Apple isn’t the only one feeling the heat despite a blow-out quarter; Samsung is seemingly getting punished for its success too.

Both companies have been posting explosive growth in recent quarters and generating the bulk of the mobile industry’s profits. While Apple’s net income was relatively flatin its fiscal first quarter, its sales still grew 18 percent. And Samsung last night said its fourth-quarter profit soared 76 percent as its sales jumped 19 percent.

Related stories:

- Samsung reigns with 30 percent of Q4 smartphone shipments

- Samsung, Apple dominate as 700M smartphones ship in 2012

- Samsung quarterly profit jumps 76 percent on Galaxy sales

- Apple still in the doghouse with Wall Street

- CNET’s take on the Galaxy Note 2

- CNET’s take on the iPhone 5

- Galaxy S3 beats iPhone 5 for best device of 2012

For any other company, those sorts of results would be cheered. But for Apple and Samsung, record-breaking quarters just aren’t enough. There needs to be proof that these trends will continue in the coming quarters, and neither company was particularly reassuring.

In fact, there’s an increasing worry that Apple and Samsung’s best days are behind them, and that the top two players in the industry are finally succumbing to the competitive pressures and harsh business environment that have punished the rest of the field. Yes, today’s results are fantastic, but many are coming to the realization that tomorrow’s results may not be so rosy.

Already, growth rates aren’t quite as high as they had been, and in the case of Apple, its iPhone sales fell short of analysts’ expectations. During Samsung’s fourth-quarter earnings conference call last night, the company warned that market conditions would be a little tougher this year.

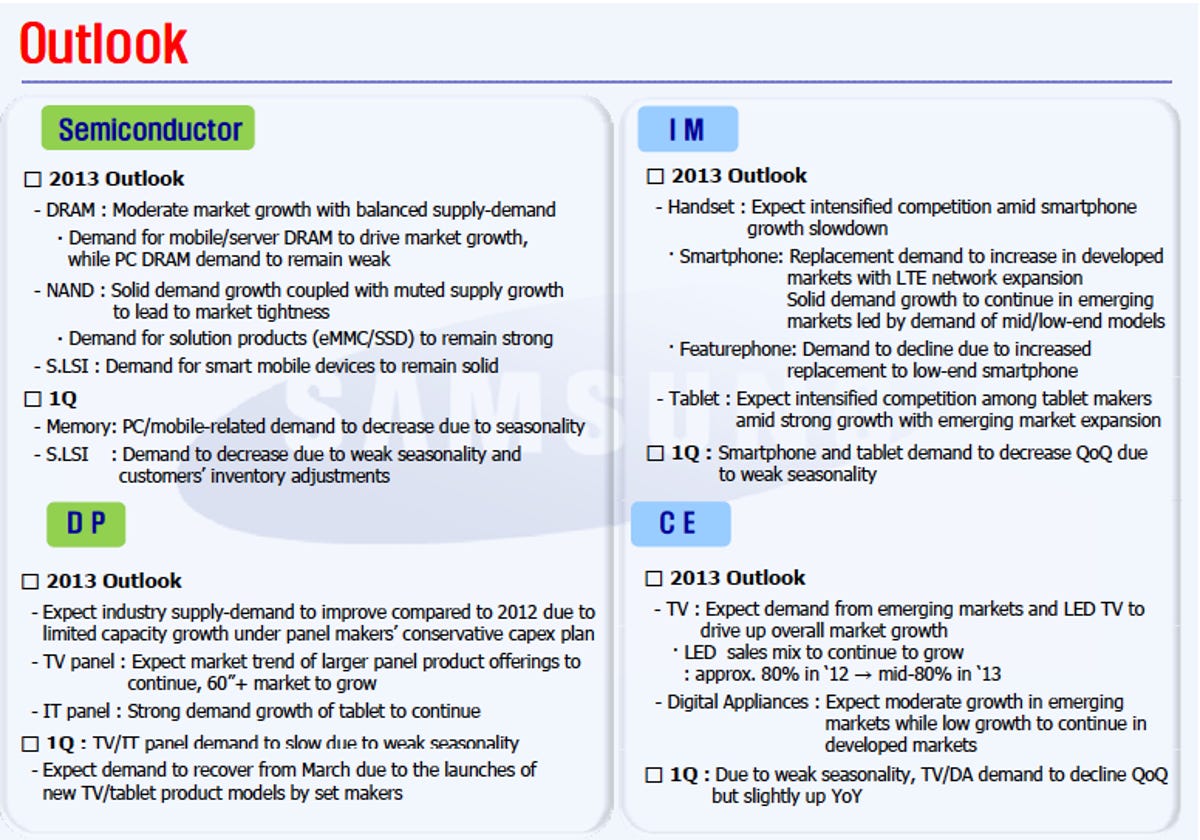

Here’s how Samsung characterized its expectations for its mobile business this quarter and year:

- First-quarter smartphone and tablet demand should decline sequentially due to weak seasonality.

- Overall for the year, the handset business should see more competition amid a slowdown in smartphone growth.

- Demand should be solid in emerging markets for mid- and low-end smartphones.

- Tablets also should see more competition, but growth should be strong amid emerging markets expansion.

And here’s the full rundown for the year, via a slide from Samsung’s fourth-quarter earnings conference call.

Screenshot by Shara Tibken/CNET

“For set businesses, especially in handsets and TV, we expect competition to intensify further due to slowing down of demand growth, new product launches, as well as expansion of mid- to low-end markets,” Robert M. Yi, Samsung senior vice president of investor relations, said yesterday during a conference call.

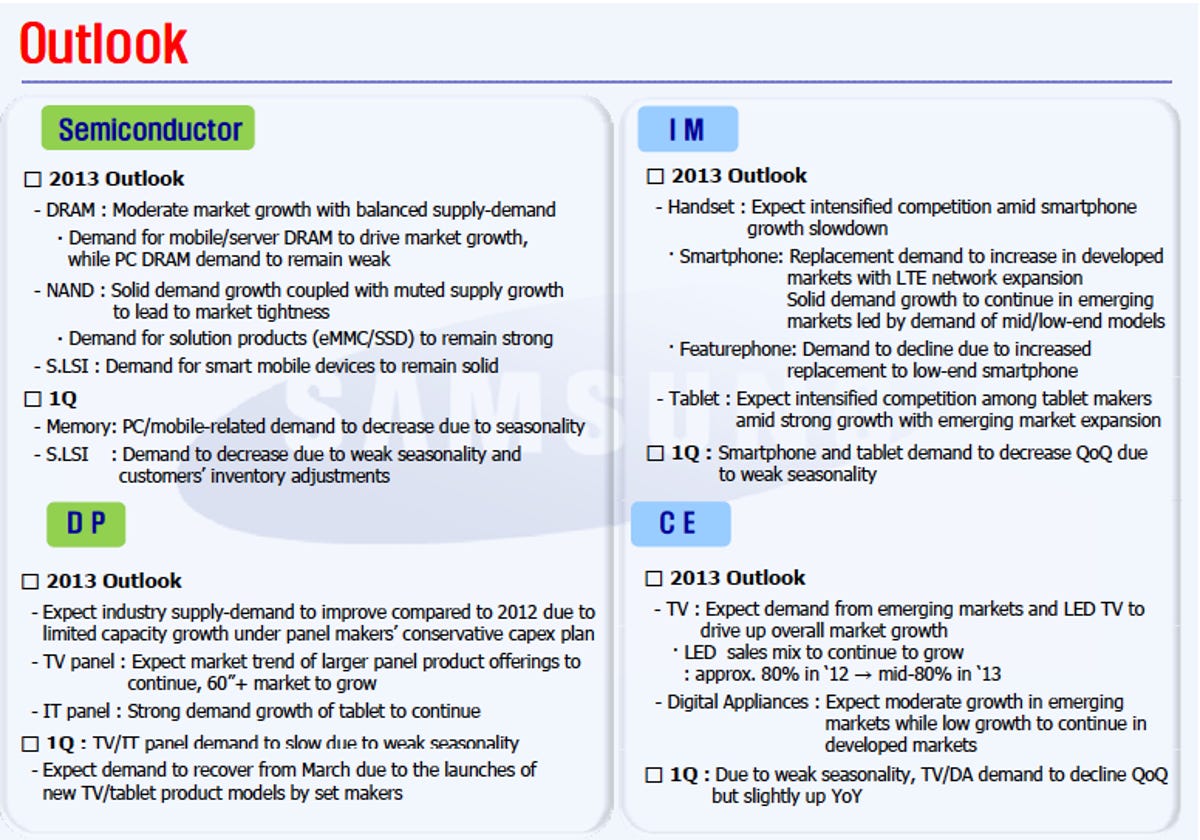

Samsung and Apple still dominate the mobile industry, and no one really expects that to change. Reports from several tech research firms over the past couple of days pegged their combined smartphone market share in the fourth quarter at about 50 percent, and both are expected to see a boost from new products coming later this year.

However, with seemingly everyone in developed markets such as the U.S. and Europe already using a smartphone, much of the growth will come from emerging countries. But those regions require lower cost — and less profitable — products and a different strategy. Samsung’s take is creating many different phones at different price points, while Apple pushes the older models of its devices.

Both are seeing strong demand from places like China. Samsung said that emerging-market demand for mid- and low-end smartphones should be solid this year, while Apple has said that China is its fastest-growing region. But Samsung, Apple, and other established vendors are now going up against cheap device makers like Huawei and ZTE that are quickly gaining ground.

IDC noted during its quarterly mobile market share report that Huawei is now the world’s third-largest smartphone maker, a first for the Chinese company. While its market share is still fairly low compared to Samsung and Apple, it’s making steady progress, as are other Chinese vendors. These companies are expected to move up the stack instead of only providing inexpensive phones.

IDC

“These guys originally came in because of mass market, lower-tier smartphones, but they’re pushing up the tiers and challenging Samsung [and others],” Forrester analyst Tony Costa said. “That will continue to escalate.”

Of course, Samsung’s business isn’t just mobile devices. The company has a broad portfolio of products, including processors and displays, and those operations are expected to keep its overall growth rate high this year.

And even if the mobile market slows, it’s still growing. Samsung plans to maintain its smartphone market share as it continues its strategy of supporting all major operating systems and offering a broad portfolio of products.

“There’s a difference between the market slowing down and the market going down,” IDC analyst Ramon Llamos said. “Clearly it’s not going down. The sky’s not falling.”

Perhaps not, but there’s a lot more negativity surrounding both Apple and Samsung than there has been in a long time, and those concerns may be legit.