Carl Icahn just can’t leave Apple alone.

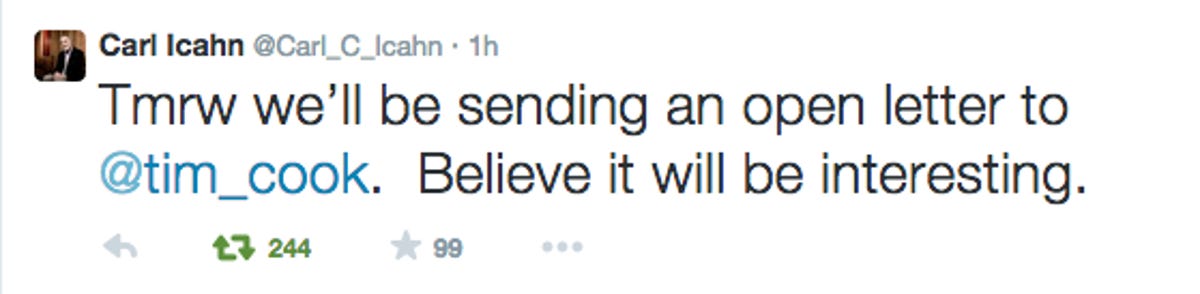

The billionaire activist investor — who has agitated for change at companies such as Dell, eBay and of course, Apple — on Wednesday tweeted from his Twitter account, @carl_c_icahn, that he plans to send an open letter to Apple CEO Tim Cook on Thursday. “Believe it will be interesting,” he said.

An earlier tweet noted that Icahn a year ago bought a large position in Apple and considered the company to be “extremely undervalued.” Since that time, Apple shares have soared more than 50 percent, Icahn added.

Screenshot by Shara Tibken/CNET

Apple shares, which were little changed earlier Wednesday, climbed 2.2 percent to $100.88 in recent trading following Icahn’s tweets. Shares hit an all-time high of $103.74 on September 2.

Apple didn’t respond to a request for comment.

The news comes only a few hours after Apple sent invitations to an October 16 press event. The company is widely expected to unveil new iPad tablets and Mac computers, as well as talk about its new Mac operating system software. Apple’s tablet hasn’t been selling as well as it used to, with sales of the iPad declining year-over-year and falling short of analyst expectations for two straight quarters. The company also hasn’t refreshed some of its Macs, such as the Mac Mini, for a couple of years. Both product lines are due for some updates.

See also

- Apple sets Oct. 16 event, with new iPad, Macs likely

- Icahn to debate share buyback with Apple CEO next month

- Carl Icahn tweets about large stake in Apple, chat with CEO

Apple, which nearly declared bankruptcy before Steve Jobs returned to the helm in 1997, now is the most valuable company in the US. Its market capitalization of more than $600 billion tops Exxon Mobil, Microsoft and IBM, all giants in their own right. In Apple’s last fiscal year, ended September 28, 2013, the company generated $170.91 billion in sales and $37.04 billion in profits.

It wasn’t immediately clear what Icahn plans to say to Apple in his letter. Former Apple CEO Jobs long ignored shareholders, but Cook has taken a more investor friendly approach. He met with Icahn a year ago after the investor built a large stake in Apple shares. At the time, Icahn criticized Apple’s buyback program as too small and said he wanted Apple to buy back $50 billion worth of shares. He dropped his proposal in February after saying Apple was close to fulfilling his requested repurchase target.

Since the talks a year ago, Apple has significantly increased its share repurchase plans and boosted its dividend. The company in June also gave investors six additional shares of stock for every Apple share they owned as of June 2. Because of the split, shares now trade at a much lower level than in the past, but it also makes the stock more accessible to investors. It’s much cheaper to own a chunk of Apple at about $100 versus $600.

The extent to which Apple buys back shares is important to Icahn and other investors. The more shares a company buys back relative to its total outstanding shares, the more the move can affect a stock price. In this case, it would mean that Apple’s shares would rise as the total stock supply falls and demand continues to stay strong.

Leave your thoughts in the comments section about what Icahn may say.