Apple

Apple Pay, the mobile payments platform unveiled at Apple’s media event on Tuesday, will generate cash for the company, but not in the way some might expect.

In an FAQ page on Apple’s site, the company confirms that Apple Pay fees will not be charged to “users, merchants, or developers.” That logically leaves one party left in the equation that would pay Apple a fee for being the intermediary in a transaction: credit-card issuing banks.

Speaking to several people who claim to have knowledge of the situation, Bloomberg reported Wednesday that Apple will indeed collect a fee for each transaction through Apple Pay from such banks. The size of the fee and whether it will change based on the transaction amount is unknown.

CNET has contacted Apple for comment on the report. We will update this story when we have more information.

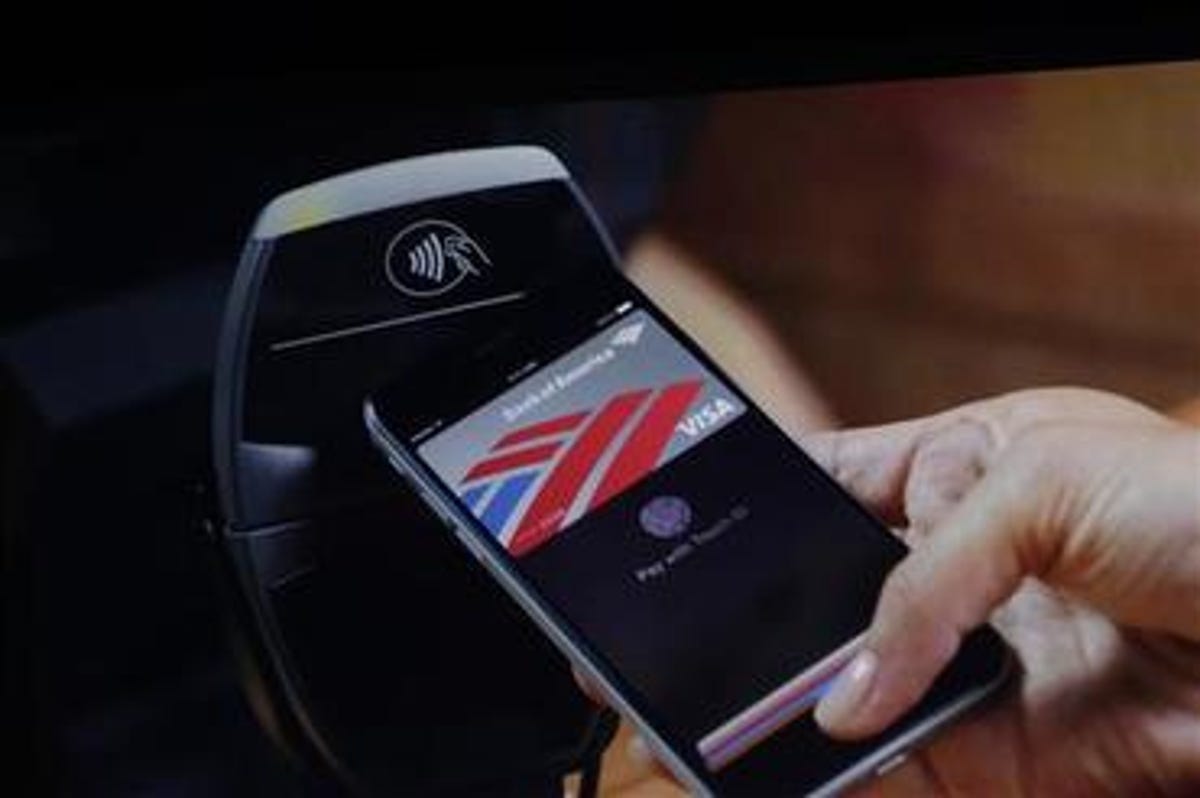

Apple Pay, which launches this fall, presents a new revenue opportunity for the Cupertino, Calif.-based company. The service works like a digital wallet — housing credit and debit cards from a wide range of banks. Upon inputting those cards into Apple Pay, users will need only to hold their finger on the iPhone 6’s TouchID sensor to confirm payment. The service does not work with any previous iPhone because of its reliance upon a near-field communication (NFC) chip that is only available in the iPhone 6 and iPhone 6 Plus.

Apple made clear Tuesday that security is crucial to Apple Pay. The company says that no credit card information is actually transmitted to the merchant in the transaction. Instead, it provides a one-time payment number and dynamic code that changes with each purchase.

While Apple was more than willing to discuss the consumer-facing elements in Apple Pay, the financial side has prompted questions. According to Bloomberg’s sources, the fees that card-issuing banks will pay to Apple for handling transactions are separate from what credit-card companies already charge merchants for transactions. Apple is essentially adding another element to the fee-based process, according to the sources.

Apple has deals with the three major card networks, Visa, MasterCard and American Express, to process payments.