The cell phone sales slump may soon be over.

The global cell phone industry captured mild gains in the third quarter, with total shipments reaching 287.1 million units, according to a report released Friday from IDC. That number marked a 6 percent decline from the same quarter in 2008 but a 5.6 percent jump over 2009’s second quarter.

With the third-quarter figures, the mobile phone business is likely showing the first signs of a rebound since the recession, according to IDC’s “Worldwide Mobile Phone Tracker.” During the third quarter, the industry pushed older devices at lower prices, leading to greater demand and higher volume, said IDC.

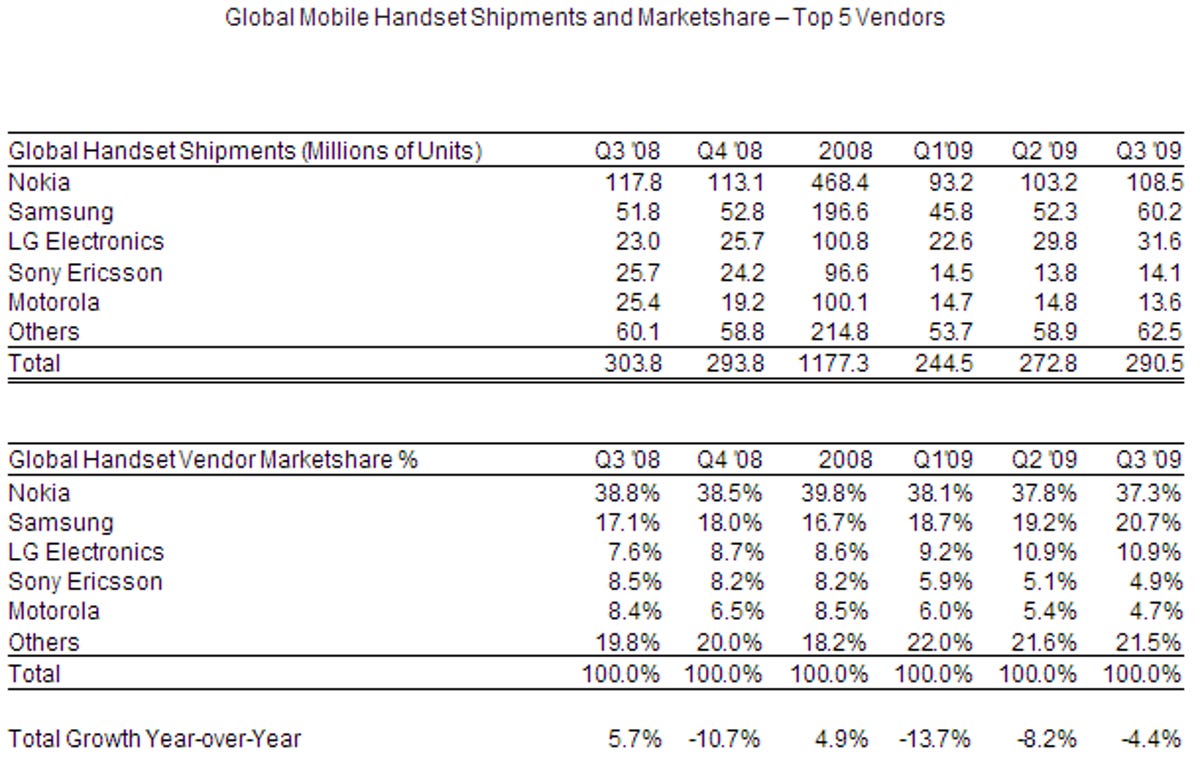

Another report released Friday, this one conducted by Strategy Analytics, offered similar findings and forecasts for the cell phone trade. The report, called “Q3 2009 Global Handset Market Share Update,” pegged cell phone shipments for the third quarter at 291 million, slightly higher than IDC’s number.

Since the rate of decline was slower than in the previous quarter, Strategy Analytics expects the industry to see positive growth in the fourth quarter as the recession winds down.

“We forecast 300 million handsets to be shipped worldwide in Q4 2009, growing 3 percent from 294 million units in Q4 2008,” said Strategy Analytics Director Neil Mawston in a statement. “We believe this will be the first time the industry has returned to positive growth since Q3 2008, signaling an end to the handset recession after four quarters of decline. Consumers and handset vendors are gradually regaining a little confidence.”

Strategy Analytics

In North America, the U.S. enjoyed solid results in the third quarter, with smartphones and prepaid handsets driving growth. But the Canadian market showed a downturn for the third straight quarter due to a weak economy and sluggish demand for traditional mobile phones.

Latin America’s third-quarter recovery was also less than stellar, hit by weak consumer demand and a decrease in cell phone subsidies. The industry suffered in Asia/Pacific as well, with China, India, and Indonesia seeing slight declines, though demand for smartphones remained strong.

The brightest spot was in Western Europe, where third-quarter sales of traditional mobile phones and smartphones grew over both the second quarter and the third quarter of 2008.

“Although some regions are still reeling from problems associated with the economic crisis, the third quarter served to cleanse the channel while providing the signs of stability necessary for additional improvement in the fourth quarter,” says Will Stofega, research manager of IDC’s mobile devices team, in a statement.

IDC also reported on the quarterly activity of key mobile phone makers.

Nokia continued to struggle, hit by a 20 percent decline in sales for the third quarter. As part of one strategy to stem the tide, the company kept busy with several acquisitions, including Dopplr, Cellity, and part of Plum Ventures, a developer of social networks.

Samsung fared considerably better. The company hit a new quarterly record by shipping more than 60 million cell phones in the third quarter, thanks to demand for both touch-screen and QWERTY messaging devices. During the quarter, Samsung grabbed a 21 percent share of the market, said Strategy Analytics.

LG Electronics also hit a new mark, shipping 30 million units for the quarter. But a paucity of smartphones and prepaid handsets kept the company from benefiting from those segments.

Though Motorola slipped in its ranking among cell phone makers, the company trimmed its operating losses through a restructuring program. Shifting its focus away from traditional cell phones to smartphones, Motorola has high hopes for its new Droid phone, due to hit Verizon stores next week.

Strategy Analytics also tracked Apple’s stellar third quarter, reporting a solid 7.4 million iPhones sold worldwide and a record 2.5 percent market share.