James Martin/CNET

Apple wants to turn your iPhone 6 and Apple Watch into a virtual wallet that could eventually replace the old plastic card sitting in your real wallet.

Apple announced Tuesday at its September 9, product launch in Cupertino, Calif., that it is finally joining the ranks of companies, such as Google, that have tried with lackluster success to get consumers to buy things with their phones, by introducing its own mobile payment offering.

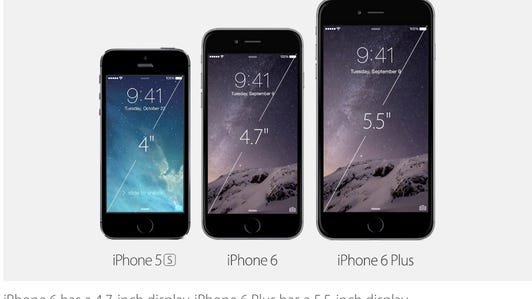

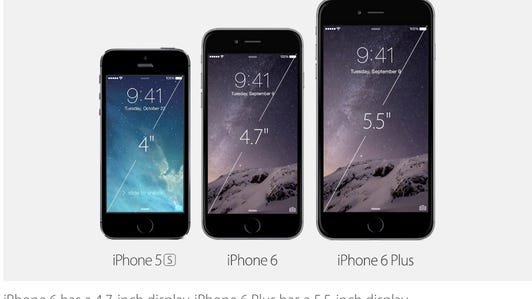

After years of speculation, the company is finally including the short-range wireless technology known as near field communications or NFC into its latest smartphone, the iPhone 6 and the bigger iPhone 6 Plus. It also announced a new digital wallet called Apple Pay , which can be accessed securely using its fingerprint Touch ID technology introduced in the iPhone 5S.

Apple’s new Apple Watch will also be equipped with NFC, which will enable older generations of the iPhone, specifically the iPhone 5, iPhone 5s and iPhone 5c to work with Apple Pay.

Apple announced Tuesday it’s partnering with Visa, Mastercard, and American Express along with several issuing banks to allow iPhone users to store their credit card accounts. Apple Pay will be available in 220,000 US merchant locations that already take mobile payments via the NFC’s short range, secure wireless capabilities.

Apple has also worked with other retailers, including Macy’s, Walgreens, Duane Reade, Staples, Subway, McDonald’s, Disney, and Whole Foods, among others to bring Apple Pay to physical store locations. At McDonald’s it’s even adding Apple Pay to the drive-through, Eddy Cue, senior vice president of Internet software and services, said during the presentation. Disney is expected to have all of its retail locations outfitted with Apple Pay by Christmas.

Apple’s Cue also said that Apple Pay will be integrated with several apps including, the car service Uber, a food app from Panera, Major League Baseball’s app, which will allow you to order tickets from your phone, and Open Table, which will allow you to pay your bill from your iPhone 6 or iPhone 6 Plus. Apple will also be making an API available in iOS 8 to allow other app developers to integrate Apple Pay into their applications.

Users will be able to fund the Apple Pay mobile wallet using the credit cards and debit cards they already have on file in iTunes. To add additional cards, users can take a photo with the phone, go to bank to verify that it’s your card, and it’s added right to Passbook, Cue said.

Apple announces iPhone 6, iPhone 6 Plus, and Apple Watch (photos)

Mobile Payments

Mobile payments, or paying for things using a mobile phone or a mobile app, is a natural progression for Apple, as the company expands its business beyond the traditional smartphone and tablet market into new areas. Apple already stores credit card account information for 800 million customers to allow them to easily buy digital music, books, TV shows, movies and apps via its iTunes store. Expanding this payment process into a digital wallet, which virtually stores these credentials and can be accessed to buy physical goods, can be viewed as an extension of this capability.

Apple CEO Tim Cook said during the presentation that Apple’s vision is to replace a wallet, and more specifically to replace antiquated, plastic credit cards. Cook noted that there are more than 200 million credit card and debit card transactions processed per day in the U.S. with consumers spending more than $12 billion every day between credit cards and debit cards.

“That’s over $4 trillion a year,” he said. “And that’s just in the US.”

He went on to explain: “This whole (payment) process is based on this little piece of plastic,” he said. “We’re totally reliant on the exposed numbers and the outdated and vulnerable magnetic stripe interface, which is five decades old.”

Apple hinted at a mobile payment solution earlier this year. On an earnings call with analysts in January, Apple CEO Tim Cook said he was intrigued by the idea of a mobile payment service using Apple’s Touch ID feature as part of the implementation to secure access to the credit card information.

“Apple isn’t trying to get rid of credit cards entirely,” said Jason Oxman, CEO of the Electronics Transaction Association “But what they are are trying to do is disrupt is the plastic credit card with that magnetic strip. Using NFC tied to your iTunes account, you can simply pay by tapping your device.”

Now playing:

Watch this:

Apple turns iPhone 6 into mobile wallet with Apple Pay

3:14

How it will work

The way Apple Pay will work is that users will be able to simply tap their devices outfitted with a small NFC chip that stores its payment credentials on a payment terminal in the checkout aisle at a number of different merchants. This will allow the store to access the customer’s credit card payment credentials so the credit card account can be charged.

When iPhone 6, iPhone 6 Plus and Apple Watch users make a payment, these credit card accounts will be charged, just as a credit card account is charged when someone makes a purchase in Apple’s iTunes music store. Following an already emerging trend in the payments industry, Apple will be using what’s known as tokenization technology to add another level of security to the transaction.

The way tokens work is that they replace the static 16-digit card numbers that appear on the front of a credit card and indicate a customer’s account number with a dynamically changing and complex code that is transmitted between devices to identify accounts. The benefit of using tokens is that even if they are intercepted by a fraudster, they are rendered useless in the next transaction, because they are constantly changing.

It’s not surprising that Apple would see potential not just in payments but in the mobile payments market specifically. According to Gartner, the global market for mobile payments is forecast to be about $720 billion worth of transactions by 2017. This is up from about $235 billion last year.

Still, other big companies, such as Google and three of the four major wireless operators in the US, have launched mobile payment services using the hardware-based NFC solution that have seen mediocre success at best.

Google was f irst to market three years ago with its Google Wallet service, which also uses NFC-enabled handsets to securely transmit credit card information between the device and a point of sale terminal in the check-out line of a retailer. The idea behind Google Wallet was to not only store credit cards but also store loyalty cards and coupons as well as leverage location information to send offers and promotions to customers. While the idea itself sounded great, a year after launch Google Wallet only worked with one credit card and bank combination. And it was only available on one wireless network: Sprint.

Meanwhile, three of the four major US wireless carriers — Verizon Wireless, AT&T, and T-Mobile — formed a joint venture to offer a similar kind of NFC-powered mobile-payment service. After a year-long trial period, the service, named Isis, launched across the nation in November with help from high-profile partners such as Coke and Jamba Juice, which offered freebies for early adopters. In July, Isis had to go dark to change its name, which too closely resembled the terrorist group Islamic State of Iraq and Syria, also known as ISIS. It’s now known as Softcard.

The mobile payment solutions offered both by Google and the wireless carriers has been stymied by a few issues. For one, the NFC technology used to enable Google Wallet and Softcard must be available on the mobile device as well as at the point of sale terminal used at the merchant. And second, in order to even store these credentials on phones, the companies enabling the wallets needed to have arrangements with credit card companies and banks.

For Google, the hurdles were difficult to get around since it does not manufacture its own devices. This meant it not only needed to convince merchants to upgrade their terminals, but it had to get device makers to include the NFC technology in the devices. This wasn’t so hard given that companies like Samsung saw other uses for NFC. But even when handset makers included the NFC chip on their devices, it was up to the wireless carriers whether that functionality would be enabled. And AT&T, Verizon, and T-Mobile shut out the Google Wallet functionality.

As a result, Google shifted gears and revamped the service, turning it into a cloud-based app that stores credit card and loyalty card credentials in a secure Internet based service rather than on the device itself. Google Wallet still uses the NFC tap-and-pay functionality to access the cloud-based credentials, but because the information is stored remotely it also means that Google Wallet users can also access it through other password-secured Google services, such as Gmail.

Apple: In a class all its own

Just because other companies have failed to make a splash with mobile payments doesn’t mean that Apple will meet the same fate. Apple’s strength has historically been taking technologies that have been invented and used by other companies and refining them. The company then packages those technologies in such a way that the service is easy to use and appealing to millions of users.

“Apple didn’t invent the smartphone or the tablet,” Oxman said. “They weren’t the first to offer mobile apps. But they raised consumer awareness of these products and services and they packaged it better than anyone else.”

Apple’s golden touch could do the same for mobile payments and the beleaguered NFC technology that Apple will use to deploy the service. For one, Apple is using its existing base of iTunes accounts to allow people to fund their “wallets” using any credit card. This is a huge advantage since that was a major stumbling block for Google as well as the wireless operators.

“Consumers that have used NFC mobile payments have liked it,” said Randy Vanderhoof, executive director of the Smart Card Alliance. “But they haven’t liked not being able to use any payment card they want in their mobile wallet. Apple’s wallet overcomes this challenge by letting consumers’ use the card of their choice through their iTunes account. It’s a smart move and a big win for NFC.”

Apple is also launching this new service at just the right time. In addition to getting consumers to buy devices that are NFC-enabled and making sure that they can access the service and link it to any credit card, another important piece of the puzzle is ensuring that merchants have the right equipment at check-out to accept the payment.

Apple may have chosen to launch its solution now since the payments industry is in the middle of a major transition to upgrade merchants’ point-of-sale machines, so that they can accept the more secure token-based EMV (Europay, MasterCard and Visa) chip technology. Credit cards that use the EMV chip technology have an embedded microchip in them that the scanner reads instead of a magnetic strip. It’s this chip that generates the unique tokens that are used to route transactions instead of static account numbers that are offered in the older magnetic strip cards that most US consumers currently use.

The move to EMV requires that merchants replace their point of sale terminals. In an effort to speed the process, the payments industry has put a deadline of October 2015 for this upgrade.

“From an acceptance perspective, the timing is really good for merchants,” Vanderhoof said. “Many are already looking to install new POS terminals to accept EMV chip cards, so they can also look at enabling NFC acceptance at the same time. Both features are available on most POS terminals shipped today.”

New life for NFC

The fact that Apple is using NFC to enable mobile payments, instead of another technology, could give mobile payments a big boost, analysts say. The company has a massive user base of iPhone users as well as the 800 million credit card account numbers stored in iTunes. It has also quietly built the foundation to its mobile-payment service in Passbook, an app introduced two years ago in its iOS software and released as a feature with the iPhone 4S. Passbook has so far served as a repository for airline tickets, membership cards, and credit card statements. While it started out with just a handful of compatible apps, Passbook works with apps from Delta, Starbucks, Fandango, The Home Depot, and more. But it could potentially be more powerful.

And the iPhone’s fingerprint sensor, which Apple obtained through its acquisition of Authentec in 2012, could serve as a quick and secure way of verifying purchases, not just through online purchases, but large transactions made at big-box retailers such as Best Buy. Today, you can use the fingerprint sensor to quickly buy content from Apple’s iTunes, App, and iBooks stores.

“No one can change consumer behavior like Apple,” Vanderhoof said. “This move will make the market for mobile payments explode. And it is a great endorsement of NFC technology as the best way to secure mobile payments.”

UPDATED 12:22 pm PT: This story was updated with additional information about the Apple Watch and background information NFC and mobile payments.