While worldwide phone sales fell slightly during the third quarter, sales of smartphones are continuing to rise, according to new figures from Gartner.

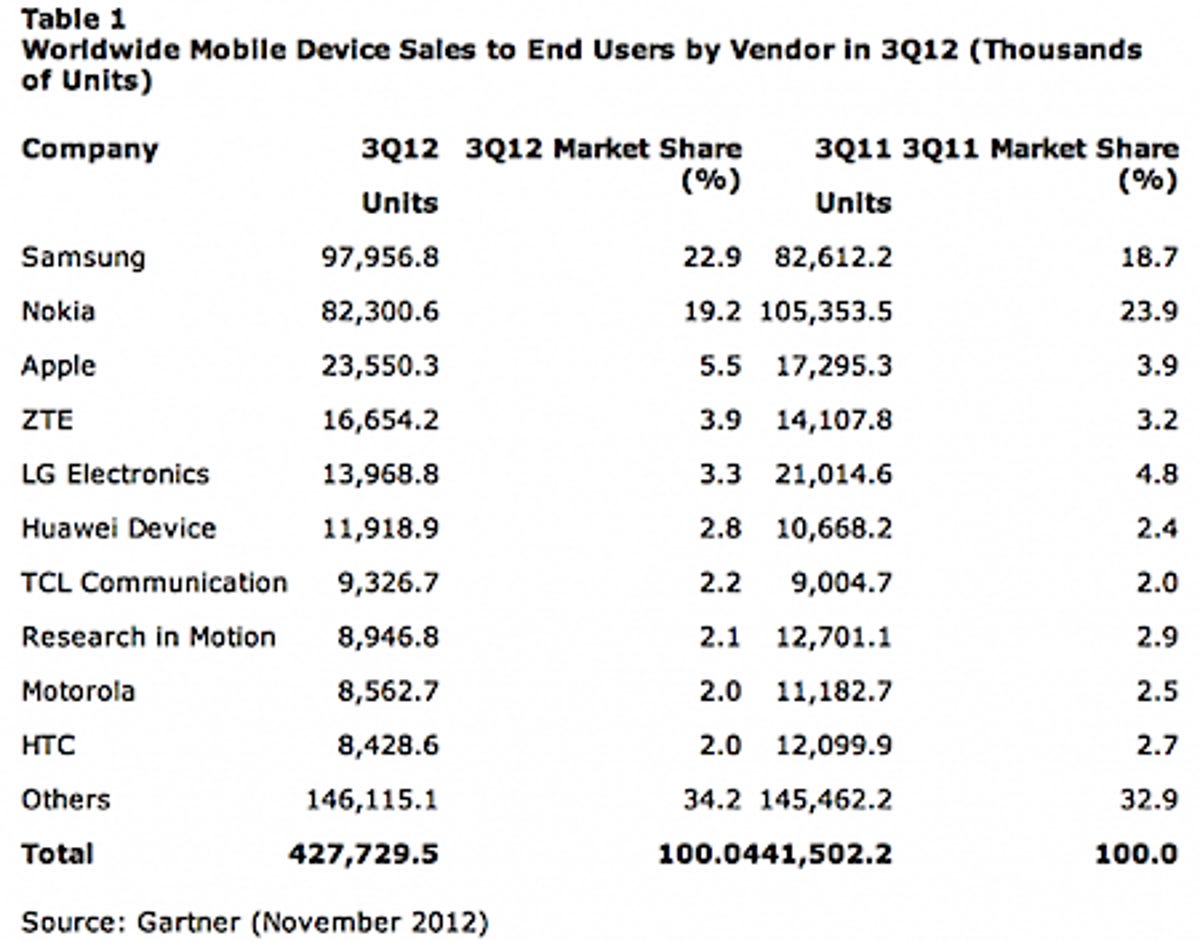

More than 427 million phones were sold in total during the third quarter, 3 percent down on the same quarter a year ago, Gartner said, but up slightly on the 419 million devices shipped in the second quarter.

Meanwhile, smartphone sales are continuing their upward trajectory compared to feature phones — 169 million smartphones were sold during the quarter, an increase of 47 percent year-on-year.

Gartner

Samsung, Nokia and Apple remain the top three vendors by sales for the quarter. Nokia, however, saw its market share drop by over 20 percent compared to last year — falling from 23.9 per cent in Q3 2011 to 19.2 per cent in Q3 this year, while Apple and Samsung’s market share both rose.

Asian manufacturers — ZTE, LG, and Huawei — saw modest gains during the quarter, while BlackBerry-maker Research in Motion and Taiwanese phone maker HTC both saw a 30 percent decrease in market share. RIM’s market share now stands at 2.1 percent, while HTC’s is 2 percent.

Google-owned Motorola Mobility also saw a decline in sales, with its market share dropping from 2.5 percent last year to 2 percent this year.

Gartner

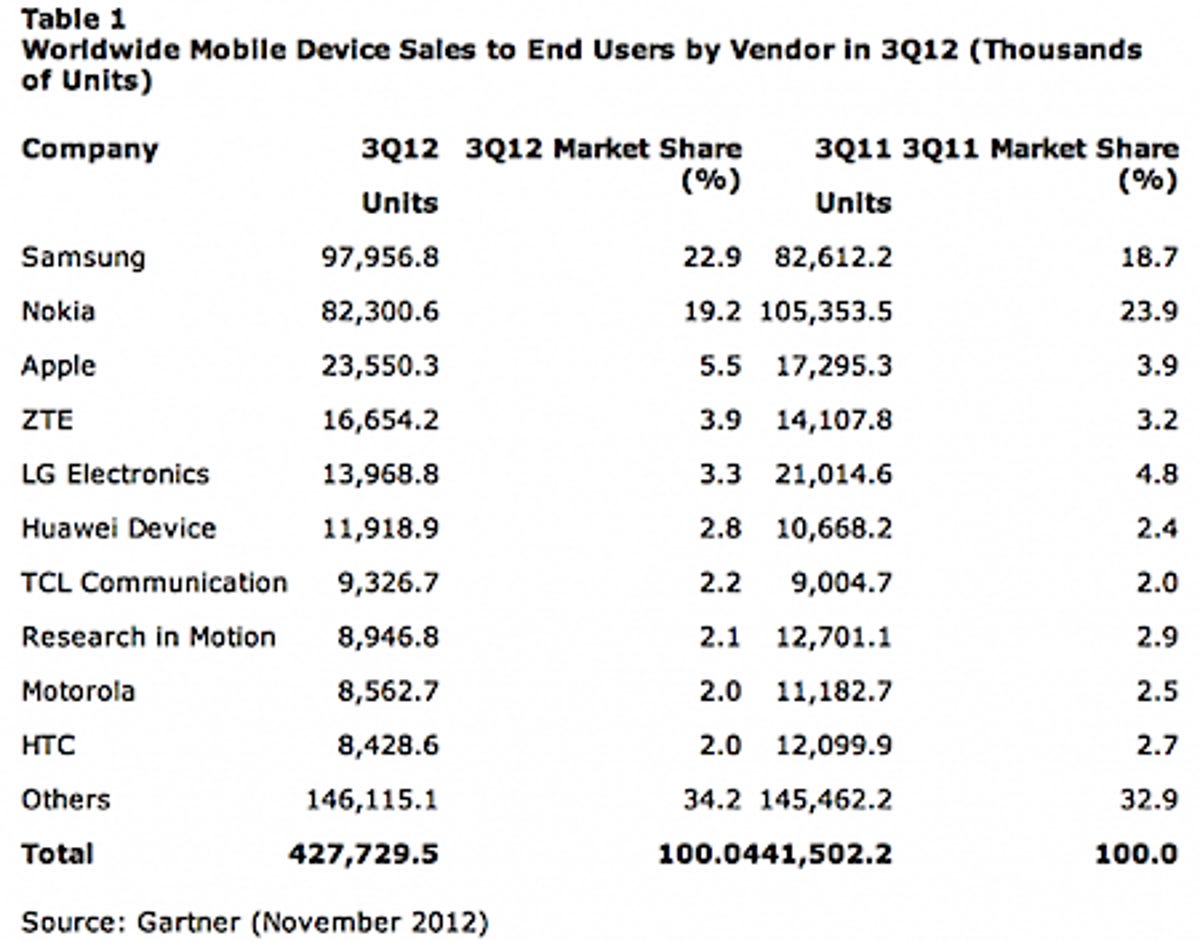

As expected, Google’s Android mobile operating system retains the smartphone platform crown (with 72.4 percent of all smartphones sold in the quarter, up from 52.5 percent last year) followed by Apple’s iOS in a distant second place (13.9 percent). Microsoft’s Windows Phone platform increase its share from 1.5 percent of all smartphones last year to 2.4 percent in the current quarter. However, the surprise jump is Samsung’s Bada mobile operating system which has passed both declining Symbian and falling-behind Microsoft in platform share, and now stands at 3 percent share, up from 2.2 percent last year.

Gartner principal research analyst Anshul Gupta said in a statement: “After two consecutive quarter of decline in mobile phone sales, demand has improved in both mature and emerging markets as sales increased sequentially,” adding: “In China, sales of mobile phones grew driven by sales of smartphones, while demand of feature phones remained weak. In mature markets, we finally saw replacement sales pick up with the launch of new devices in the quarter.”