A surge in sales turned Android into the second biggest smartphone platform in the world last year, according to a new report from Gartner.

Unit sales of smartphones running Google’s mobile OS grew 888.8 percent year over year, from 6.8 million in 2009 to 67.2 million in 2010. In terms of market share, that translates into major shift–from 3.9 percent in 2009 to 22.7 percent in 2010.

Sales received a strong kick in the fourth quarter due to demand for a number of high-end smartphones, including HTC’s Evo 4G and Incredible, Samsung’s Galaxy S series, and Motorola’s Droid X and Droid 2, Gartner said in today’s report.

Though still in first place by a healthy margin, Nokia’s Symbian saw its smartphone market share drop further, from 46.9 percent in 2009 to 37.6 percent in 2010. The fourth quarter was especially weak for Symbian, allowing Android to actually overtake it in sales during the period. Gartner noted one factor in Nokia’s favor: Symbian is used by Fujitsu and Sharp and in legacy products from Sony Ericsson and Samsung.

Market share for Apple’s iOS inched up from 14.4 percent in 2009 to 15.7 percent in 2010, but its unit sales soared from 24.8 million in ’09 to 46.6 million last year. Those numbers helped Apple’s mobile platform reach the No. 4 spot in the global smartphone rankings last year, just behind BlackBerry maker Research In Motion. Apple’s iOS is in “excellent shape,” according to Gartner.

Overall global smartphone unit sales climbed 72.1 percent last year, from 172.3 million in 2009 to 296.6 million in 2010. The industry as a whole still found its biggest audience in economically developed regions with faster networks and more disposable income.

“Western Europe and North America accounted for 52.3 percent of global smartphone sales in the fourth quarter of 2010, with smartphones accounting for close to half of all handsets sold in these regions,” Roberta Cozza, principal research analyst at Gartner, said in a statement.

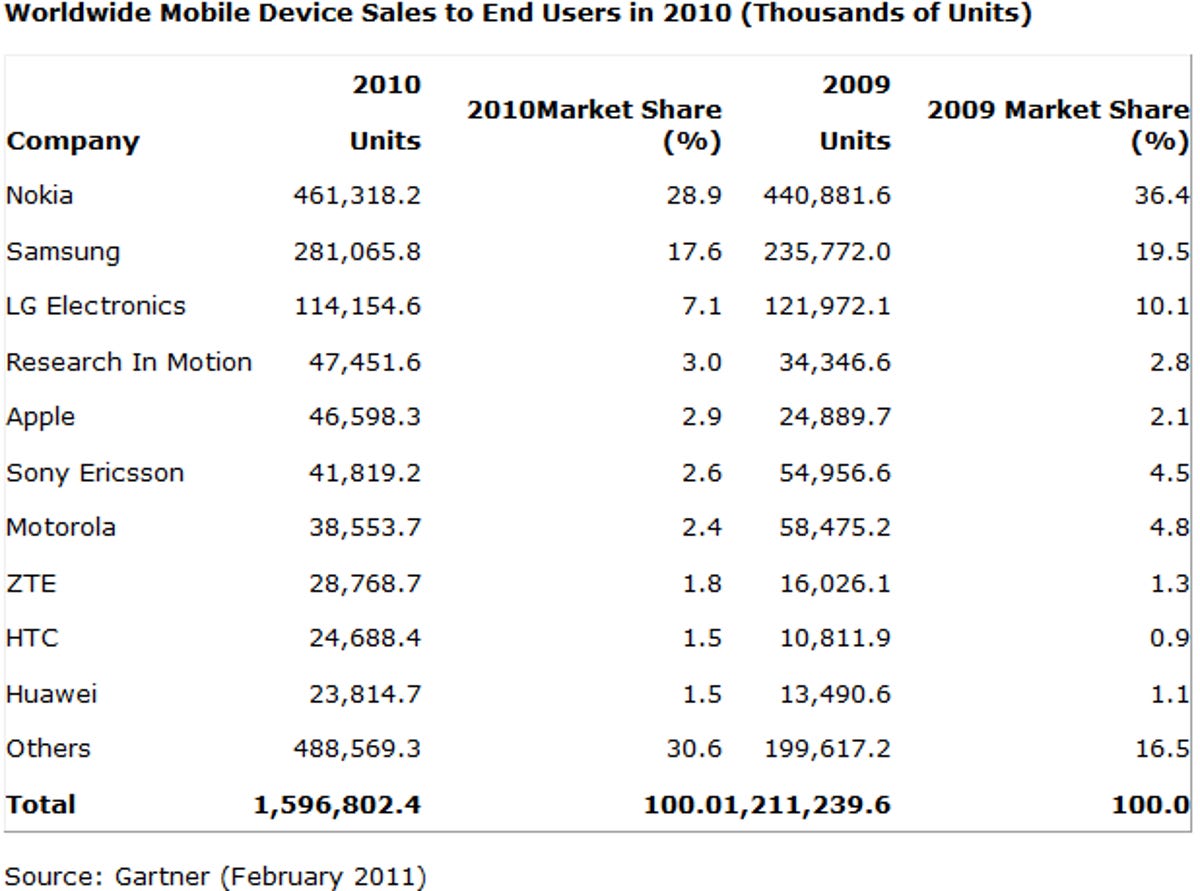

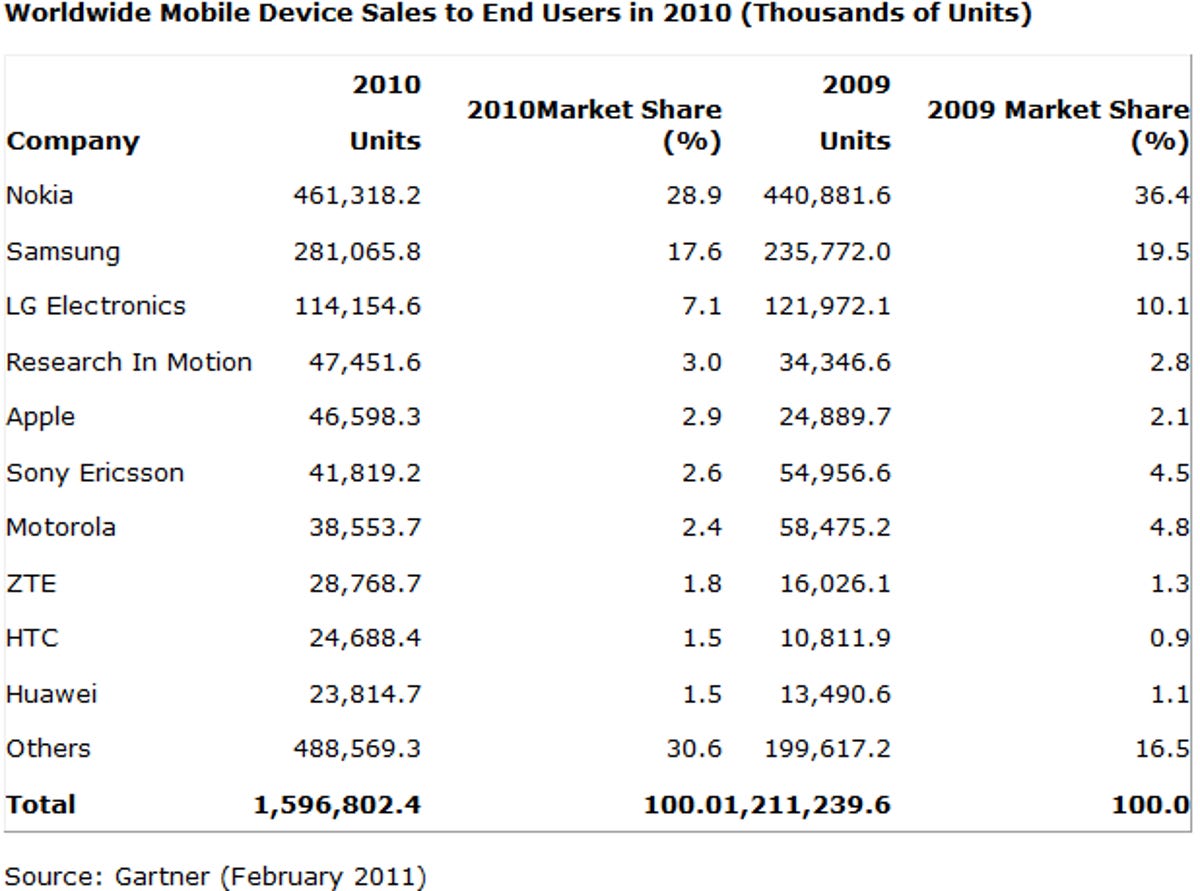

Looking at the entire mobile phone market–not just the smartphone segment–unit sales reached 1.6 billion last year, a 31.8 percent rise from 2009.

Among makers of all mobile handsets, Nokia was the top dog with a 28.9 percent chunk of the market, though that was down from 36.4 percent the prior year. Samsung and LG took second and third place, respectively, followed by RIM and Apple. But even taking into account the entire mobile phone landscape, smartphone sales were a deciding factor.

“Strong smartphone sales in the fourth quarter of 2010 pushed Apple and Research In Motion…up in our 2010 worldwide ranking of mobile device manufacturers to the No. 5 and No. 4 positions, respectively, displacing Sony Ericsson and Motorola,” Milanesi said. “Nokia and LG saw their market share erode in 2010 as they came under increasing pressure to refine their smartphone strategies.”