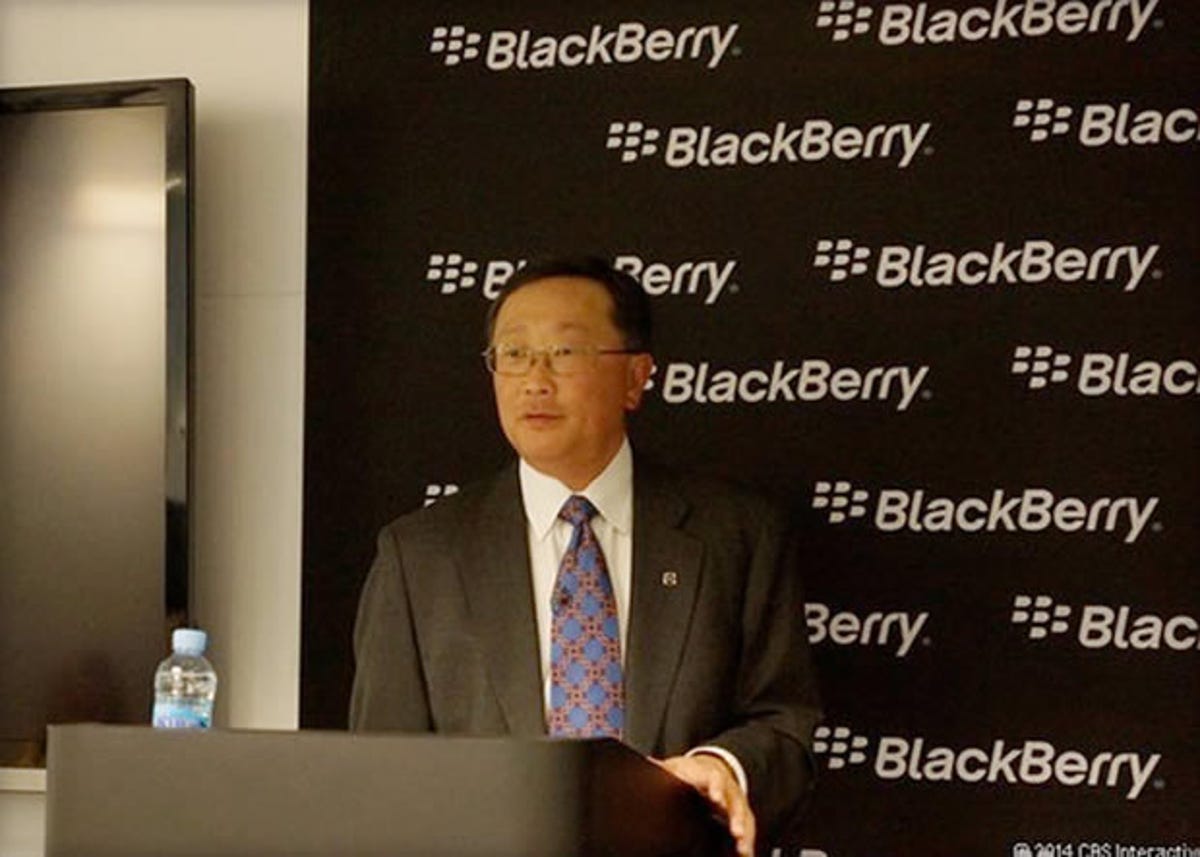

Brian Bennett/CNET

BlackBerry may be hit by quarterly losses for at least another two years, according to one analyst’s crystal ball.

In an investors note released Monday, Canaccord Genuity’s Michael Walkley said he was impressed with BlackBerry’s cost-cutting moves but believes management’s long-term initiatives may not pay off for a while. As such, he expects the company to post operating losses through fiscal 2015, which began earlier this month.

BlackBerry’s financials may start to improve following the launch of its BlackBerry Enterprise Service this coming November. But the breakeven point may not come until fiscal 2016 comes to a close, which means March of 2016.

Related stories

- BlackBerry will continue run of BB7-powered Bold

- BlackBerry sales tumble 64%

- BlackBerry CEO confirms Foxconn-made Q20 and Z3 phones

For its final quarter of fiscal 2014 ending March 1, the company recorded a loss of $423 million, compared with a profit of $98 million from the prior year’s quarter. Revenue sank by 64 percent to $976 million.

Despite his nod toward BlackBerry’s cost-cutting plans, the analyst said he thinks the company will need to trim expenses even further in light of weak demand for its devices and lower subscriber numbers. Even the deal with Foxconn to make BlackBerry-powered smartphones won’t provide enough of a boost in the highly competitive mobile market, according to Walkley.

“With respect to BlackBerry’s hardware business, we struggle to assign any value to this segment given our belief that despite the recent Foxconn partnership, it will remain difficult for BlackBerry to maintain a profitable hardware business as a sub-scale smartphone supplier versus larger global OEMs Apple and Samsung and a very large group of price-aggressive Chinese Android OEMs,” Walkley said.