Screenshot by Shara Tibken/CNET

Carl Icahn just wasn’t that impressed with Apple’s announcement on Monday that it will return more of its massive cash pile to investors.

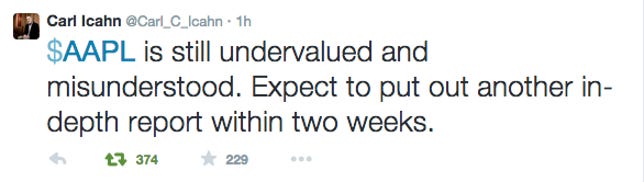

The activist investor on Tuesday tweeted that Apple, the highest valued public company in the world, “is still undervalued and misunderstood.” He added that he will publish another in-depth report within two weeks.

Apple didn’t immediately respond to a request for comment.

Icahn, who has pushed for change at other companies such as Dell, has been a thorn in Apple CEO Tim Cook’s side for years. Cook, after he took over as CEO in late 2011, started new programs to return some of Apple’s cash to shareholders, and the company has consistently increased the level of returns. Still, Icahn hasn’t been satisfied with Apple’s programs, instead demanding the company do more.

In response to Icahn a year ago, Apple revealed a big increase to its dividend and share repurchase program by about $30 billion to more than $130 billion, as well as said it planned to give investors six additional shares of stock for every Apple share they owned as of June 2, 2014. Because of the split, shares now trade at a much lower level than in the past, but it also makes the stock more accessible to investors. It’s much cheaper to own a chunk of Apple at about $100 versus $600.

See also

- Apple boosts capital return program to $200 billion

- iPhone demand pushes Apple to record Q2

- Apple most-valued company ever, but that’s not enough for Carl Icahn

Monday, alongside its fiscal second-quarter earnings, Apple increased its capital return program by 54 percent to $200 billion, with plans to distribute the money to shareholders by the end of March 2017. As part of the program, the company raised its share repurchase authorization to $140 billion from $90 billion. It also increased its quarterly dividend by 11 percent, to 52 cents a share.

“We believe Apple has a bright future ahead, and the unprecedented size of our capital return program reflects that strong confidence,” CEO Tim Cook said in a statement Monday. “While most of our program will focus on buying back shares, we know that the dividend is very important to many of our investors, so we’re raising it for the third time in less than three years.”

Overall, Apple ended the quarter with $193.5 billion in cash plus marketable securities, up $15.6 billion from three months earlier. More than $171 billion of that money is held overseas.

Shares of Apple, the highest-valued public company in the world, were about flat at $132.68 in recent trade, up 20 percent in the year to date. The company is already valued above $750 billion, about twice as much as as the second most-valued company, Microsoft.