Slidejoy

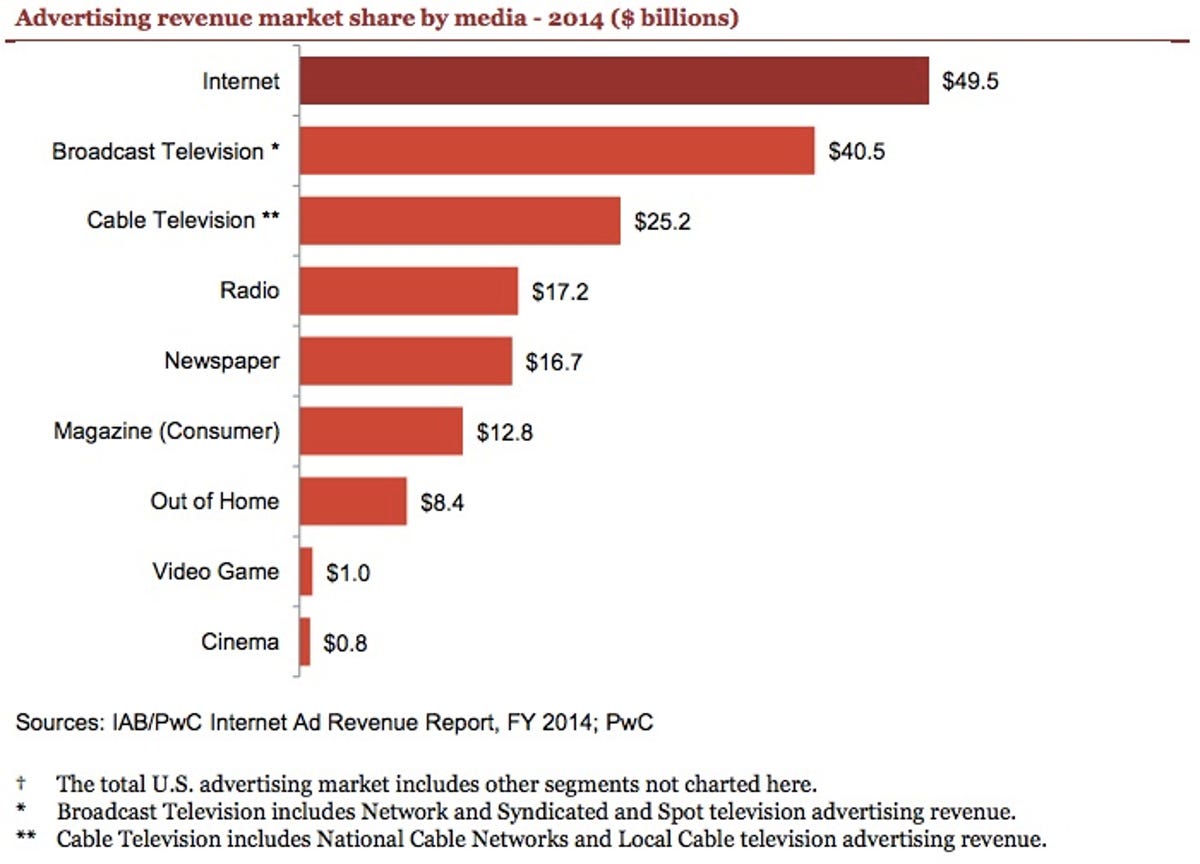

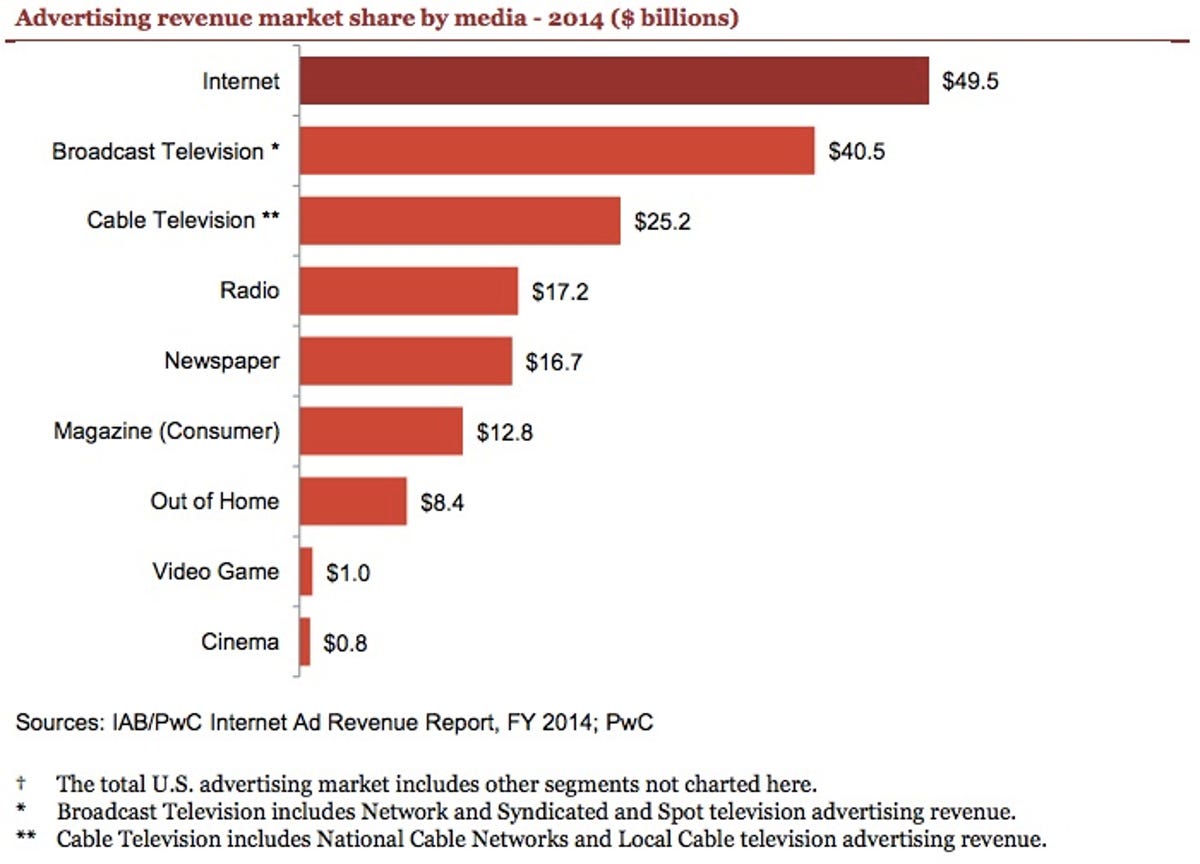

Internet advertising revenue climbed 16 percent to $49.5 billion in 2014, as a spike in sales for mobile spots pushed it above banner ads for the first time, according to a study from the Interactive Advertising Bureau.

“Marketers clearly recognize that consumers are leading mobile-first lives,” IAB chief Randall Rothenberg said in the report, published Wednesday.

The interplay of ad budgets underscores not only consumer trends but also fundamental changes at companies that rely on advertising revenue to survive.

Search revenue, the biggest ad sales category, continues to lose market share, all while Google — the dominant force there — keeps expanding its businesses into sectors like mobile phone service. Digital video advertising is on the rise, and TV programmers like HBO are racing this year to launch Internet-delivered channels.

In the latest report, mobile advertising increased 76 percent last year to reach $12.5 billion. The surge lifted it above the total spending on banner ads, which represented 16 percent of the total pie versus mobile’s 25 percent. A year earlier, banner ads led mobile by two percentage points at 19 percent.

Advertising on social media — a common mobile activity — also jumped, up by nearly 60 percent last year to $7 billion.

Digital video advertising also increased by a double-digit percentage, keeping its share at 7 percent of total spending. Search, banner and classified ad revenue all lost share.

Though Internet advertising spending is still shy of that dedicated to traditional television, it now represents more ad dollars than radio, newspapers and magazines combined. It surpassed cable TV revenue in 2011 and broadcast TV revenue in 2013, but combining the two, total TV ad dollars were about $65.7 billion last year, compared with digital’s $49.5 billion.