This story is part of Taxes 2023, CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

There are a number of tax scams that resurface every tax season, but tax related identity theft might be the worst. That’s when someone uses your Social Security number to file a tax return in your name with the purpose of stealing your tax refund.

Robert Rodriguez/CNET

You might not even know you’ve been scammed until you file your tax return and it’s rejected because of duplicate personal information. You do have recourse with the IRS for identity theft, but you’re in for a long process.

Recent major privacy breaches at PayPal and T-Mobile remind us of the vulnerability of our Social Security numbers, which often work as both login and password for government services and benefits. “It’s totally reasonable to assume that your Social Security number has been compromised at least once, if not many times,” said Notre Dame technology professor Mike Chapple in an interview with Forbes.

If your Social Security number is floating around the dark web, how can you prevent someone from filing a tax return in your name? One smart move is to file your taxes early (before anyone else can), but you can also lock your tax return down with an IRS Identity Protection PIN, or IP PIN.

Learn how an IRS IP PIN works, why you might want to get one and why the IRS might send you one automatically. For more tax tips, check out the biggest tax changes for 2023 and all the potential tax credits and deductions for homeowners.

What is an IRS Identity Protection PIN?

An IRS Identity Protection PIN is a unique six-digit passcode that can protect taxpayers from tax-related identity fraud. The code is known only to the individual taxpayer and the IRS and should only be shared with trusted tax preparers.

Taxpayers who have been victims of tax-related identity fraud in the past may be issued an IP PIN by the IRS. In that case, you should receive a CP01A notice in the mail with your six-digit code each year.

How do I create an IP PIN for my taxes in 2023?

Taxpayers can create their own IP PIN in a few minutes on the Get An Identity Protection PIN page of the IRS website. You’ll need to create an online IRS account and verify your identity first, if you haven’t already.

If you don’t want to create an IRS account or request an IP PIN online, you can also file IRS Form 15227, “Application for an Identity Protection Personal Identification Number,” but only if your adjusted gross income on your last tax return was less than $73,000 for single filers or $146,000 for married filing jointly.

After filing Form 15227, you will get a telephone call from the IRS to confirm your identity and then receive your IP PIN via the mail in about four to six weeks.

You can also get an IP PIN from a local IRS Tax Assistance Center. You can find a location and book an appointment by calling 844-545-5640. You’ll need to bring two forms of identification, one of which must be a government-issued photo ID.

How do I use my IRS IP PIN?

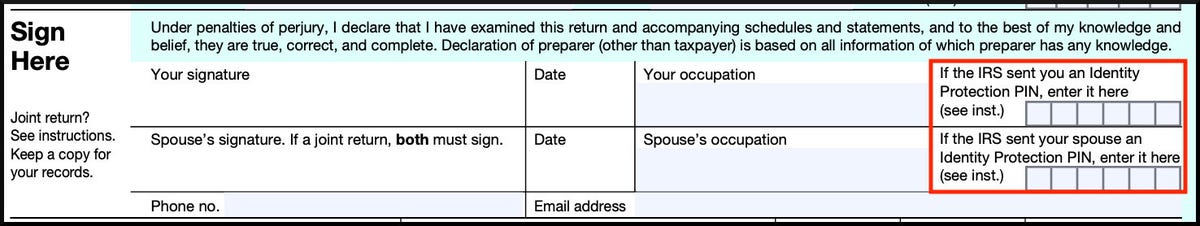

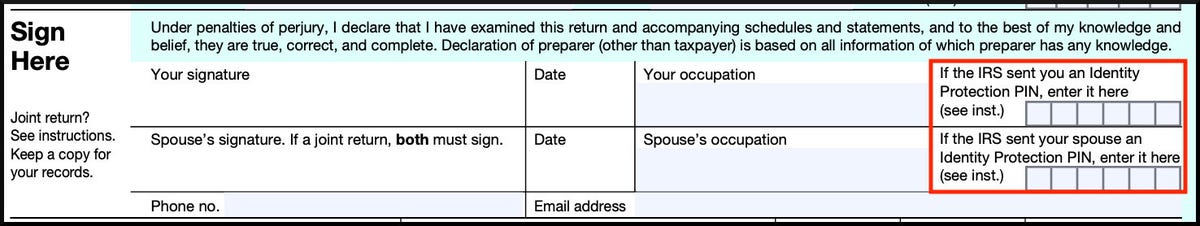

Once you’ve been issued an IP PIN by the IRS, you’ll need to enter it on any of the Forms 1040 that you use to file taxes, including 1040-NR, 1040-PR, 1040-SR and 1040-SS. You’ll enter the IP PIN at the end of the form on the line where you sign your tax return.

Your IP PIN goes at the end of your Form 1040 next to your signature.

IRS/Screenshot by Peter Butler/CNET

If you’re using tax software to file your tax return, each program will have a step in its filing process where it asks you for your IP PIN. If you and your spouse are filing jointly and both have IP PINs, you’ll need to enter them both.

If you file electronically and do not include your IP PIN, your tax return will be rejected. If you file with paper forms and forget to include your IP PIN, your return will be delayed for additional processing to verify your identity.

Each IP PIN only lasts for one year, so you’ll need to create a new PIN each tax season if you want continued protection against identity theft. The online tool for generating IP PINs is available from mid-January to mid-November.

If you’ve received an IP PIN from the IRS via CP01A notice, you’ll continue to receive a new PIN in the mail each year before tax season in December or January.

When the IRS expanded the IP PIN program to all Americans in January 2020, it announced that the agency would add the ability to opt out in 2022, but that change does not seem to have occurred. The latest info we can find about opting out of an IP PIN comes in an IRS release from April 2022 that says, “Once an individual is enrolled in the IP PIN program, there’s no way to opt-out.”

I created my own IP PIN for the first time during last year’s tax season. Sure enough, when I logged into my account this year, there was another six-digit code waiting for me.

What if I lost or never received my IRS IP PIN?

Taxpayers who generated an IP PIN or received one from the IRS and later misplaced or forgot the code will need to retrieve it in order to file taxes electronically in 2023.

If you created an IP PIN using the IRS’ online self-service tool, you can simply return to the IP PIN generator to find your PIN again. Log into your IRS online account and visit the Get an Identity Protection PIN page again. The IRS warns, “You may be required to verify your identity again due to our increased account security.”

If you were sent a CP01A notice with an IP PIN and lost it or never received it, you’ll need to call a special IRS phone number: 800-908-4490. After the agency verifies your identity, you’ll receive your IP PIN in the mail within 21 days.

The IRS does have one odd exception to retrieving an IP PIN from a CP01A notice. You cannot retrieve the IP PIN after Oct. 14 if you haven’t filed a 1040 or 1040 PR/SS form for the current and previous year.

In that rare case, the IRS advises you to file your taxes on paper. Filing on paper without a required IP PIN will cause a processing delay but will also trigger identity verification for your tax return that will likely resolve your situation.

For more on taxes in 2023, see whether you need to pay taxes on Social Security benefits and learn about recent rule changes for reporting income from Venmo and PayPal.