We may be finally getting over the iPhone.

Apple on Tuesday said it sold 74.8 million iPhones in the fiscal first quarter, ended December 26, missing Wall Street expectations and posting the slowest growth since the company began selling the smartphones in 2007. Sales were essentially flat compared with the same quarter last year, when it sold 74.5 million units. Analysts had expected the company to sell 76.3 million units this year, according to a poll by Fortune.

What’s worse, Apple predicted that total company revenue will slide and that iPhone sales will see their first slump ever in the current quarter that ends in March.

CEO Tim Cook blamed Apple’s weaker results on the stronger value of the US dollar and on global economic softness.

“We are seeing extreme conditions unlike anything we have ever experienced before,” he said during a conference call with analysts.

Get personal with the iPhone 6S (pictures)

The numbers, massive for any other company but worrisome for Apple, underscore the cooling attitude toward phones in general. More than two-thirds of the company’s revenue now comes from the iPhone. And the problem is that Apple’s recent next big thing, whether the Apple Watch or a bigger iPad, hasn’t really gotten us excited.

The redesigned iPhone 6, released in September 2014, proved popular and led Apple to report in last year’s first quarter the highest profit ever of any public company. The Cupertino, California-based tech giant on Tuesday once again reported the most profitable quarter in history.

But the latest iPhone models, the 6S and 6S Plus, didn’t add enough new features to prompt customers in places like the US to upgrade. In addition, the economy in China, one of Apple’s most important markets, has been struggling and may have put a damper on the willingness of consumers there to snap up a new phone.

First iPhone sales drop

Apple typically doesn’t provide estimates for iPhone sales in future quarters, but Cook on Tuesday confirmed that in the current quarter iPhone unit sales will fall for the first time ever. He wouldn’t comment about expectations that iPhone sales will drop for the full year, and he said he doesn’t think the market is saturated. Almost half the iPhones sold in China in the December quarter were to people buying their first smartphone, and Apple also sees opportunities in other emerging markets.

“This indicates to me there’s still a tremendous number of people in the world who will buy smartphones and we ought to be able to win over our fair share of those,” Cook said.

See also

- Can Apple escape iPhone fatigue?

- Apple beats world record in quarterly profits

- Rough year ahead for those selling PCs, tablets and smartphones, too

Piper Jaffray analyst Gene Munster noted that Apple’s March revenue forecast implies it will sell 50 million to 52 million iPhones in the period. Before Tuesday’s report, analysts projected Apple would sell about 55 million iPhones in its second fiscal quarter.

Part of the expected iPhone weakness is due to China. Cook on Tuesday said Apple started seeing some signs of economic weakness there earlier this month, particularly in Hong Kong, but he added that he remains confident in the longer term.

In the December quarter, sales in Greater China, which includes mainland China, Taiwan and Hong Kong, rose 14 percent, to $18.4 billion. The region has been one of Apple’s most important markets in recent quarters and even surpassed the US in last year’s March quarter to become the company’s biggest iPhone market.

March wobbles

Analysts had largely expected Apple to post a slight increase in its fiscal first-quarter iPhone sales but hit a speed bump in the current March quarter. More than 10 of the company’s major suppliers have warned that business has slowed down in recent weeks, and it’s hard to imagine that Apple would be immune to those woes.

“There are downside concerns given continued negative data points from the supply chain as well as continued currency deterioration, particularly in China,” UBS analyst Steven Milunovich said in a note before Apple’s earnings release.

For the March quarter, Apple projected revenue of $50 billion to $53 billion, down from $58 billion last year. Analysts polled by Thomson Reuters had expected sales of $55.48 billion. The decline would be Apple’s first drop in a decade.

In the December quarter, Apple reported revenue of $75.9 billion, compared with $74.6 billion in the year-earlier period. Wall Street had expected sales to total $76.5 billion.

Net income increased to $18.4 billion, or $3.28 a share, from $18 billion, or $3.06 a share, last year. Analysts estimated per-share earnings of $3.23 a share.

Now playing:

Watch this:

Apple reports first drop in revenue in over a decade

1:19

iPad and Mac declines

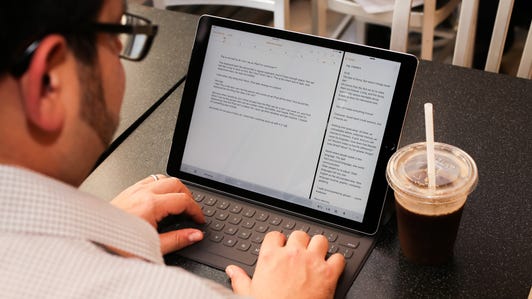

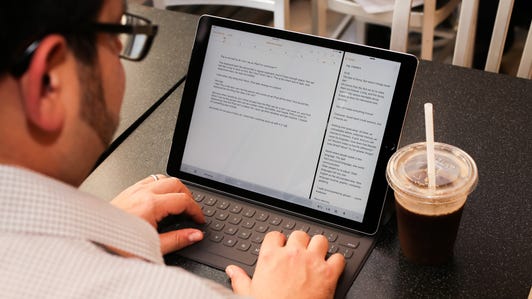

Apple’s iPad business continued to struggle during the quarter despite the introduction of the 12.9-inch iPad Pro. The company launched the device in November to attract business users and other buyers to its tablet line, which has been struggling for the past couple of years.

Hands-on with the iPad Pro (pictures)

Overall, iPad unit sales dropped 25 percent, to 16.1 million. Analysts polled by Fortune expected it to sell 17.8 million units. This quarter’s sales decline marks the eighth time in a row iPad sales have fallen from the previous year.

Macintosh computer sales also slid in the period, down 3.8 percent, to 5.3 million. Analysts projected sales of 5.8 million.

Apple didn’t break out Apple Watch sales figures. The company lumps the device in with “other products” like iPods. Revenue for that segment grew 62 percent, to $4.4 million. Analysts polled by Fortune believe Apple sold 5.5 million Apple Watches during the December quarter.

Cook didn’t give more information about Apple Watch sales beyond saying they set a “new quarterly record” and were “especially strong” in December. The device hit the market in April.

Apple shares initially rose less than 1 percent in after-hours trading, as the March guidance wasn’t as bad as feared. By the end of the conference call, though, shares had dropped 2.5 percent, to $97.50.

RBC analyst Amit Daryanani noted that the March forecast, while below the average number expected by analysts, “will be perceived positively given rather difficult compares they had [versus the] iPhone 6 cycle.”

Update, 1:45 p.m. PT: Adds details about iPad and Mac sales. Update, 1:55 p.m. PT: Adds analyst comments. Updates from 4:20 to 5 p.m. PT: Add comments from conference call.