Tim Stevens/CNET

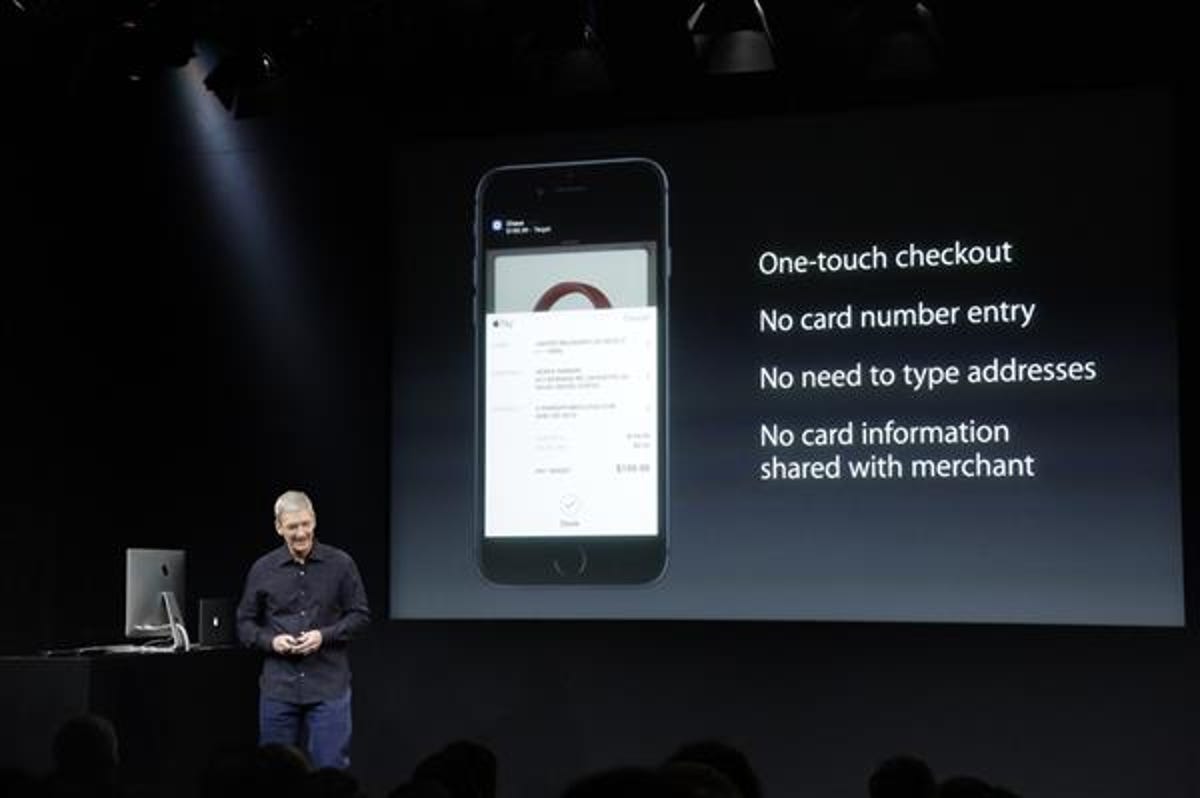

Apple is rolling out its mobile payments service Apple Pay on Monday, CEO Tim Cook announced at an event on Thursday.

He said enthusiasm for the service has been huge, with 500 new banks partnering with Apple since the service was announced last month.

“It’s easy, it’s secure and yes, it’s a private way to pay for things,” Cook said at the event in Cupertino, Calif., Thursday. “We think that it is going to be profound.”

Apple unveiled Apple Pay with the launch of the iPhone 6 and iPhone 6 Plus in September. The company has partnered with Visa, Mastercard and American Express, along with several issuing banks, to allow iPhone users to store their credit card accounts. Apple Pay will be available in 220,000 US merchant locations that already take mobile payments via the NFC chip’s short-range, secure wireless capabilities.

Previously, Apple announced that it’s also working with many retailers — including Macy’s, Walgreens, Duane Reade, Staples, Subway, McDonald’s, Disney and Whole Foods, among others — to bring Apple Pay to physical store locations. McDonald’s is even adding Apple Pay to the drive-through, Eddy Cue, senior vice president of Internet software and services, said last month. Disney is expected to have all of its retail locations outfitted with Apple Pay by Christmas.

Mobile payments is a natural progression for Apple. The company already lets hundreds of millions of users — about 800 million, as of Apple’s earnings in April — buy music, books and apps through an iTunes account linked to their credit cards. Expanding this payment process into a digital wallet is a feasible shift for the company.

Related Links

- Apple takes NFC mainstream on iPhone 6; Apple Watch with Apple Pay

- Hello, Apple Pay, good-bye credit cards? All bets are off

- Apple Pay to launch October, streamlines online and retail transactions with iPhone 6 handsets

- Get to know Apple Pay, the successor to your wallet

Cook said last month that Apple’s vision is to replace a wallet, and more specifically to replace antiquated, plastic credit cards. Cook noted that there are more than 200 million credit card and debit card transactions processed per day in the US with consumers spending more than $12 billion every day between credit cards and debit cards.

The service works by allowing users to simply tap their iPhone devices to payment terminals and then touch their devices’ fingerprint sensors to purchase items. Both the devices and the terminals must have near-field communication (NFC) chips that store payment credentials — something that limits the service to the new iPhone 6 and 6 Plus phones.

But Apple Pay has another component that doesn’t require an NFC chip but does need the company’s TouchID. People now can pay for items in apps using a single touch on their device’s fingerprint sensor, something that removes time and the hassle of entering credit card and address information over and over. Previously, Apple allowed consumers to use the fingerprint sensor to quickly buy content just from its iTunes, App and iBooks stores. Apple also announced Thursday that it was adding Touch ID to its iPads.

Cue previously said that Apple Pay will be integrated with several apps, including the car service Uber; a food app from Panera; Major League Baseball’s app, which will allow you to order tickets from your phone; and Open Table, which will allow you to pay your bill from your iPhone 6 or iPhone 6 Plus. Apple will also be making an application programming interface available in iOS 8 to allow other app developers to integrate Apple Pay into their applications.

Now playing:

Watch this:

Apple Pay is coming Monday, October 20

0:39

Jim McCarthy, Visa’s vice president of Innovation and Strategic Partnerships, called these in-app purchase options the real “game changer” despite the buzz around NFC technology. This will allow developers to connect with Apple Pay for a myriad of purposes, and create new services that people haven’t imagined possible, he told a group of journalists on Wednesday before Apple’s event.

That said, McCarthy did not downplay the value of using Apple Pay in the physical world, particularly through connected devices. This includes Apple’s Apple Watch, which was also unveiled last month. The watch will sync with an iPhone to receive the same security credentials as the handset. The wearer can then leave the phone behind and purchase items simply using the watch, which will be matched to the wearer’s heartbeat. Once the watch is removed, the device will unlink from the phone as a security measure.

Even further down the line, McCarthy can imagine a connected car that will allow the driver to pay for gas from inside the car through Apple Pay.

Mobile payments has been promised for a long time but so far has struggled to gain much traction. The goal with offerings like Google Wallet was that people could get rid of all their credit cards, loyalty cards and coupons that filled their wallets and instead store and access them from their mobile phones. While the idea itself sounded great, a year after launch Google Wallet still only worked with one credit card and bank combination. And it only worked on one wireless network: Sprint.

It’s not surprising that Apple has waited until now to introduce the payments service.

The company tends to stay away from new technologies until it has had a chance to smooth out the kinks.

Typically, Google Wallet and other offerings have relied on hardware-based short-range wireless technology known as near -field communication, or NFC. Using this technology, consumers could load credit card information into an Android app that stored the information in a secure element that was part of the NFC chip, and then, using the short-range wireless technology, it transmitted the payment information from the phone to the sales terminal with a simple tap. The problem with NFC, however, was that both mobile devices and the point-of-sale processing terminal needed the same hardware. But that’s changing, with merchants required to switch out machines to include new security technology introduced by the credit card industry.

It’s not surprising that Apple would see potential not just in payments but in the mobile payments market specifically. According to Gartner, the global market for mobile payments is forecast to be about $720 billion worth of transactions by 2017. This is up from about $235 billion last year.