Mobile phone and smartphone sales are on a roll, according to figures released Wednesday by market researcher Gartner.

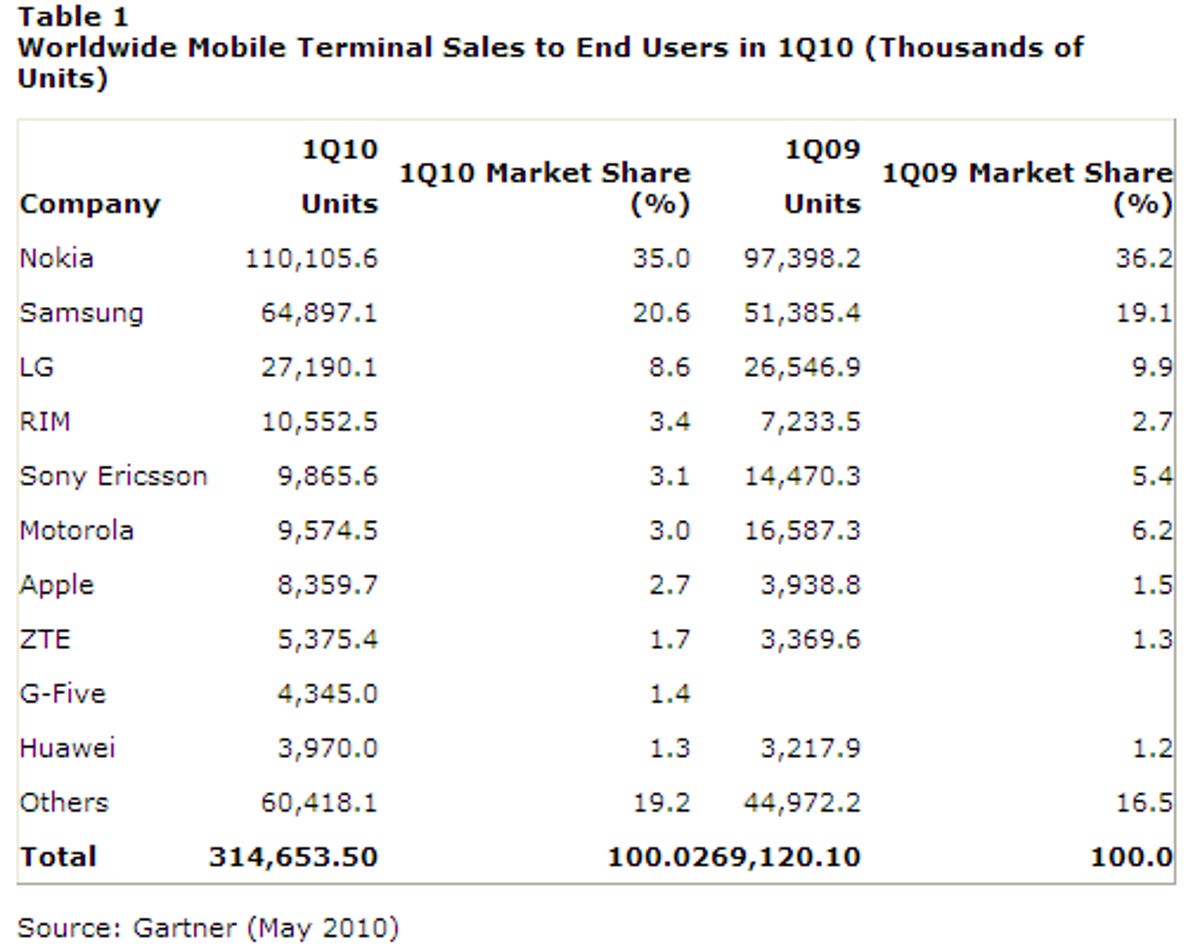

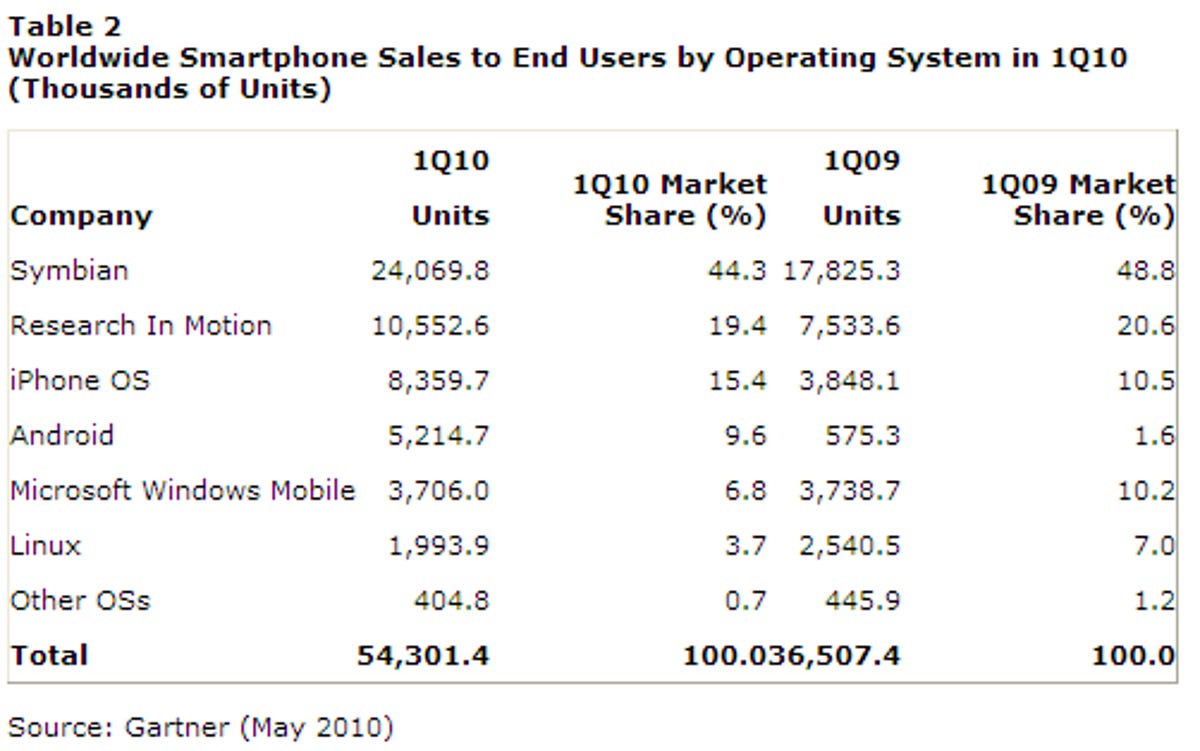

In the first quarter, customers worldwide bought 314.7 million mobile phones, a 17 percent increase year over year. Smartphones sales specifically jumped 48.7 percent from the year-ago quarter, as 54.3 million units flew off the shelves.

Demand within mature markets and lower prices are part of the reason for the double-digit gains, Gartner said.

For the quarter, the usual mobile phone makers topped the ranks, with Nokia in first place with a 35 percent market share, followed by Samsung, LG, Research In Motion, and Sony Ericsson. But smaller players have also started to inch their way up the ladder. Hong Kong-based G-Five climbed into the list of top 10 mobile manufacturers worldwide, winning 1.4 percent of the market.

An array of other manufacturers across Asia also made a big dent in market share, collectively accounting for 19 percent. This surge had some impact on the top five companies, Gartner said, as their collective market share dropped to 70.7 percent in the first quarter from 73.3 percent a year ago.

Among the top five, Nokia continues to face strong competitive challenges. Although its midmarket phones sold well in the quarter, the company doesn’t yet have any high-end products driving sales. Its MeeGo-based devices and other higher-tier phones won’t have an impact until the end of the third quarter at the earliest, Gartner predicts. Nokia’s impending reorganization, announced last week, is a sign that the company is also trying to improve its standing among investors.

As for the rest of the pack, Samsung and RIM saw sales and market share grow during the quarter, while LG and Sony Ericsson watched their results drop.

In the smartphone arena, the industry enjoyed its strongest year-over-year sales growth since 2006, according to Gartner. Ranked by smartphone operating system, Nokia’s Symbian led the pack with a 44.3 percent slice of the market. But that was down from the 48.8 percent share a year ago.

Among the top five smartphone operating systems, the iPhone and Android were the only ones to enjoy growth in market share from a year ago. The first quarter proved to be Apple’s strongest yet, helped in part by overseas sales from mature regions such as the U.K, but also new markets such as China and South Korea. Demands for Android phones continued to grow in the first quarter, especially in North America, where sales jumped 707 percent from a year ago.

What does Gartner expect for the near term? Mobile e-mail, text-messaging, and social networking will continue to spark demand for smartphones and enhanced phones with hardware keyboards. But in Gartner’s view, the most successful companies will be the ones that control an integrated product in terms of operating system, hardware, and services. To stay competitive, manufacturers must integrate hardware, the user interface, the cloud, and social networks to continued to attract consumers, Gartner said.