AMSTERDAM — From the European government’s perspective, those who operate telecommunications networks are moving too slowly. From the operators’ perspective, the government’s rate of change would mean unacceptable financial risk.

That, in a nutshell, is the debate that underscores many declarations and discussions here at the Broadband World Forum. The industry players share a love of high-speed networking and all that it can bring to the world, but they don’t always share a vision of how to move beyond basic broadband.

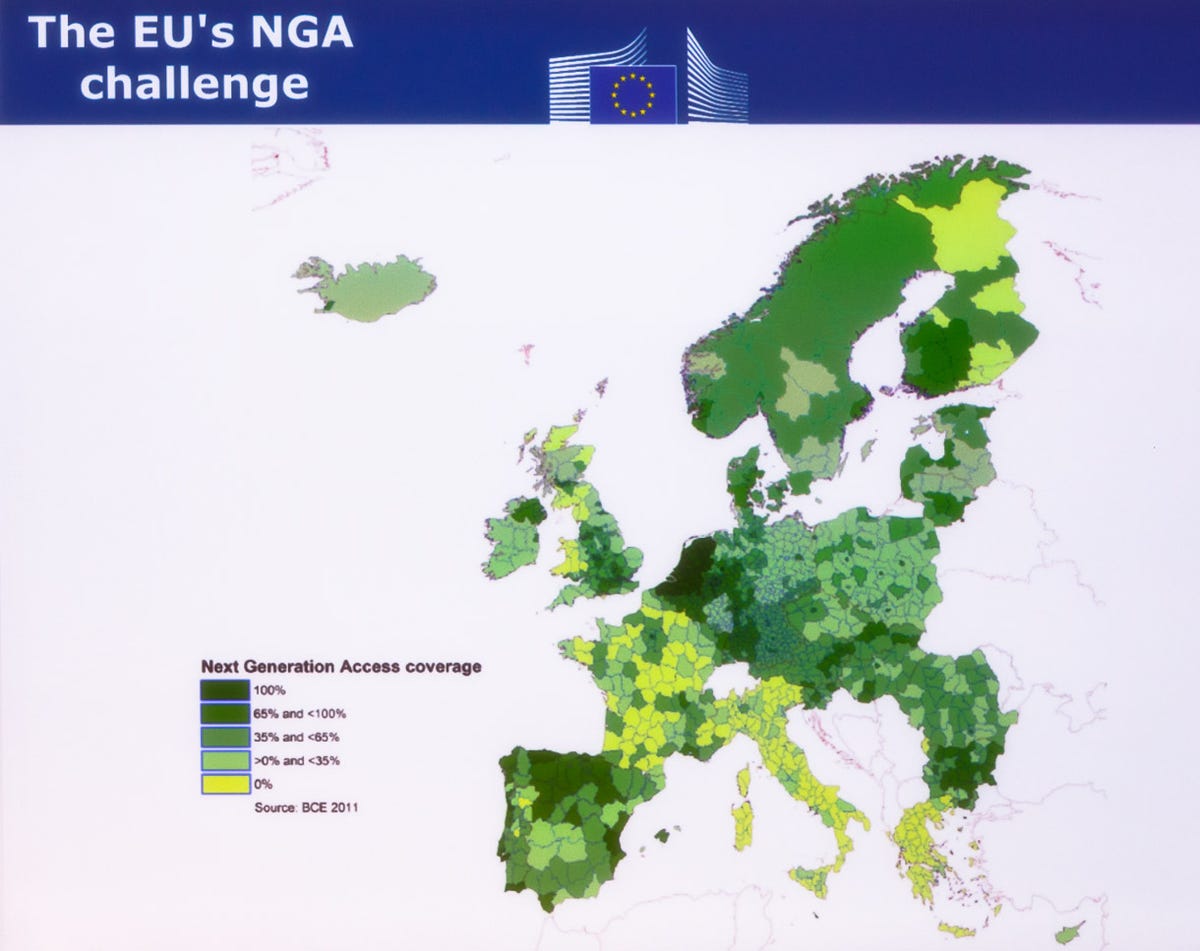

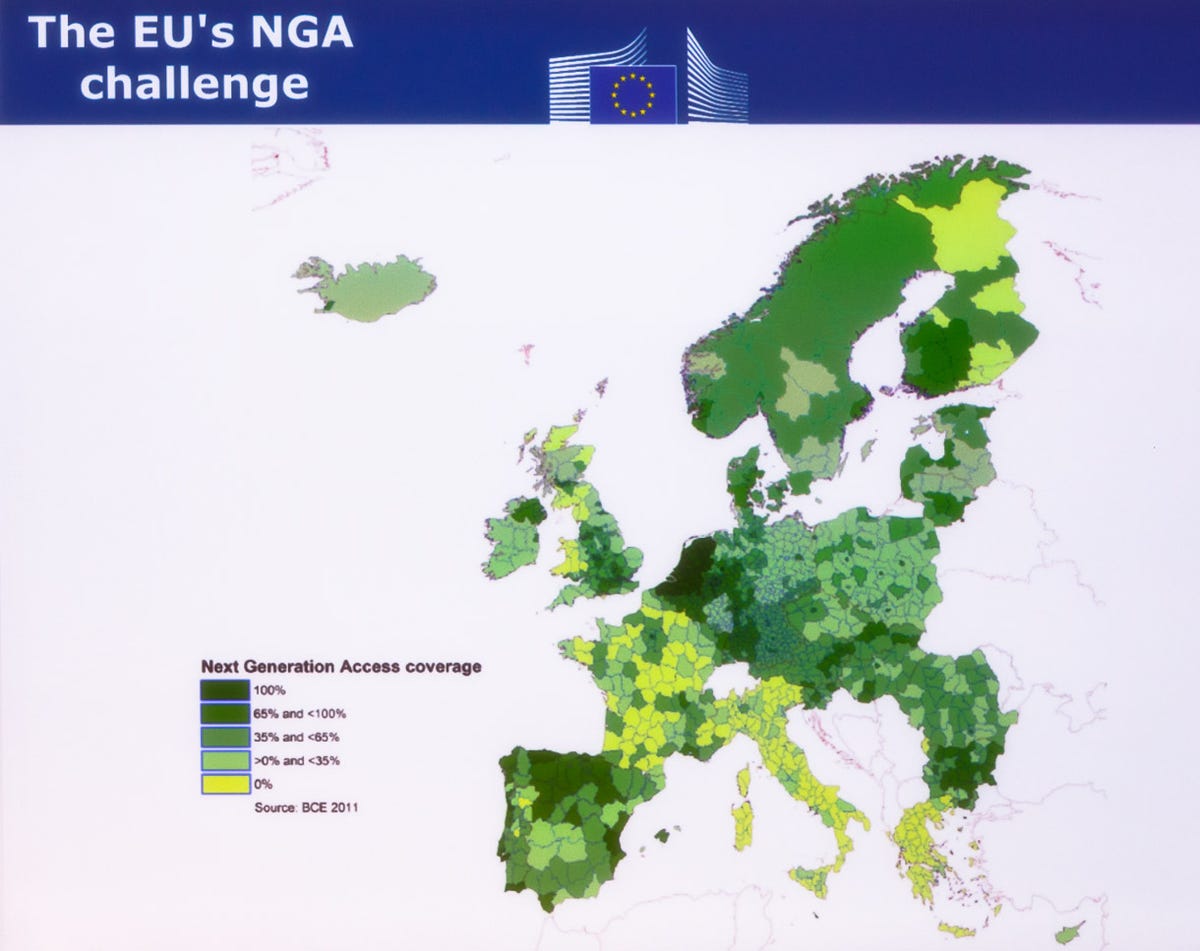

Last week, the European Commission (EC) announced it reached its 2013 goal of basic broadband at 100 percent of homes in the European Union. The EC vice president in charge of that initiative, Neelie Kroes, said in a video appearance piped into the broadband show that the next set of goals for 2020 — 100 percent with access to connections of at least 30Mbps and 50 percent at 100Mbps or better — will be hard.

“We have a long way to go to reach our 2020 target,” Kroes said. The EC is offering some help to encourage the private sector to upgrade its networks and reach rural areas, but it’s clear Kroes has more persuading to do.

A long way indeed.

“Putting the consumer agenda ahead of an industry that has not yet reached the level of return on investment to get the first objective (basic broadband this year) is probably premature,” said Vivek Badrinath, deputy CEO of Orange France, the carrier operated by France Telecom. In other words, carriers don’t want to invest in new technology when they haven’t recouped existing investments.

Stephen Shankland/CNET

Orange has been investing heavily, he added, but carriers simply don’t have financial leeway. “Our ability to massively invest is hampered by the fact that there is huge price pressure on this continent,” Badrinath said. Translation: Orange can’t afford to raise prices.

One problem is that for regulatory reasons, older mobile 2G networks can’t be retired so carriers can put their wireless spectrum to new use, Badrinath added.

Network operators aren’t just pitted against regulators and consumers who want them to move faster. Network equipment makers, with a strong business interest in getting mobile and wired network operators to upgrade, also are pushing. But moving aggressively is in the carriers’ best interest, argued Ulf Ewaldsson, chief technology officer at Ericsson.

Stephen Shankland/CNET

He showed a chart that compared revenue growth for carriers that moved quickly to new technology with those that didn’t. The result: an annual revenue growth rate 10 percent better for the fast movers.

“Superior performance on the network really counts,” Ewaldsson said. “Those who made the jump best from a voice-centric model (charging for phone calls) over to a data-centric model — they grow faster than the peer group.”

Orange’s Badrinath said he was pleased with network equipment makers’ efficiency improvements, but he had a big complaint too: Equipment makers need to cut their power consumption. The efficiency of such equipment has been increasing, which Badrinath said is good, but power consumption increases are “much faster than revenue,” meaning that operational costs increase.

“There needs to be a wakeup call,” he said.

Balan Nair, chief technology officer at Liberty Global, is caught in the same investment bind as Orange, but Nair seems more optimistic. Indeed, Nair expects that broadband will speed up enough that Wi-Fi inside a house won’t be able to keep pace with the broadband connection to the network. The 802.11g standard with 54Mbps limit is dominant today, and it’ll be years before people move to faster 802.11n and 802.ac sequels. Nair said he expects that the maximum data-transfer speed that can be relied upon will be 60Mbps.

“Very quickly we’re going to start seeing the limits are going to be in the home,” Nair said.

Stephen Shankland/CNET

Nair is sensitive to the bottom line. For example, adaptive bit rates, in which a network starts delivering video at a lower resolution but then increases it until the network maxes out, will use up lots of resources that previously were available for other uses.

“No matter how much capacity you have, it’s just going to keep eating it,” Nair predicted, which is one reason he’s a fan of “volume-based pricing” — or, data caps.

Anna Krzyzanowska, though, leader of the EC’s division that focuses on next-generation, high-speed Internet networks, was contrastingly pessimistic about the network upgrade pace.

“The investment in networks is lagging behind,” she said. “Basic broadband is with us, but the vast majority of ambitious services cannot be delivered on very, very slow networks.”

The problem, as she sees it, is that the economic benefits for the region from faster broadband aren’t tied closely enough to the financial incentives for network providers.

“To us, the return on investment in broadband goes way beyond what can be monetized in the short term,” Krzyzanowska said. That’s why the EC is sweetening the pot so private-sector players will find it worthwhile to reach to rural areas and the European Investment Bank

will provide some long-term financing options for the region’s priorities.

Google is one fan of the EC’s approach, according to Kevin Lo, leader of the Google Fiber project to build 1GBps network access in Kansas City, Mo. and Kan.; Austin Texas; and Provo, Utah.

“We welcome the commission’s proposal,” he said of the EC’s draft regulation on reducing broadband costs that debuted earlier this year.

Google is eager to bring about a more Internet-centric future — one in which it no doubt sees new profit. Kroes, too, has an economic incentive — albeit a broader one — for faster Net access.

“The Internet creates five jobs for every two lost,” Kroes said. “This is an economic and employment opportunity not to be missed.”

Stephen Shankland/CNET