Now playing:

Watch this:

Pantech Discover, AT&T’s higher-end ‘budget’ Android

2:42

One of my favorite smartphones on today’s market also happens to be one of the least expensive. It costs just $50, runs Android, boasts a rapid-fire processor and a 12.6-megapixel camera, and offers up some ergonomic design elements you won’t see anywhere else.

Who makes this humble wonder device? I’ll give you a hint: the Korean phonemaker isn’t Samsung, or even Sammy’s compatriot rival, LG. Instead, credit for the Discover goes to Pantech, the country’s third-largest handset maker.

Pantech Discover is contoured Android comfort (pictures)

Although less well-known in the U.S., Pantech has managed to achieve some important milestones that other second-tier smartphone brands have not. First, Pantech primarily sells phones through Verizon and AT&T, the country’s largest two wireless networks.

Second, Pantech manages to price its smartphones below $100, often charging just $50 with AT&T for models that wrap up a lot of features for not very much dough.

Cheap, but good

By Pantech’s own admission, the Discover is its most premium smartphone to date.

Related stories

- Pantech Discover: Curves in all the right places

- Get to know Pantech’s U.S. smartphones (pictures)

- Samsung expects another record quarterly profit on Galaxy sales

Even before the Discover, smartphones like the Burst and Flex represented high-value, high-quality components for around half the up-front price of comparable smartphones.

Pantech’s Verizon devices tend to cost more, but still hover in the hundred-dollar range.

This kind of pricing is a noteworthy feat for a subsidized phone. Typically, the manufacturer and carrier negotiate a subsidized price for consumers that comes in hundreds of dollars lower than the phone’s full retail price. That’s how iPhones and Samsung Galaxy S3s sell for roughly $400 less through a U.S. carrier than they would on their own.

Generally, the more powerful, in-demand brands can negotiate better deals to lure in customers. Otherwise, these brands foot more of the bill to reduce the carrier’s sticker price and advertise the phone.

Despite its minimal corporate influence and relative obscurity, Pantech has still kept costs low and value high across the board. How?

Screenshot by CNET,Pantech

“It has a lot to do with our manufacturing process,” said Chandra Thompson, a marketing manager for Pantech USA, when I posed this very question.

Pantech spends a lot of money on in-house research, development, and design, Thompson said, which helps keep prices down. “There are cost efficiencies that can be achieved by developing technologies in house instead of outsourcing them.”

That may be, but plenty of other companies like Samsung, HTC, and Apple do exactly the same. Yet the majority of Samsung’s feature-comparable smartphones, to draw one parallel, come in higher.

It’s Thompson’s second half of the answer that strikes truer: steering clear of multibillion-dollar campaigns keeps the company’s phones’ total price lower. In other words, since Pantech doesn’t have to offset expensive print and TV ads, it can afford to sell its smartphones for less.

Get to know Pantech’s U.S. smartphones (pictures)

“We look for quality materials; none of our stuff is cheap at all,” Thompson added.

Not every Pantech smartphone or messaging phone comes out as big a winner as the Discover, though few recent models are truly problematic (the admittedly cute Swift might be one), and all look stylish.

Pantech phones also earn consistently high manufacturer ratings from AT&T for the fewest dropped calls. On the Verizon side, Pantech goes through a company called PCD, which helps bring clients’ smartphones to market (Verizon’s HTC ThunderBolt was a well-known PCD win.)

Humble beginnings

CNET

Pantech has traveled a long road to reach this point. The company began selling phones in the U.S. as white-label devices that lacked Pantech branding. Take, for instance, the Helio Hero of May 2006. This was Pantech’s first “high-end” cell phone for the U.S., and by today’s standards, it doesn’t look like much.

Throughout the years, Pantech has sold messaging cell phones for AT&T and then Verizon, like the Pantech Laser touch phone and swiveling Razzle.

It wasn’t until 2011 that the company set forth with its first smartphone, the durable but entry-level Pantech Crossover for AT&T.

Since then, the company has released six more smartphones in the U.S., in addition to several messaging handsets.

Super in Seoul

Interestingly enough, Pantech has little brand value even on its home turf. That’s because it sells phones there under the Sky brand. In the U.S., even the best smartphone Pantech has made so far sells as merely very good, but not premium. In its South Korean homeland, though, Pantech — or Sky — can tell a different story.

There, the Vega 3 smartphone can directly challenge front-runners like Samsung’s Galaxy Note 2, with its 5.3-inch LCD screen, 1.5GHz quad-core Qualcomm Snapdragon S4 Pro processor, 13-megapixel camera, and 2,600mAh battery.

Despite a respectable list of of Vega sub-branded phones, Pantech doesn’t sell to Samsung’s volume. The company launched four new smartphones in Korea in 2012, and three smartphones in the U.S. (plus some feature phones and the Pantech Element tablet.)

Pantech

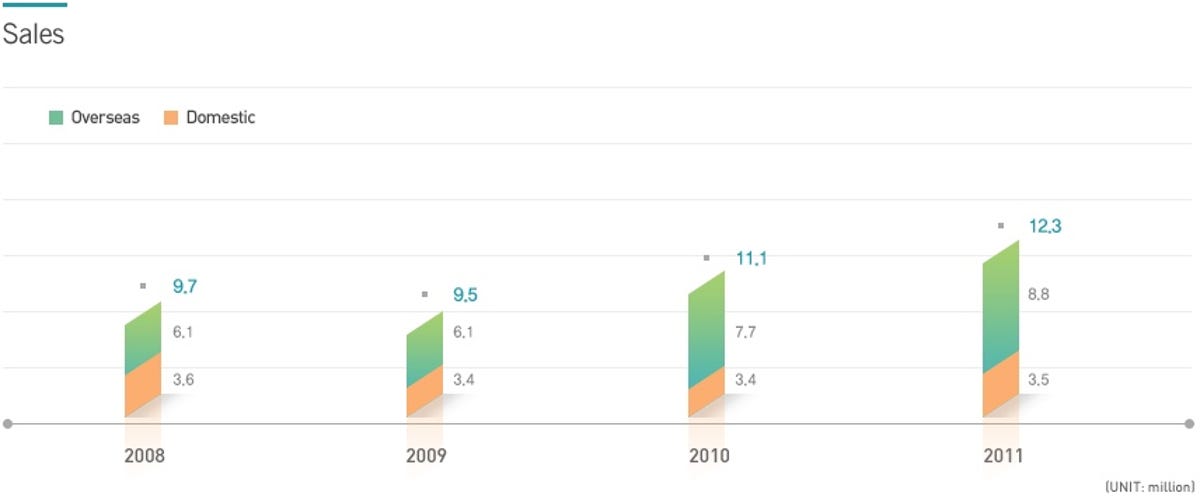

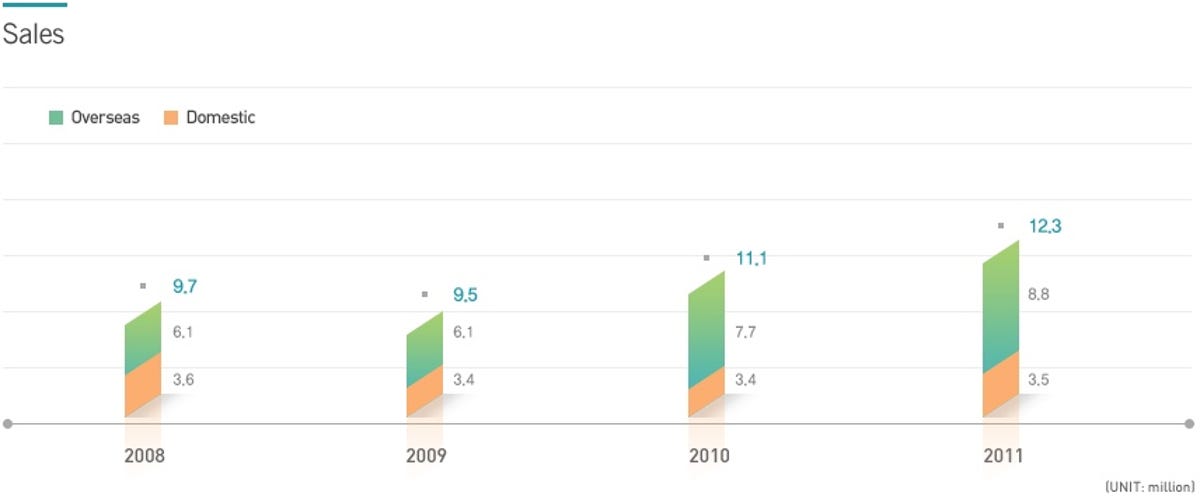

In addition to the U.S., Pantech also has a presence in Japan. Combined, the country’s overseas sales for 2011 — 8.8 million units — dwarf domestic sales of 3.5 million units. Likewise, Pantech’s U.S. and Japanese sales ($1,540,000 million) exceeded the company’s at-home revenue of $1,260,000.

Pantech

To put the numbers into perspective, Pantech is still small potatoes compared with Samsung, which pulls revenues in the billions and sells millions of units of just its flagship phone.

What’s next for Pantech

Although Pantech remains a smaller brand compared with the heavy hitters, expansion is most definitely in its future. In the U.S., Pantech aspires to become more consumer-focused, perhaps holding events at fashion and music shows in the future.

2013 will also see the company generate some grassroots exposure for the Pantech Discover, which they’ll position as a mass-market device skewed toward Millennials.

In addition, Pantech’s Web site points to establishing corporate offices in Europe and China.

“We’re not a consumer brand,” Pantech’s Thompson said. “We’d certainly like to become one.”

So long as the handset maker can continue releasing top-performing smartphones like the Discover for a low ticket price, it’ll have a shot.