying to change the perception that this an intimidating, nascent space,” said Henderek. “They want to send the message that this is a finished product.”

An arms race that never starts?

It’s easy to paint Apple, Google, Samsung and Motorola as competitors in a battle over which company has the leading hardware and software for the mainstream wearable market. Yet it could make little difference in an increasing ecosystem-centric landscape.

The Apple Watch is “going to be an accessory to an iPhone, just like other smartwatches,” said Brian Blau, an analyst at Gartner. Unlike fitness bands such as the Fitbit Force or Jawbone Up24 or multiplatform smartwatches like Pebble, the current offerings from the big tech companies are closed down and restricted to their respective mobile operating systems.

As accessories, wearables aren’t likely to make or break your decision to switch between Apple’s iOS and Google’s Android. In that sense, these type of closed-garden wearables are designed only for the smartphones with which they are compatible. Whatever feature or hardware race takes place may be to avoid looking behind the times and to continue offering the same ecosystem benefits as competitors.

The Apple iPhone 6 and iPhone 6 Plus have arrived (pictures)

+19 more

“Is this going to kick-start the smartwatch revolution?” said Blau. “The revolution is going to happen anyway.”

Apple’s entrance, he said, is a wake-up call that wearables have arrived, even if the device doesn’t mark a true iPhone, iPod, or iPad moment for the market.

The wearables category has been gaining momentum with the release of several Android Wear devices and increasing interest from the fashion industry. Intel, last week unveiled a luxury smart bracelet that will be sold at Barney’s New York for less than $1,000 later this year.

With Apple’s presence, the market will continue to push forward at greater speed. “All of a sudden, you’ve got a lot of momentum,” Blau said.

CNET Staff Writer Donna Tam contributed to this report.