Amazon’s latest addition to its Appstore could very well ignite the ire of a litigious patent holder, and cause a new legal and monetary headache for app makers.

Amazon yesterday announced its in-app purchase service, offering developers a way to let users spend money inside of apps. While not a new feature among mobile apps, it adds new ways for developers to make revenue after an app has been downloaded, whether it was paid or free.

That particular mechanism, which has been available for app makers on Google’s Android and Apple’s iOS platforms for some time now, has piqued the interest of an aggressive patent-holding firm named Lodsys. Last year, the Texas-based company peppered numerous developers — big and small — with requests for licensing deals for using in-app purchase with the threat of litigation if deals were not made.

While Google, Apple, and Microsoft are licensees of the firm’s technology, Lodsys argued that these licensing deals did not cover applications from third-party developers. The firm has now told CNET that Amazon is not a licensee. In other words, without coming straight out and saying it, they are inching toward a declaration that Amazon also needs to license their patents to offer such a feature.

“Amazon is not licensed,” Lodsys told CNET in a statement. “Lodsys Group LLC will continue to seek license agreements from companies that are infringing the claims in its portfolio.”

The company also re-iterated that its licensing agreement with Apple, Google and Microsoft “(does) not extend to third party applications which run on those platforms.”

Amazon did not respond to repeated requests for comment on the matter, and a Google spokesman declined to comment.

So where does that leave Amazon? Unlike Google, Apple, and Microsoft, Amazon is not a purveyor of the underlying operating system which it’s selling apps on. Instead, the company’s platform revolves around a standalone store, separate from the one that Google includes out of the box with Android devices.

Nonetheless, Amazon’s own Appstore has quickly proven itself as a strong contender to Google’s own Play service (formerly known as the Android Market). In a study released last month covering mobile-application store activity during the first two months of 2012, Flurry Analytics — a company that tracks usage among apps on iOS, Android, Amazon, and others — said Amazon was pulling in considerably more revenue per user than Google. Compared to every $1 spent per user in Apple’s App Store, developers on Amazon’s platform were generating 89 cents, the study said. By comparison, developers on Google’s Play service were generating 24 cents per user.

Those numbers are especially relevant given the rise of so-called “freemium” titles, software that’s given away for free, and then relies on in-app purchasing to turn a profit for its makers. According to a study released in February by another mobile-analytics company named Distimo, around 65 percent of Amazon’s Appstore were paid apps, a number the firm says held “stable” during the latter part of 2011.

No stranger to patent protection

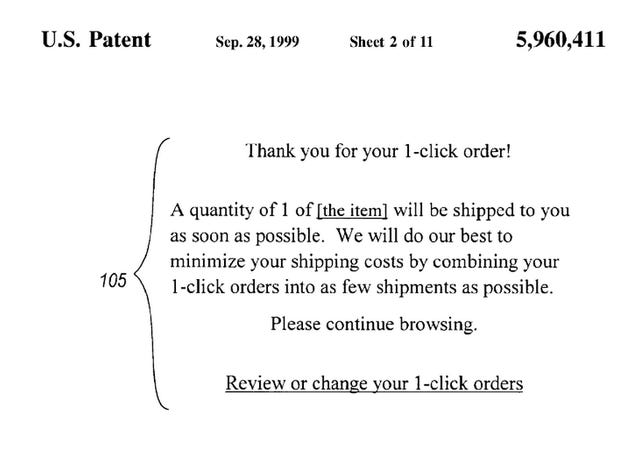

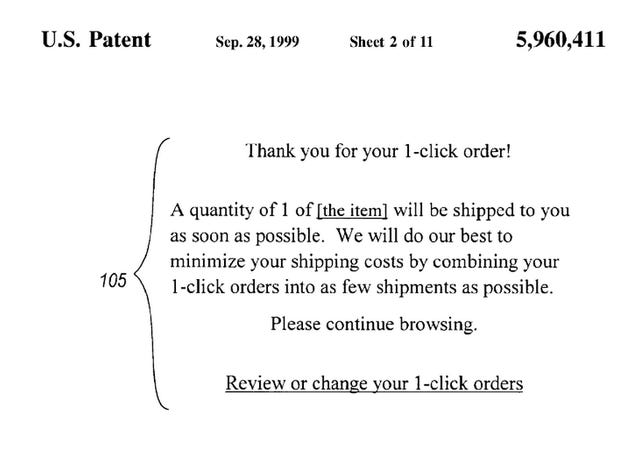

Amazon has a storied history with software patents, building its business around its “1-Click” patent the firm was granted in 1998. As the name would suggest, the system lets shoppers make a purchase with a single click, versus being carried through to a page where they are required to fill out billing information and other personal details.

USPTO

The patent was a cause of controversy in the technology world after Amazon went to court against rival Barnes & Noble, which was using a similar purchasing system on its Web site. The two companies reached a settlement over the issue in 2002. Separately, Apple signed a licensing agreement with Amazon to include it in its own products in 2000.

Several years later, the United States Patent and Trademark Office ordered a re-examination of the patentupon the request of a New Zealand actor named Peter Caveley, who cited prior art. That led to a rejection of a few of the patent’s claims, and several amendments by Amazon. In March 2010, the USPTO passed the 1-Click patent through the re-examination process, with the stipulation that it’s tied to a virtual shopping cart.

“Amazon built a substantial business around that innovation, and licensed it to major players including Apple,” said Erin-Michael Gill, the managing director and chief intellectual property officer at MDB Capital Group. “Apple is using that innovation to make it easier for developers’ apps to be purchased on iTunes. That’s how the system is supposed to work.”

By comparison, Gill says that Lodsys’ current strategy seeks the same ends, but is going about it in a potentially destructive manner.

“Because it appears that Lodsys is attempting to leverage the inefficiencies in the patent system to extract royalties — apparently looking to settle with developers that don’t have the resources to defend themselves, for just under the cost of litigation — there ends up not being this virtuous cycle of innovation promoting further innovation,” Gill said. “This leads to the entire ecosystem going on the offensive.”

Amazon

Lodsys patents under attack

There have been notable efforts to keep app developers out of harm’s way when using built-in APIs, as well as get all of Lodsys’ patents invalidated. Apple, whose developers were some of the first to be targeted, sent a letter to Lodsys last May, saying it was “undisputedly licensed to these (patents),” adding that app makers were protected under its licensing agreement. Lodsys publicly rebuffed that letter, saying that Apple was mistaken. The firm then proceeded to file a lawsuit against several additional app developers, and send similar licensing requests to Android developers.

Related stories

- How much is that patent lawsuit going to cost you?

- Scoop: Bounty set for invalidating Lodsys patents

- Apple throws weight behind devs on patent issue

- iOS app makers targeted in patent spat

After its own developers were targeted, Google responded last August by filing a request with the United States Patent and Trademark office seeking a re-examination of two of the four Lodsys patents. That process is still on-going, though since then there have been no newly filed suits against Android developers.

Seemingly separate from both of those efforts was one launched last year from Article One Partners, a business that crowd-sources intellectual property research. It offered a reward to the party that found prior art, or examples of pre-existing technologies or other IP that could be used as evidence to invalidate one or more of Lodsys’ patents. All three of those studies were completed successfully, resulting in $15,000 worth of prize money being doled out to three researchers.

“When folks like Microsoft, Apple, and now presumably Amazon start pulling together and pooling resources to really dig into these assets, every little nuanced issue becomes critical,” Gill said.