Sarah Tew/CNET

You can’t keep BlackBerry down.

The struggling smartphone manufacturer posted a surprise profit on Friday for the second quarter in a row, eking out gains thanks to a massive cost-cutting effort and an adjustment to the value of its investment in a broad patent portfolio.

For its fiscal fourth quarter, which ended February 28, BlackBerry posted earnings excluding certain items of 4 cents a share, compared with Wall Street’s forecast of a loss of 4 cents a share.

BlackBerry shares rose 3.2 percent to $9.60 in premarket trading Friday.

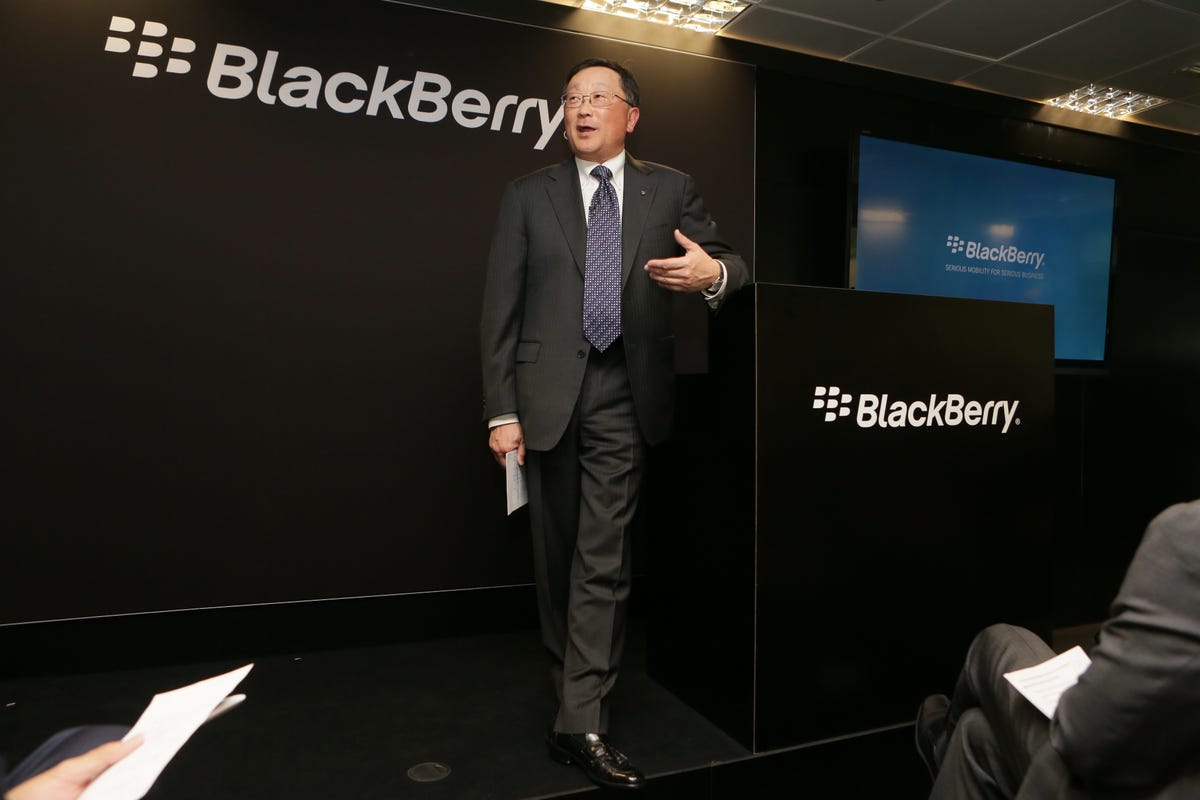

The Canadian company, a once-dominant phone maker that has fallen far from its peak, is in the midst of a transformation under CEO John Chen. While its core BlackBerry business continues to be a focus, Chen is streamlining the business and shifting its resources into the potentially more profitable software and services realm. At the same time, he is more narrowly targeting big business customers as the company gets away from its earlier attempts to be a mass-market brand.

“Our financial viability is no longer in question,” Chen said in an earnings conference call, noting that he is halfway through his turnaround efforts.

The company earlier this month said it plans to bring some of BlackBerry’s key elements — including its security services and “BlackBerry Hub” interface — to the iPhone and Android smartphones. It also announced a partnership to team with Google to support Android for Work and is working closer with Samsung’s Knox security feature.

That’s not to say BlackBerry has given up on the smartphone business. At the Mobile World Congress trade show earlier this month, the company unveiled two smartphones: an affordable, all-touchscreen device called the BlackBerry Leap, and an as-of-yet-unnamed smartphone with a curved edge like the Samsung Galaxy S6 Edge and a slide-out keyboard.

BlackBerry Leap swaps keyboard for touchscreen (pictures)

+9 more

BlackBerry shipped 1.3 million BlackBerry smartphones in the quarter and said customers snapped up 1.6 million units at an average sales price of $211. Its main BlackBerrys, the Bold-like Classic and the squat Passport, finally hit the US carriers at the beginning of this year.

“The early reports of those sales are encouraging,” Chen said.

He noted 160 carriers in 86 countries are selling BlackBerry smartphones, which he touted as the widest support the company has had in several years. Of the BlackBerrys that shipped, 90 percent are the more profitable, newer-generation devices.

BlackBerry posted a fiscal fourth-quarter profit of $28 million, or 5 cents a share, when all charges and adjustments are factored in, compared with a year-earlier loss of $423 million, or 80 cents a share.

Revenue, however, fell by a third to $660 million, below Wall Street’s expectations of $786 million.

Blackberry ended the quarter with cash, cash equivalents and short-term investments of $2.88 billion.

For fiscal 2016, Chen said he is focused on sustainable profitability, on making sure the company generates free cash flow from operations every quarter and on stabilizing its declining revenue. He believes the devices business will be increasingly profitable in the second half of the year.

Now playing:

Watch this:

BlackBerry Leap ditches physical keyboard with 5-inch…

0:53