For the most up-to-date news and information about the coronavirus pandemic, visit the WHO and CDC websites.

The nation’s largest wireless and broadband companies are extending their promise to not disconnect service through June 30, in an effort to help customers through the COVID-19 crisis. In March, these service providers voluntarily signed on to the Federal Communications Commission’s Keep Americans Connected pledge.

Wireless providers AT&T, Verizon, and T-Mobile, along with the nation’s largest cable provider, Comcast, have each extended for another seven weeks their commitment to not charge late fees or disconnect service of customers who can’t pay their bills. Comcast has also said it’ll extend its free offer of the Internet Essentials program for low-income individuals through the end of June. And the cable giant said it will suspend requirements that prevent eligible customers from taking advantage of the service if they have an outstanding balance with the company.

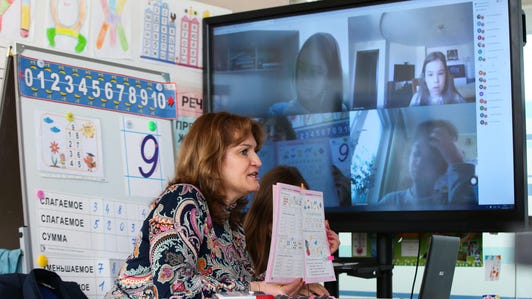

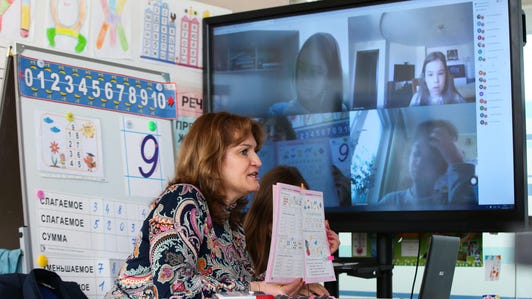

The promise to extend the pledge comes as states debate whether to start opening up for business or whether to extend stay-at-home orders, which require many to work from their residence. Several governors have also closed schools for the remainder of the school year. As a result, Americans nationwide will continue to rely on their broadband and wireless services to stay connected to schools, workplaces and medical professionals.

More than 700 broadband and wireless companies have signed on to the pledge, according to the FCC. As part of the pledge, wireless and cable broadband providers have opened up their public Wi-Fi hotspots for free, promised not to terminate service if subscribers can’t pay and waived overage and late fees.

AT&T, T-Mobile and Verizon each said they won’t terminate service or charge late fees for residential or small-business customers so long as customers notify the companies about their inability to pay due to the coronavirus crisis.

The pledge and its extension also applies to home broadband and TV services from AT&T and Verizon.

Though the companies’ executives, like Verizon CEO Hans Vestberg, say they’re committed to helping alleviate the effects customers may experience from the economic hardships of the virus, their commitments are having a financial impact.

Verizon said on its earnings conference call last week that “bad debt” expenses increased by $228 million as a result of customers who are unable to pay their bills. The company said it expects this number to increase in the second quarter.

Coronavirus updates

- I’m Eligible for a Second COVID Vaccine Booster. When Should I Get It?

- Free COVID Antiviral Pills: New Official Website Helps Find Them

- Long COVID Symptoms May Depend on the Variant You Contracted

- News, advice and more about COVID-19

Now playing:

Watch this:

Fired Amazon employees accuse company of retribution

9:05

Our new reality now that coronavirus has sent the world online